Cards

STATE OF THE HOBBY: Fervor of investors, passionate collectors fuel strong sports collectibles market

To say 2025 was a wild ride for the hobby could be a massive understatement.

From big-name investors such as “Shark Tank’s” Kevin O’Leary entering the space to diversify their portfolios to hobby-rocking scandals to a possible shakeup in the infrastructure of grading companies, collectors lived it all.

However, all the hoopla didn’t diminish the enthusiasm, growth and high prices realized. Interest in the hobby is at an all-time high.

One telling example is that the National Sports Collectors Convention shattered its attendance record, hitting six figures for the annual, five-day event.

“I think the hobby is in great shape, and I’m going to say that with a caveat of all the stuff that has happened this year,” longtime collector Mike Moynihan said. “All the scandals and autograph people killing themselves and shill-bidding controversies and buyouts and consolidation of the hobby infrastructure, the hobby still at the core is just a bunch of dudes collecting sports cards.

“Shows are more popular than ever, auction houses are popping up left and right, meaning the marketplace—the availability of cards—has never been greater and will only I think continue to increase. Which is great if you’re a collector and looking to buy something, you have many, many places to go try to do that.”

Related Content:

Dealers that SCD spoke with are also extremely pleased with the state of the hobby. Kevin Savage of Kevin Savage Cards has set up at 44 straight Nationals, capped off a solid year.

