Cards

Collectors concerned over Beckett acquisition, legal experts raise monopoly question after purchase by PSA

Collectors—the parent company of third-party grading giant PSA—just keeps crushing its competition.

In one way or another.

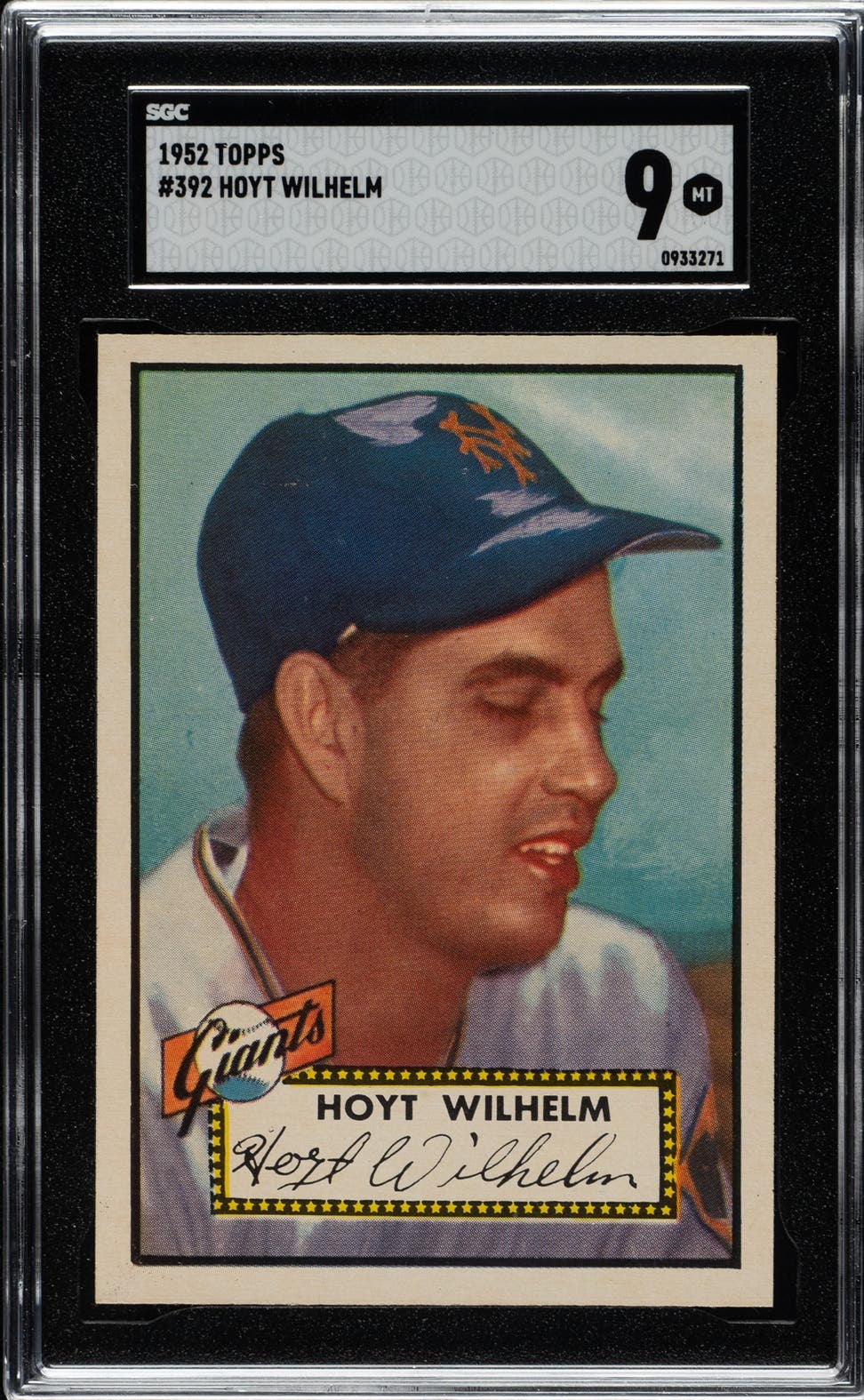

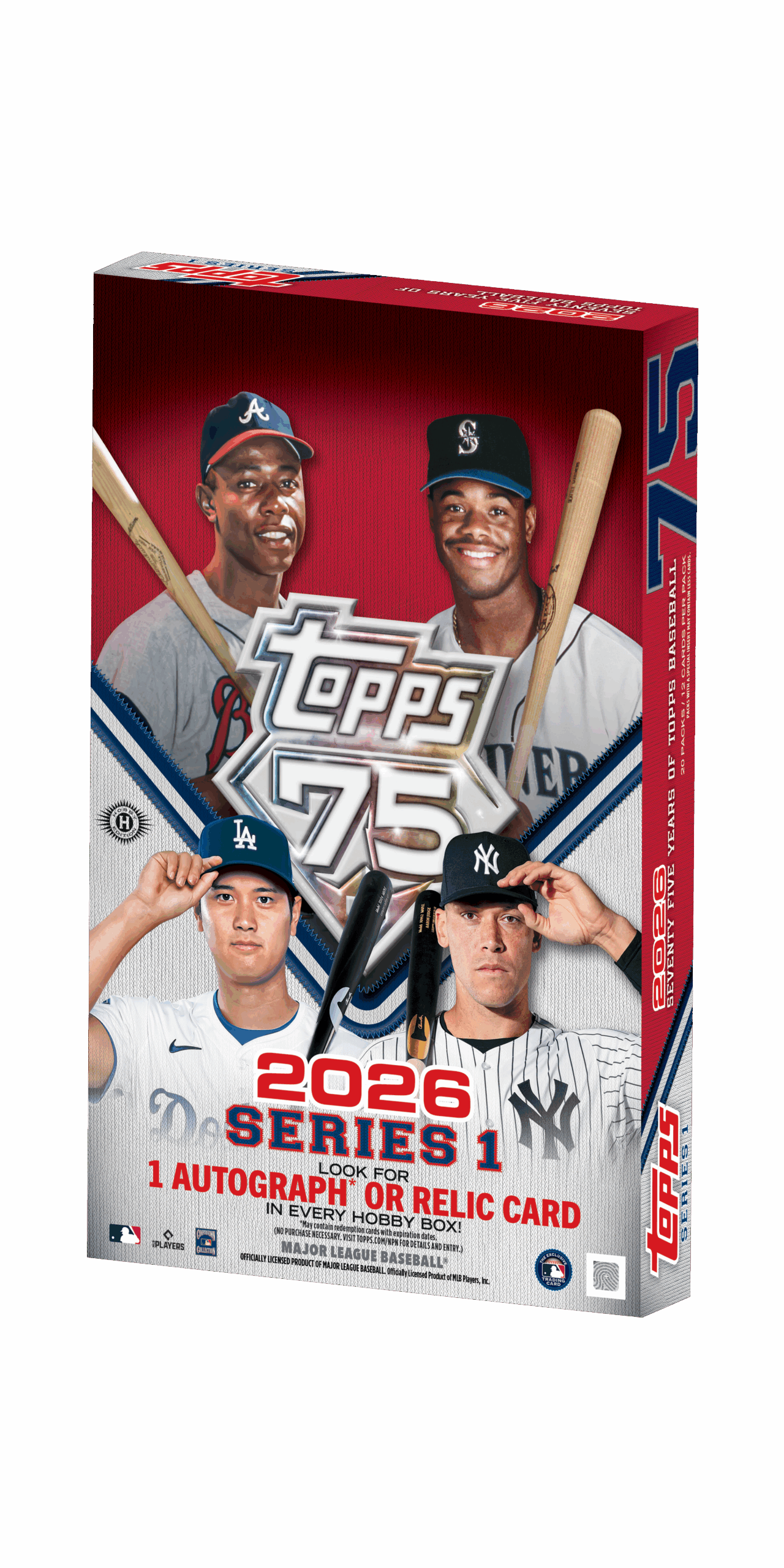

Nearly two years after purchasing grading rival SGC, Collectors announced on Dec. 15 that it was acquiring another one of its longtime rivals, Beckett. The Beckett brand, which has been around since 1984, is synonymous with the sports collecting hobby.

Related Content:

The deal means Collectors will own three of the top four grading companies in the industry in terms of the number of cards they receive and grade. With its purchase of Beckett, Collectors will have an eye-popping market share of 79%.

