News

PWCC acquires $175 million in financing to help provide loans, cash advances to clients, collectors

PWCC Marketplace has acquired $175 million in credit to help grow its commercial financing business, which provides loans and cash advances to clients in the trading card industry.

PWCC has established a $175 million asset-based credit facility led by WhiteHawk Capital Partners, LP as sole lead arranger and book runner with Wingspire Capital LLC serving as revolver agent. D.A. Davidson & Co. served as exclusive financial adviser to PWCC for the financing.

“The demand for PWCC’s commercial financing services has reached the level where partnering with industry leaders in asset-based financing solutions makes strategic sense for all involved,” PWCC Founder and CEO Brent Huigens said in a PWCC press release. “Our clients now have additional capital options presented to them as part of their PWCC Vault accounts, the company can continue to innovate around its capital practices, we gain access to experts in the financing field, and WhiteHawk gains exposure to a high-performing financing program in an emerging sector. It is a strategic partnership that is exciting for all parties.”

“The PWCC management team has built a best-in-class, full-service auction, storage and lending platform,” WhiteHaw Managing Director Rob Chimenti said in the release. “We are excited to be part of their growth and success as an innovative industry leader in the emerging collectible sector.”

“PWCC is a global market leader in the trading card and related collectibles industry and has successfully transitioned to a dynamic, software-enabled technology company,” said Brad Gevurtz, managing director at D.A. Davidson. “We are very happy to have worked with the PWCC management team on this partnership. We see a bright future for PWCC as it grows and expands its global footprint.”