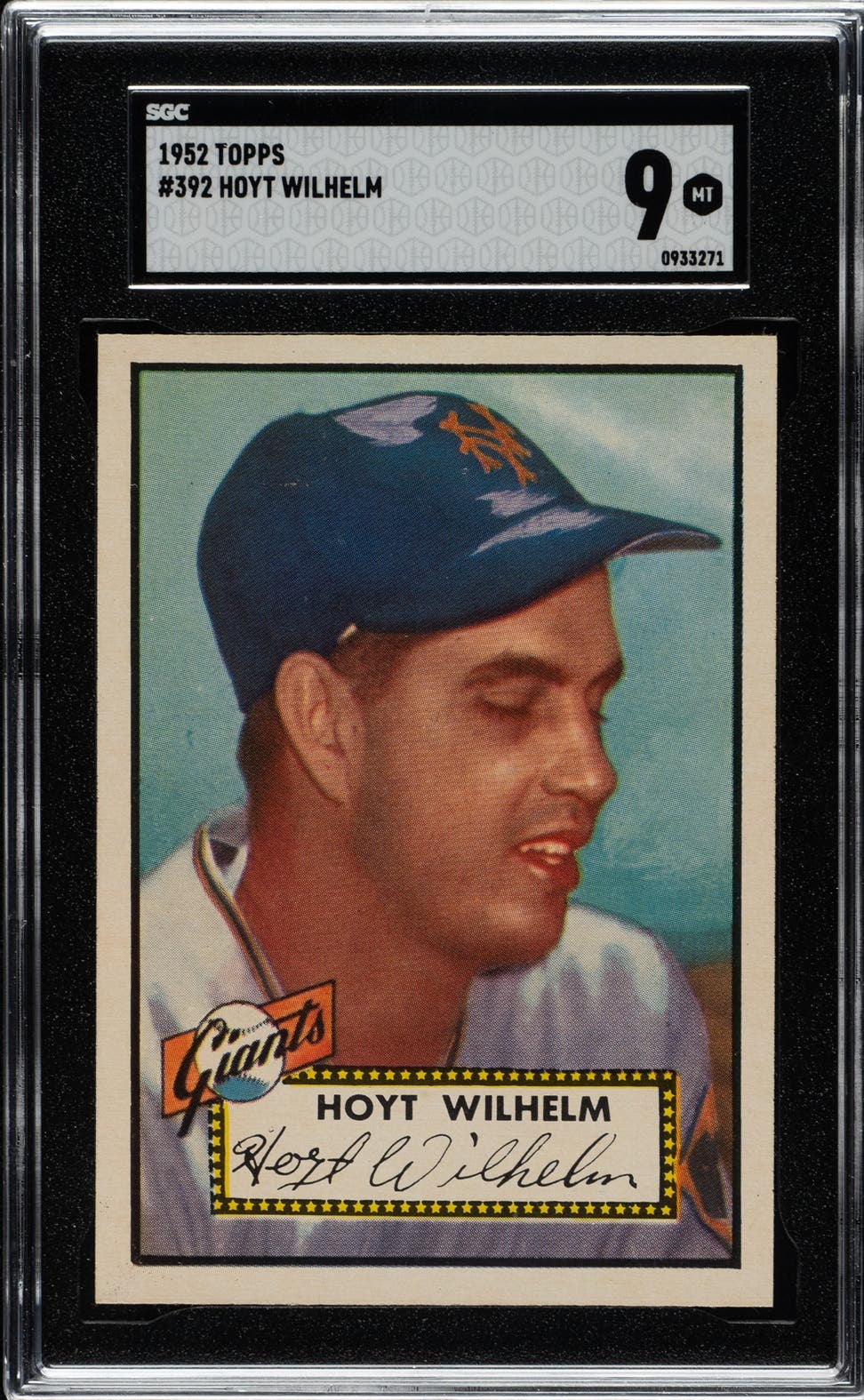

“I think things overall are very positive,” Savage said. “It seems like we have more bidders than ever. It seems like prices, at least for vintage stuff, are pretty strong, especially in the card area. Memorabilia and publications and things like that aren’t as good. But the card market overall for vintage seems to be very strong, both ungraded and graded. I’ve done a lot of shows the last four, five months and it seems like crowds are bigger than ever.

“We’re definitely in a good place. I think most dealers are doing pretty well right now. With the guys I talk to, maybe not having a record year, but they’re sustaining what they’re doing and if they work hard at it, they can make a pretty good living.”