That figure has plenty of collectors in the hobby concerned about one grading company dominating the space.

“As collectors, we have fewer and fewer choices. Everything’s just becoming monopolized,” longtime vintage card collector John Mangini said. “That’s never good for collectors, having less choices.”

Collectors, dealers and hobby insiders haven’t been shy on social media in suggesting that Collectors is building a monopoly in the grading space.

Neither Beckett nor Collectors have commented on the acquisition since the initial announcement. Collectors CEO Nat Turner and Beckett representatives did not respond to requests for comments about the acquisition. SCD was told PSA President Ryan Hoge isn’t commenting at this time.

As the deal sent shockwaves through the hobby, many collectors took to social media to express outrage.

With the possibility of monopolization, SCD reached out to two card collectors who have extensive knowledge on antitrust issues and the legality on two of the largest grading companies merging.

Paul Lesko, who is a plaintiffs’ litigator for Lesko Law LLC, is intrigued by this case.

“I would differentiate between an illegal monopoly and a monopoly. You can have legal monopolies,” said Lesko, who is known to collectors as “The Hobby Lawyer.” “The antitrust law is not there to knock out all monopolies whatsoever. It’s to knock out monopolies that interfere with competition or hurt consumers.

“So, would I say that they’re just a monopoly, period? With that market share, yes, I would definitely say that they’re a monopoly. Now are they to the grounds of illegal monopoly where antitrust should step in? They’re really close.

“As a plaintiffs’ attorney, I’m looking at it.”

UPDATE: U.S. Congressman Pat Ryan of New York called on Dec. 19 for the Federal Trade Commission to investigate the deal for a monopoly and possible anti-trust violations.

According to Lesko, antitrust laws are ultra-complicated, because there are so many factors to take into account. One of the main elements is percentage of market share. PSA was already well above the 50% threshold prior to its purchase of Beckett and its grading arm, Beckett Grading Services (BGS).

“By acquiring Beckett, this puts them above the 75% mark. Having 50% control, that’s loose market share,” Lesko said. “You get to 67%, you’re like, OK, that’s pretty high. Then I always think anything above 67%, especially when you get to nice, round numbers like 75% or above, anything more shows that you have market share. I think that’s a big thing that’s jumping out at a lot of people.”

Collector Chris Harris agrees that one company owning 79% market share in a space is way too much. Harris is well-versed in antitrust having worked 12 ½ years for the Federal Trade Commission (FTC) in its bureau of economics as a research analyst doing antitrust enforcement.

“I think if this gets approved under normal circumstances, I’ll preface it this way, some of my old colleagues at the FTC might cause a stink about it and maybe force Collectors to spin off either one or both of BGS and/or SGC—ideally both,” Harris said.

“With that said, Beckett is a brand that still means something. It still has some equity to it. They still make the magazine, they still have the website. Not so much in recent times, but they are for a lot of people the number one news source in the hobby. I’d like it if that part of the company went to someone that knows what they’re doing hobby-wise.”

More Industry News:

In the last couple of years, CGC—which started its card grading service in 2020—has moved into second place in the number of cards graded and submissions. Having its top three competitors, PSA, SGC and BGS, all owned by the same company makes things more challenging for CGC and its parent company, Certified Collectibles Group (CCG).

CCG CEO Steven Eichenbaum provided SCD with a statement on Collectors’ acquisition of Beckett.

“[The] announcement only reinforces what I've been saying for a while: CGC is the clear choice for collectors,” Eichenbaum said. “We offer fast turnaround times, consistent grading, the best holders and great customer service. All done with integrity.

“In my 25-plus years at the helm of this company, I know that change is inevitable. However, when the world changes around us, we focus on the reason we exist: to protect collectors and dealers by providing accurate and impartial grading services.”

BUYING COMPETITORS

When Collectors bought SGC in February 2024, SGC was recording the third-highest submissions per month among grading companies, according to GemRate. In July of that year, SGC hit its peak at 194,000 cards graded and briefly surpassed CGC into second place in the grading race. In June 2025, SGC received 158,000 submissions. However, by November, SGC was down to grading just 35,000 cards per month.

Collectors seems to be driving SGC into the ground.