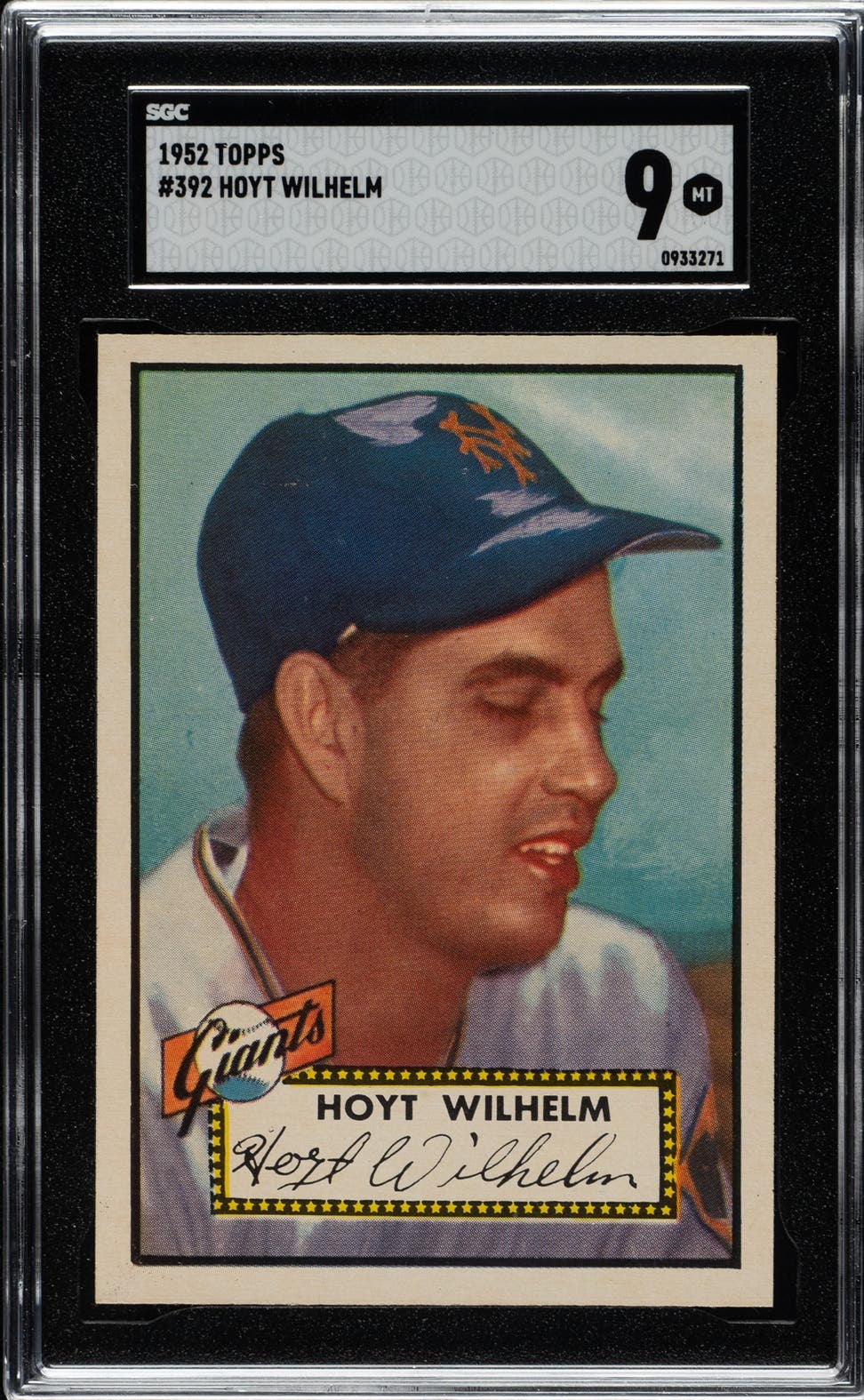

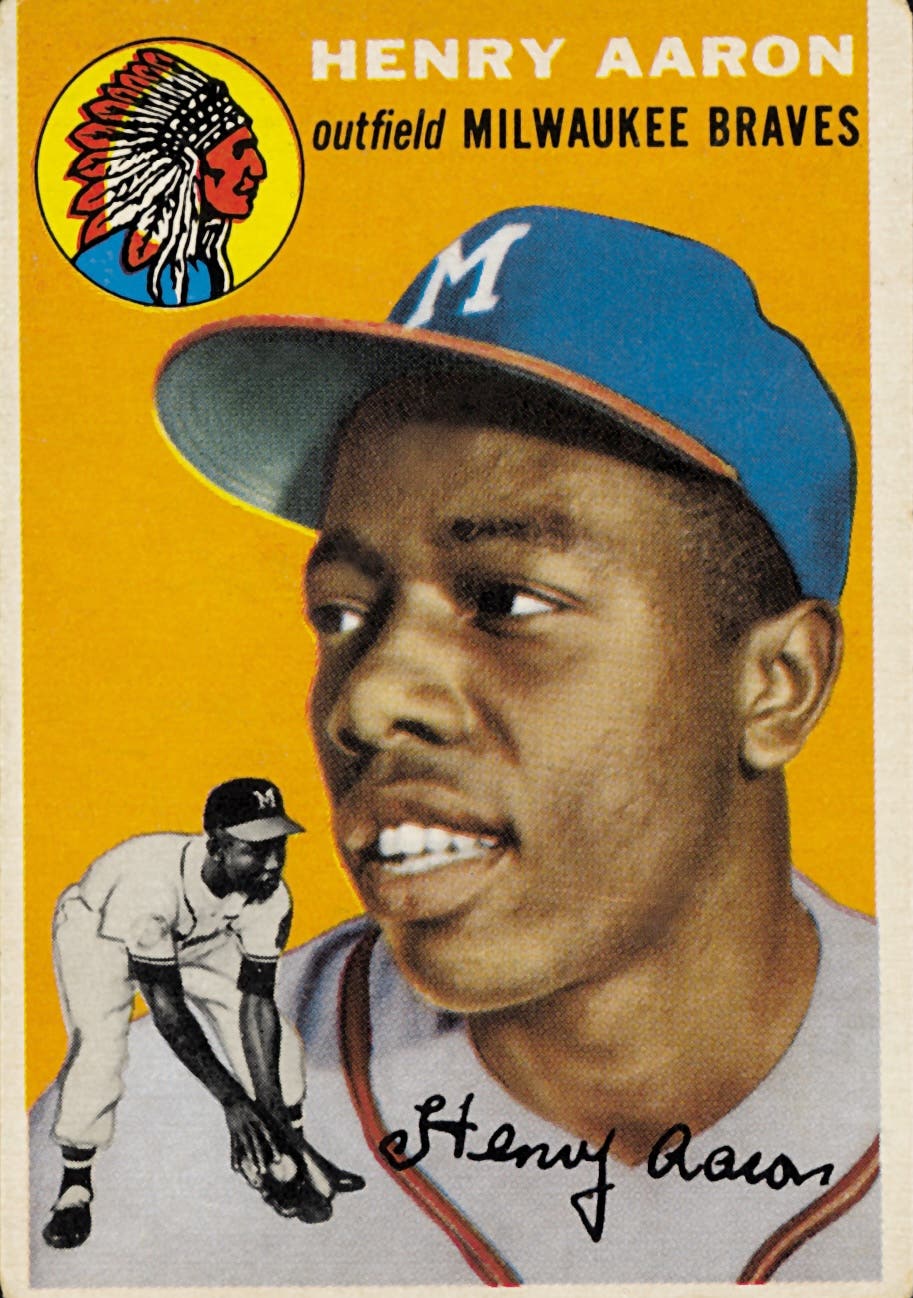

PWCC is one of the leading sports collectibles companies in treating trading cards as a tangible asset. The company has developed multiple market indicators — the PWCC 100, PWCC 500, and PWCC 2500 — to track trading card performance as an alternative investment. According to the company, the PWCC 500 is up 902 percent from January 2008 through March 2022.

PWCC, founded in 1998, launched its own standalone marketplace in 2021. Since the launch, it has added more than 150,000 registered clients, launched a series of new technologies and seen the value of assets stored in its vault rise to more than $750 million.

“This Financing further validates the trading card asset class as a liquid market with a growing universe of buyers and sellers in which PWCC continues to be a leader and innovator,” said Amy Johnson, managing director and head of debt advisory at D.A. Davidson. “We are pleased to have worked with PWCC and WhiteHawk on this pivotal institutional debt capital raise for the company.”

“This partnership will help shape the future landscape of collectibles asset-based lending,” said Chad Fister, chief financial officer at PWCC. “We are extremely grateful to the Davidson team for their endless dedication and professionalism, and we couldn’t be happier to be partnering with WhiteHawk.”