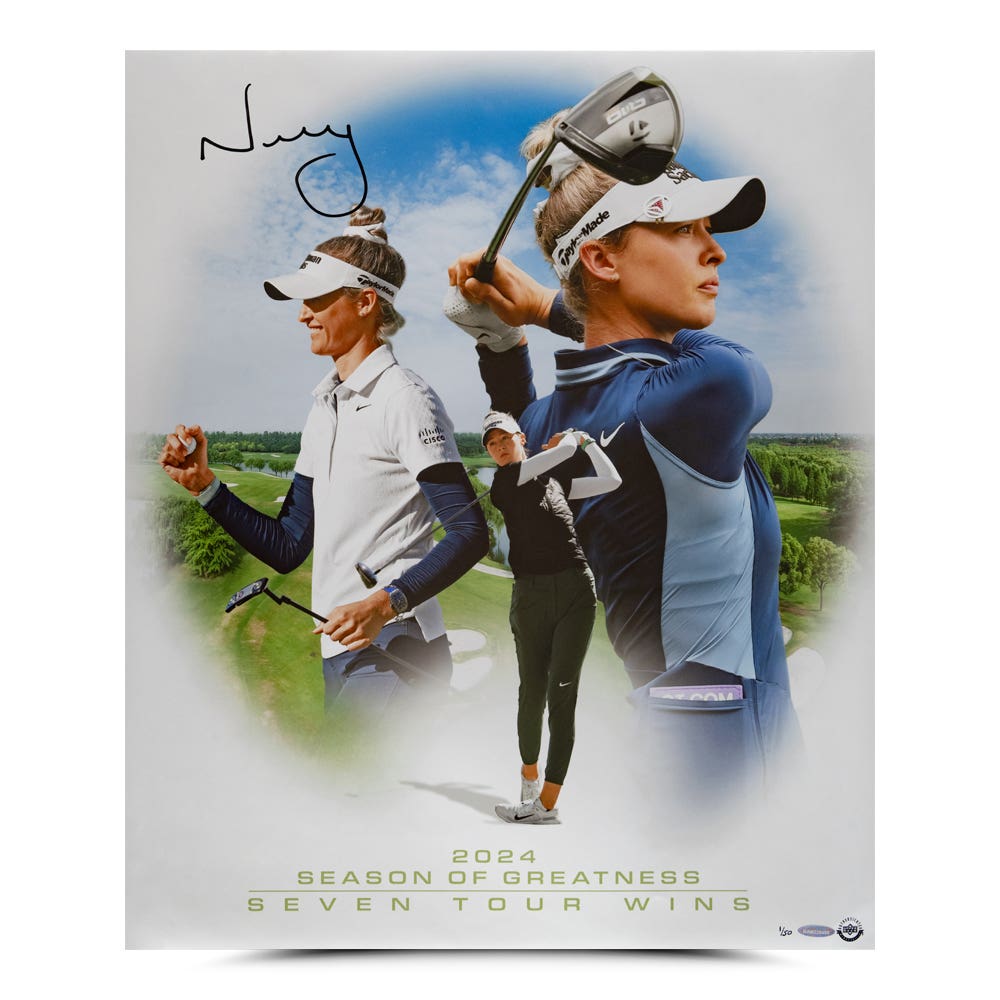

The biggest scandal to shake the hobby happened in mid-July 2025. Memorabilia dealer Brett Lemieux published a post in the Facebook group Autographs 101 admitting to forging millions of athlete autographs and holograms over the past 20 years under the company name Mister Mancave.

Lemieux claimed that his company allegedly sold over four million items, surpassing $350 million. When local law enforcement and the FBI were closing in on Lemieux, he committed suicide at his home in Westfield, Ind. Authorities are still investigating the case.

Dealer Rick Giddings, owner of Gizmo’s Sportscards, has witnessed the ripple effect from the memorabilia forgery and fraud case.

“The memorabilia market is dying a little bit,” Giddings said. “The old-timers are getting out of it and all the bad news that has come out—the guy who shot himself. We just got rid of a lot of stuff from Operation Bullpen, and then we’ve got this clown that comes out and says he did, what, half a million items? People are scared.”

Show Calendar: 2026 shows

Upper Deck President Jason Masherah believes the hobby is strong and in a really good place. But good or bad, some of the recent situations to arise have been eye-opening.

“I think what’s really come out the last few months is people have really become aware of some of the market manipulation and some of the conflicts of interest that are going on that have caused a lot of discussion,” Masherah said. “But those are things that in a lot of cases have been there for a long time. I think it’s just good that the collectors are getting more awareness of some of the things going on in the hobby.”

PEAK PRICES

When the card and memorabilia market was going haywire in 2021 during the pandemic, record prices were realized left and right. It set a high bar in numerous categories.

But 2025 was no slouch.

A 2007-08 Upper Deck Exquisite Collection Dual Logoman Autographs card of Michael Jordan and Kobe Bryant broke the record for the highest selling sports card at $12.932 million. Purchased by a group led by O’Leary, the card sold through Heritage Auctions at the end of August.

Another incredible sale happened in mid-December, when a Shohei Ohtani 1-of-1 card went for $3 million through Fanatics Collect. The 2025 Topps Chrome MVP Award Gold MLB Logoman card nearly tripled the previous high for an Ohtani card.

“I think the market’s actually hotter than it was in COVID,” Masherah said. “If you look around and see what’s going on with singles, what’s going on at shows, when you see the secondary market on some of the sealed wax products, I would say the market is currently stronger. I think it’s a macroeconomic thing. If you look at the prices of everything, whether it’s the stock market, it’s the price of gold, up until recently it’s been Bitcoin and cryptocurrency, everything that people can invest in or speculate on is up. And it’s no different for our market.”

Heritage Auctions Director of Sports Auctions Chris Ivy agrees card prices are at or beyond what was experienced at the height of the pandemic in 2021.