“Soon after PSA bought SGC, SGC raised prices, they got rid of a bunch of discounts for group submitters and they’re taking less submissions. That’s all not good for the consumer,” Lesko said. “Just on past performances—obviously not a 100% predictor for future performance—but if PSA does what it did for SGC with Beckett, well, then, again, that’s not good for consumers. It looks like you’re buying your competitors, you’re raising the prices on them, you’re lowering the submissions, which means more people are going to come to you.

“In the antitrust analysis, it looks worse and worse for PSA. Now, does it get to the area that, hey, now you’re immediately an illegal monopolist? That’s what you would need to discover to go forward.”

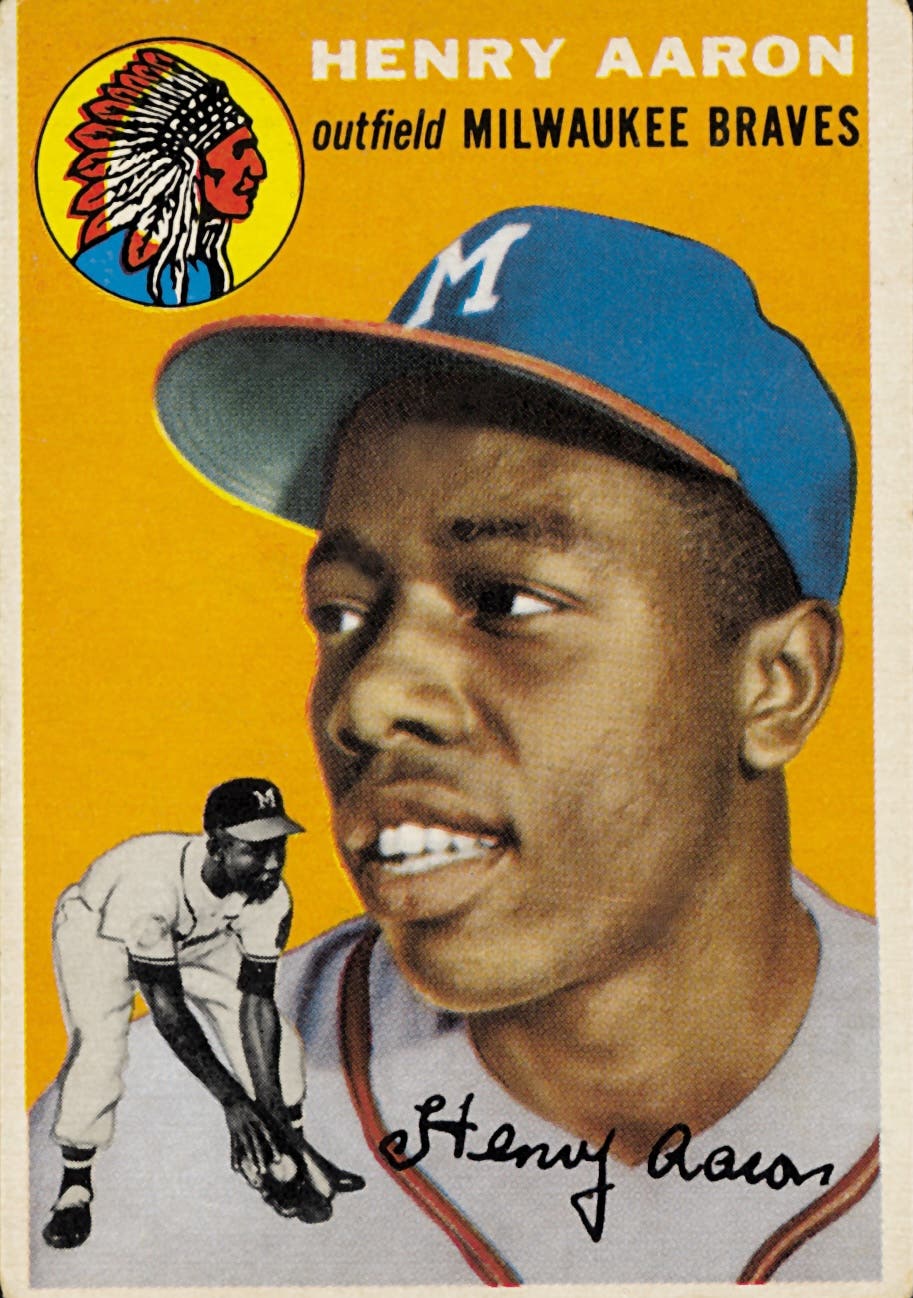

BGS has been an important part of the grading evolution since it launched in 1999. Starting around 2008, there were a number of years where a BGS 9.5 graded card was more desirable than a PSA 10. That sentiment changed amongst collectors around 2015. By the time of the pandemic hit, PSA submissions went crazy and the company surged to the top.