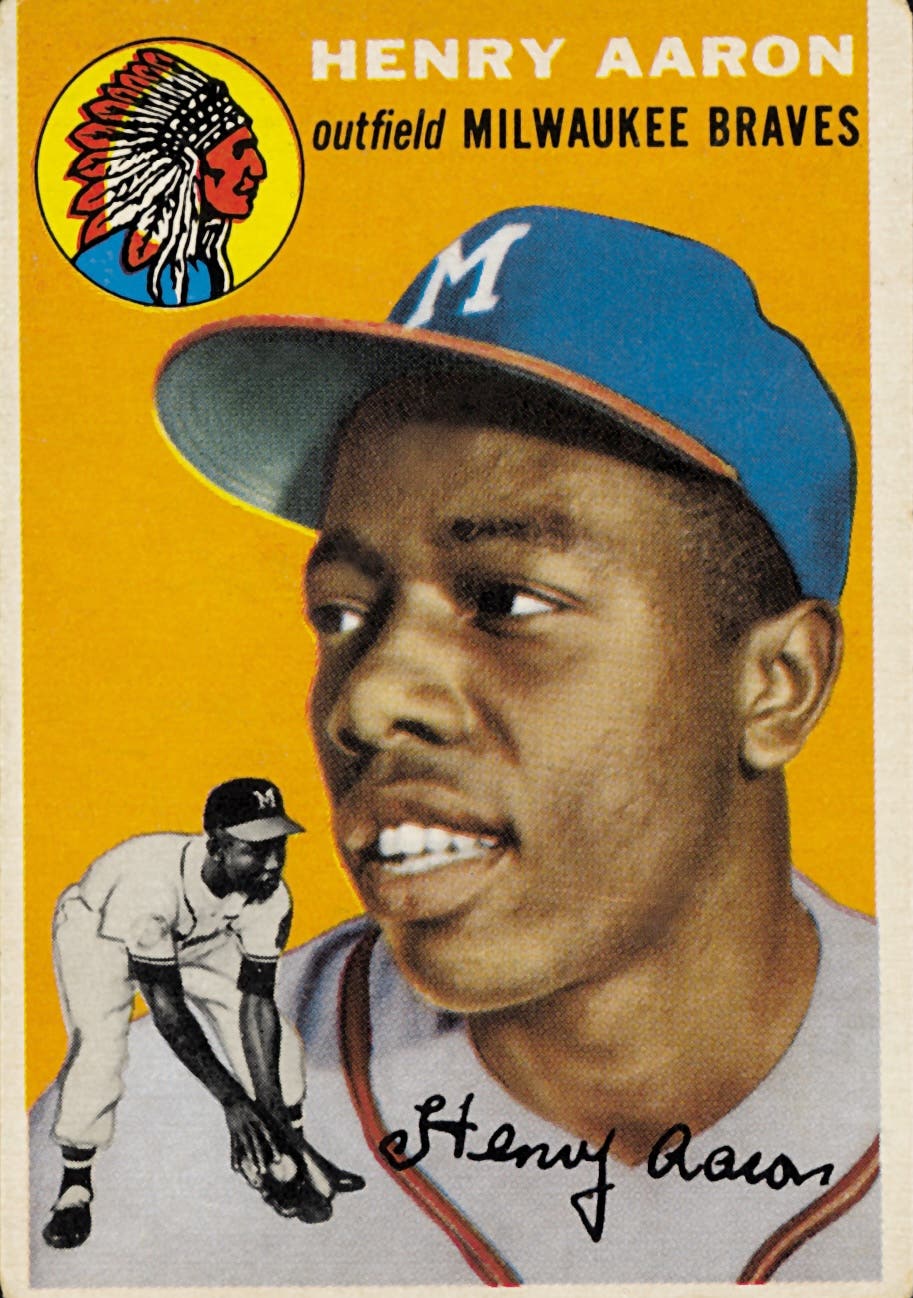

“What got really popular around that time was kind of the best of the best type of athletes: Michael Jordan, Tom Brady, Muhammad Ali and Babe Ruth. We’re seeing that trend continue,” Ivy said.

“We’re also seeing a lot of people getting involved in the modern market, which is a little bit more speculative, because those players are still playing. We’ve always seen that focus in sports collecting. Rookies have always been king. Buying in on the most popular players and youngest players, so we’re seeing that with Cooper Flagg in the NBA. And what Shohei Ohtani’s done for the baseball market is incredible. I can’t remember the time I’ve seen a baseball player have this type of worldwide effect on his cards and the market at the same time.”

According to Moynihan, if the interest in the hobby is measured in fervor, he believes it has surpassed peak COVID levels. The hobby is surprising him in many ways.

“Honestly, if you would have told me after 2021, I would have thought group breaking and all of that was going to die the way of the dodo,” Moynihan said. “I thought it was going to be a quick and painful death, and it’s more popular than ever. And repack products and all this stuff, and it’s the gambling aspect of the hobby that is attractive to that type of person that wants to do that.”

Savage added: “I think interest may be just as high as 2021, but I think there’s more competition. I think in the last two, three years we’ve gotten a lot more dealers, a lot more people buying and selling stuff. So, the pie might be the same size, but it might be sliced up a little bit more.

“I know very few guys that I talk to that are doing better than they did in 2021. That seemed to be like the best year ever for most guys. But I think guys are happy with what they’re doing and they’re definitely doing better than they were say 10 years ago.”

Giddings still believes the market isn’t as hot as it was in 2021. Modern and vintage cards were both highly desirable commodities.

“In my mind, we’re a little bit less than the pandemic during the boom,” Giddings said. “I would say that we’re a little less than that because there’s not as much excitement about the blasters and mega blasters that are at Walmart, because they’re mass produced.

“But the industry overall, pre-pandemic, we’re kicking its ass. I would say we’re two-thirds of what the pandemic was. It’s still pretty hot.”

VINTAGE VS. MODERN

It’s been a classic debate for years: which is more desirable and hotter in the minds of collectors, vintage or modern?

For the real blue-chip vintage cards, they steadily continue to increase in price. Modern cards have always been more susceptible and vulnerable to swings because athletes are still competing, unlike athletes pictured on vintage cards.

“The hobby’s always been tilted to whatever’s current. It’s probably current versus older,” Moynihan said. “People want the current players, especially kids, right? They want to buy the players they see on TV. Then you age as a collector, you mature as a collector, you go through this life cycle of a collector and you go, you know what, Mickey Mantle was pretty good, Hank Aaron was pretty good. I want to go buy their cards. But that takes time for that to happen.

“I think the hobby’s growing, for sure. I still have people every week shock me, ‘Hey, I just got back in the hobby a few months ago.’ … There’s people discovering this hobby every day. And I think that will only grow as the hobby gets more and more into the mainstream media and the lexicon of our culture and higher prices, it brings attention.”