For a long time, BGS was second fiddle to PSA in the number of cards graded. But in the last five years, BGS numbers have slipped as SGC and CGC both surpassed BGS.

Over the last two years, BGS hit a low of 34,000 submissions in November 2024. This past month, BGS graded 74,000 cards, according to GemRate.

“When Collectors bought SGC in February of last year, SGC at the time I believe had about a 12-15% market share, and that’s been wound down to about 2-3%,” Harris said.

“Adding BGS is going to be problematic to PSA, because they’re already, even without SGC, they kind of have what we call in antitrust enforcement ‘monopoly power.’ They may not have 100% market share, but they are the dominant player and the dominant player by far. They’ve kind of exploited that to do things that have definitely hurt the consumer. They’ve raised prices, they’ve extended turnaround times. I think the lowest level of service is now a 75-day turnaround time. And, of course, they do things like nickel-and-diming consumers with fees. The big controversy, of course, recently has been up-charging.”

Do these diminishing figures indicate that BGS could start to fade away just like SGC has done?

“It could. It does look like that’s what’s happening to SGC,” Lesko said. “It does look like somebody’s dialing back SGC and making it a real niche company that at some point won’t mean anything. If you submit cards and they’re not going to look at them because they have such a backlog, you’re going to go somewhere else.”

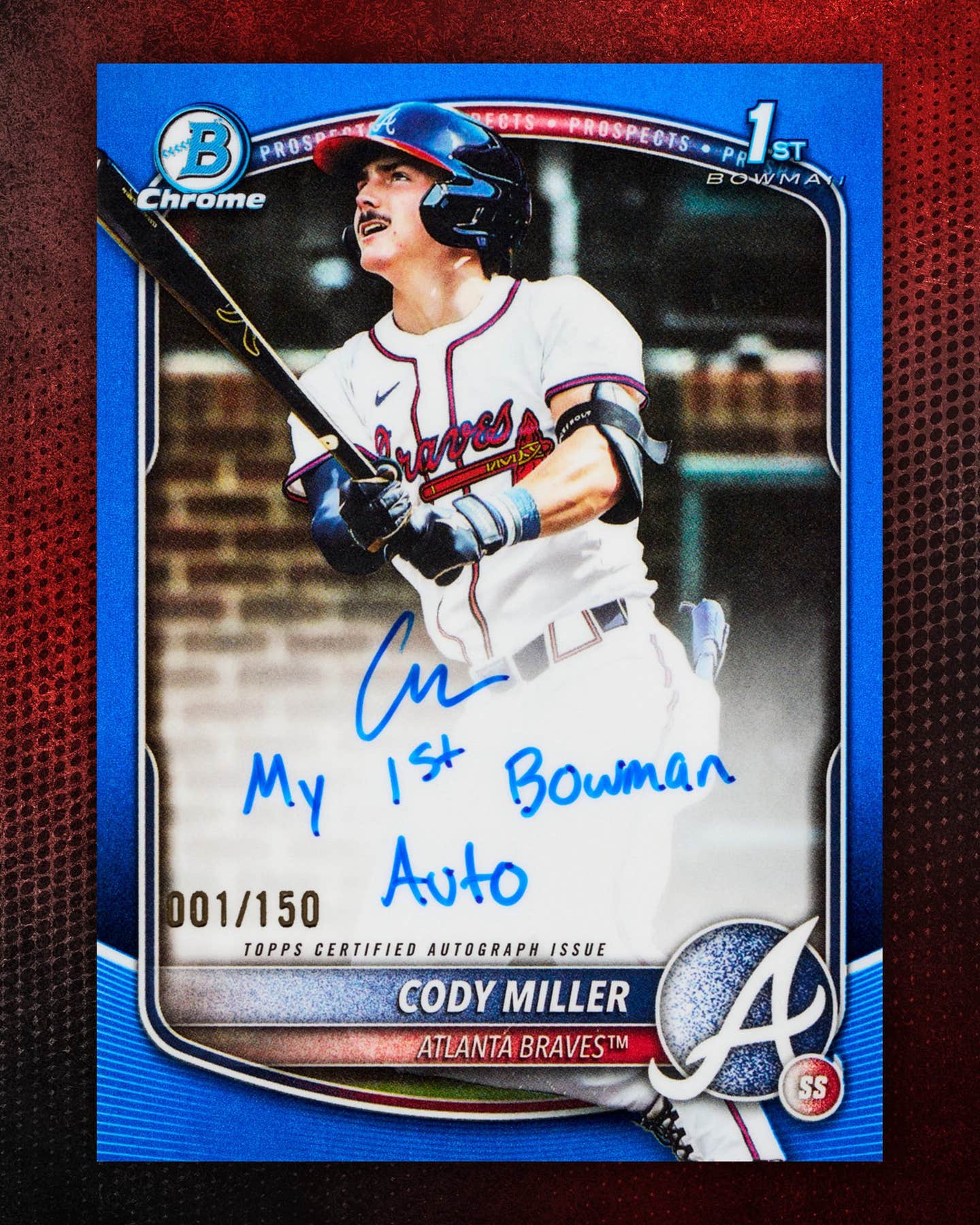

If SGC and BGS essentially fold, dealers and people who sell slabs from those two companies might be forced to crack their cases and submit them to PSA since PSA slabs demand high resale in the hobby.

Mangini hopes SGC and BGS slabs don’t become obsolete if both companies are eliminated.

“They’re going to go down in value, there’s no question about that in my mind,” Mangini said. “At one time, Beckett was the number one grader for modern cards. Everyone wanted a Beckett 9.5; they didn’t want a PSA 10. And in recent years that changed when Beckett went down a little bit.

“People are going to want the hottest thing, and, let’s face it, it’s what’s going to sell for the most amount of money. That is PSA’s thing. Collectors, for whatever reason, will pay up for a PSA slab over an SGC slab in many or most cases. So, if you’re a seller, you have to grade with the company that’s going to get you the most money, period. But I think that young collectors coming in, newer collectors coming in as time goes on, they’re not going to have any appreciation or respect for SGC or Beckett. A lot of the old-timers will—those of us that have loved SGC over the years.”