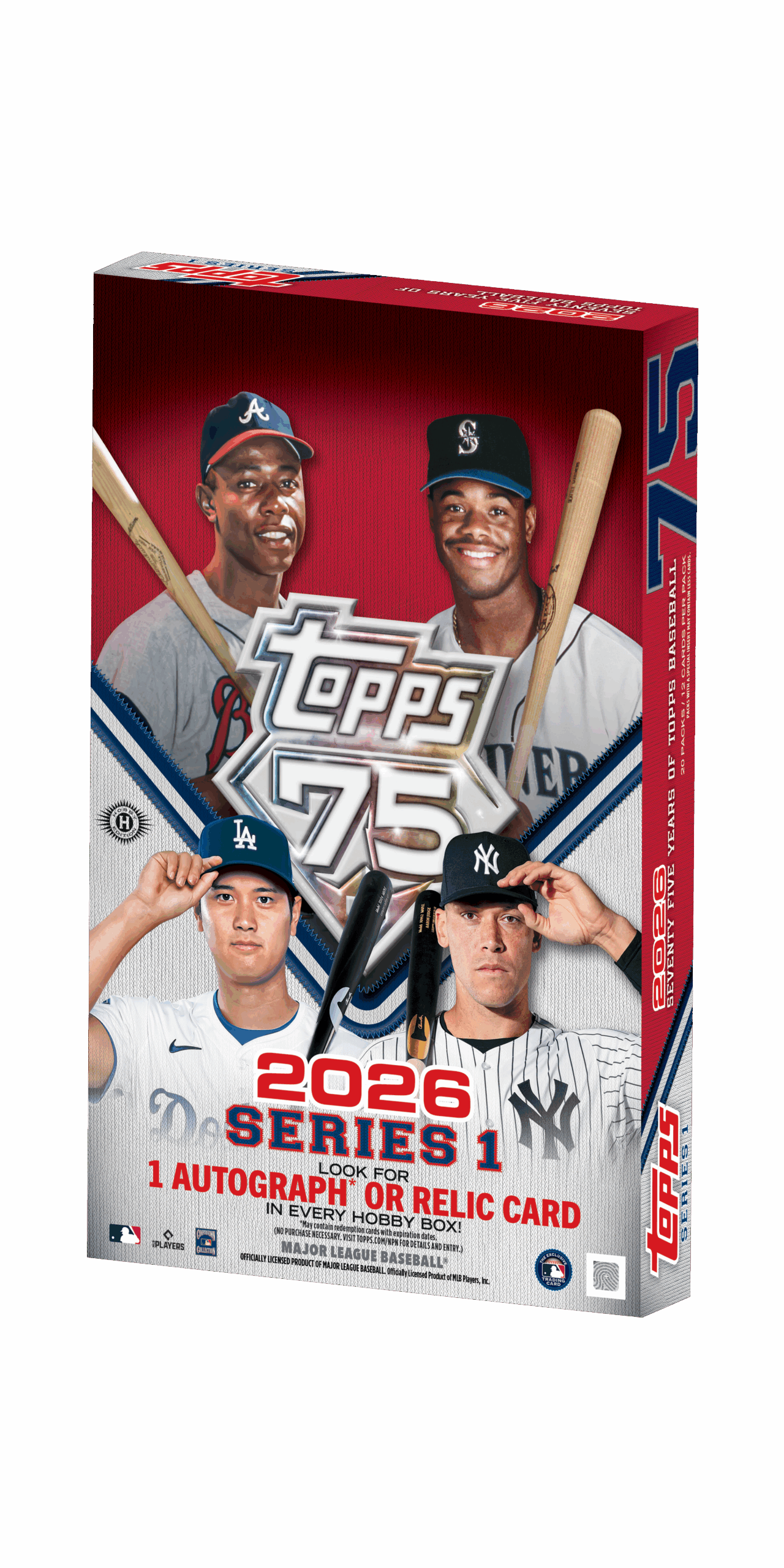

There has been a lot of excitement swirling around modern cards. In October, Fanatics took over the exclusive basketball license from Panini and started producing licensed hoops cards for the first time since 2009. Collectors have clamored over Topps Chrome Basketball returning to the market. Fanatics will also get the exclusive football license from Panini in April 2026.

With 20-plus years working in the hobby, Ivy feels like modern cards are at their all-time highest peak.

“I think just with the numbers we’re seeing and the collectors getting involved, the popularity of the breaks and repacking, there’s just so much demand there that the supply can’t even keep up,” Ivy said. “Then you’ve got Fanatics that’s joining the market, and their first releases I’m sure are going to be incredibly popular. So, everything’s kind of coming together to create this frenzy. We’re seeing a very strong aspect of the market right now for modern.”

Giddings will always say vintage is going to outsell modern any day of the week. Something he thought was a fascinating trend that started in 2025 was collectors going after low-grade vintage cards. That’s a big change, he said.