SEPARATE ENTITIES

When Collectors announced the acquisition of Beckett, a press release stated that “Beckett will remain an independent brand within the Collectors family of companies.”

Harris is skeptical that Collectors and Beckett will run as separate entities.

“I seem to recall that they were going to keep SGC separate and they’ve wound up winding that down,” Harris said. “By the way, the Clayton Antitrust Act of 1914, it is illegal to buy one of your competitors for the purpose of either shutting it down or winding it down, which is what PSA has seemed to have done with SGC. So, that could be one thing that the FTC brings up if it decides to bring action.”

Mangini doesn’t believe Collectors won’t dictate how Beckett operates its company.

“SGC, from everything I hear, is becoming more like PSA. I don’t think they’re completely leaving it alone. I just don’t believe that,” Mangini said. “As time goes on, why are they going to have these three separate companies? It doesn’t seem to make sense moving forward.”

Things could get dicey if any competing companies or individuals decide to file an antitrust lawsuit to try and stop or break up the Collectors-Beckett merger.

“It depends on if anybody at the FTC is paying attention to this,” Harris said. “If collectors want the FTC or the Department of Justice—they also have some say over antitrust law—to look into this, my advice would be to just open up a complaint with the FTC and/or the DOJ’s antitrust wing. Maybe that will get their attention. The FTC can’t look at everything and not every merger and acquisition is really worth the FTC’s time. But you never know.”

If the merger, which doesn’t require FTC approval, ruffles enough feathers and makes its way to Washington, D.C., anything could happen.

But Lesko isn’t sure the trading card industry is large enough to attract interest from federal government officials.

“I think there’s still that ‘trading cards are cute’ persona. Is it really a big market?” Lesko said. “So, I don’t think a large governmental agency—especially in the political climate right now—anyone will stick their heads out for a grading company of trading cards. But if you have somebody who wants to try something, I think the prerequisites are there to at least file a lawsuit.”