“As far as the new stuff, it’s neat and the inserts are cool, the shiny and the cracked ices and all that good stuff. But they’re selling boxes everywhere,” Giddings said. “Disk Replay’s got it now. I’ve seen it at Farm & Fleet, believe it or not.”

NEW INVESTORS

As big-time players like O’Leary discover that there’s money to be made in the sports card industry, more and more wealthy investors are going to invade the space.

Ivy believes it’s a plus when anyone new enters the hobby, especially a recognizable name in Hollywood.

“He’s been out there talking about the market as a whole and investing in this type of material as an alternative asset, so I think all those things kind of coming together is bringing more interest into the market and bringing more collectors on board. That helps everybody,” Ivy said.

“It’s a double-edged sword, right? It increases the prices of these things. I’ve always felt that it was undervalued. This material is unique, a lot of it is one of a kind and it’s nice to see it’s finally getting its due. While people getting involved in the market does increase the value and price some people out, if you are a collector and you’re holding this material, then the way you look at it is the stuff that I’m collecting is also going up in value at the same time. While it may cost more to acquire a new piece, you can also sell a piece that you’ve had for a while to maximize your return on that and help pay for new pieces to your collection.”

So, are investors driving up prices and starting to price out regular collectors?

Moynihan doesn’t think so, because regular collectors aren’t at the same level as investors.

“That high-end world that gets all the glitz and the headlines, that’s a .01% of the hobby,” Moynihan said. “The rank-and-file collector, the rank-and-file card buyer, that doesn’t affect them. In fact, I think those prices have stabilized quite a bit.

“Are we at peak levels? Pricing, no. But from a fervor level, yes. Those are two different things. We are actually seeing some prices come down and stabilize for a large degree in the mainstream type of stuff.”

Having investors entering the space isn’t anything new, according to Masherah. He recalls in the 1990s when financial experts and stock brokers came in and invested in product.

“It is a market cycle—we’re seeing it,” said Masherah, who has worked at Upper Deck for almost 20 years. “Some of the investments that are being made are, I think, being made more for PR (public relations) than they are for pure investment. But the reality is blue-chip cards and super rare and important cards are going to continue to escalate in price the way they always have. We’ve never really seen a backwards trend with the key cards in the industry. They go up over time. They’re kind of like real estate. If they’re important and they’re historical, the cards will go up.”

Masherah isn’t shy about opening up about the rising prices in the industry. He believes regular collectors are getting priced out by Upper Deck’s rival companies, namely Topps/Fanatics and Panini. Upper Deck, which owns the exclusive license to produce hockey cards, is trying to cater to collectors at every level.

“I think in hockey and the Upper Deck products we always make sure to have a portfolio of products that are very affordable,” Masherah said. “I think the industry and the other sports have gotten very reliant on breaks and being able to escalate the cost of a box or a case to be able to send to breakers. I think the industry has lost sight of the average collector being able to buy a box of hobby product and take it home and break it themselves.”

2026 OUTLOOK

Everyone SCD talked to is anticipating another solid, record-setting year in the hobby for 2026.

“Things seem to be pretty good and I don’t see any signs that they’re going to die off,” Savage said. “But we’re linked a little bit to the overall economy and if the overall economy tanks for some reason that will definitely affect this market, too. We’re still dealing with peoples’ extra money. I think they’re eating and paying for their house and paying for their car before they buy their first sports card every month.”

Added Ivy: “I don’t see any reason why we wouldn’t see the continued popularity and growth of the hobby. It’s interesting because I always seem to get things wrong. In 2020, first I thought the sports collectibles market would take a dip, and it did the opposite. It was throwing gasoline on the fire.

“If I had to predict, I would say there might be some softness in the less expensive parts of the market—kind of the meat and potatoes items, I guess is a good way to say it. But I think the best-of-the-best material, the stuff that's really rare and really sought after, I think we’re going to continue to see record prices being set and more interest in that type of material.”