News

CCG purchased by investment group with ties to NBA

Sports collectible grading company Certified Collectibles Group (CCG) has been purchased by an ownership group with ties to the NBA.

Investment firm Blackstone announced Thursday that funds managed by its Tactical Opportunities business is acquiring CCG in a transaction valuing the company at more than $500 million. CCG founder Mark Salzberg and CEO Steve R. Eichenbaum will retain a minority stake.

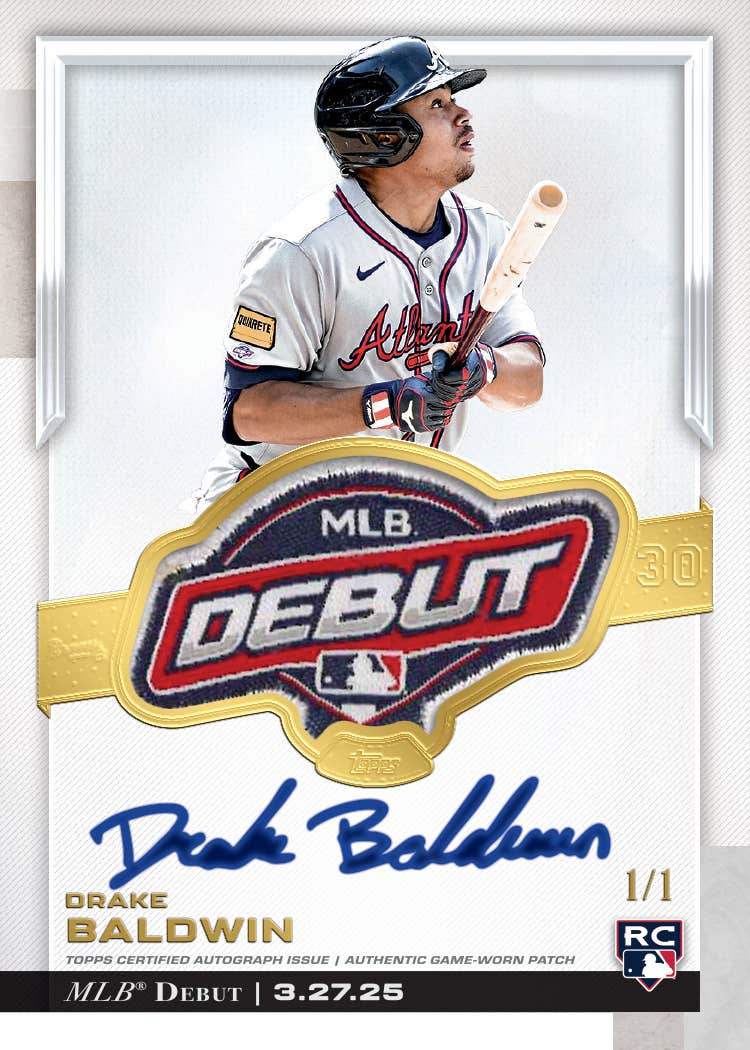

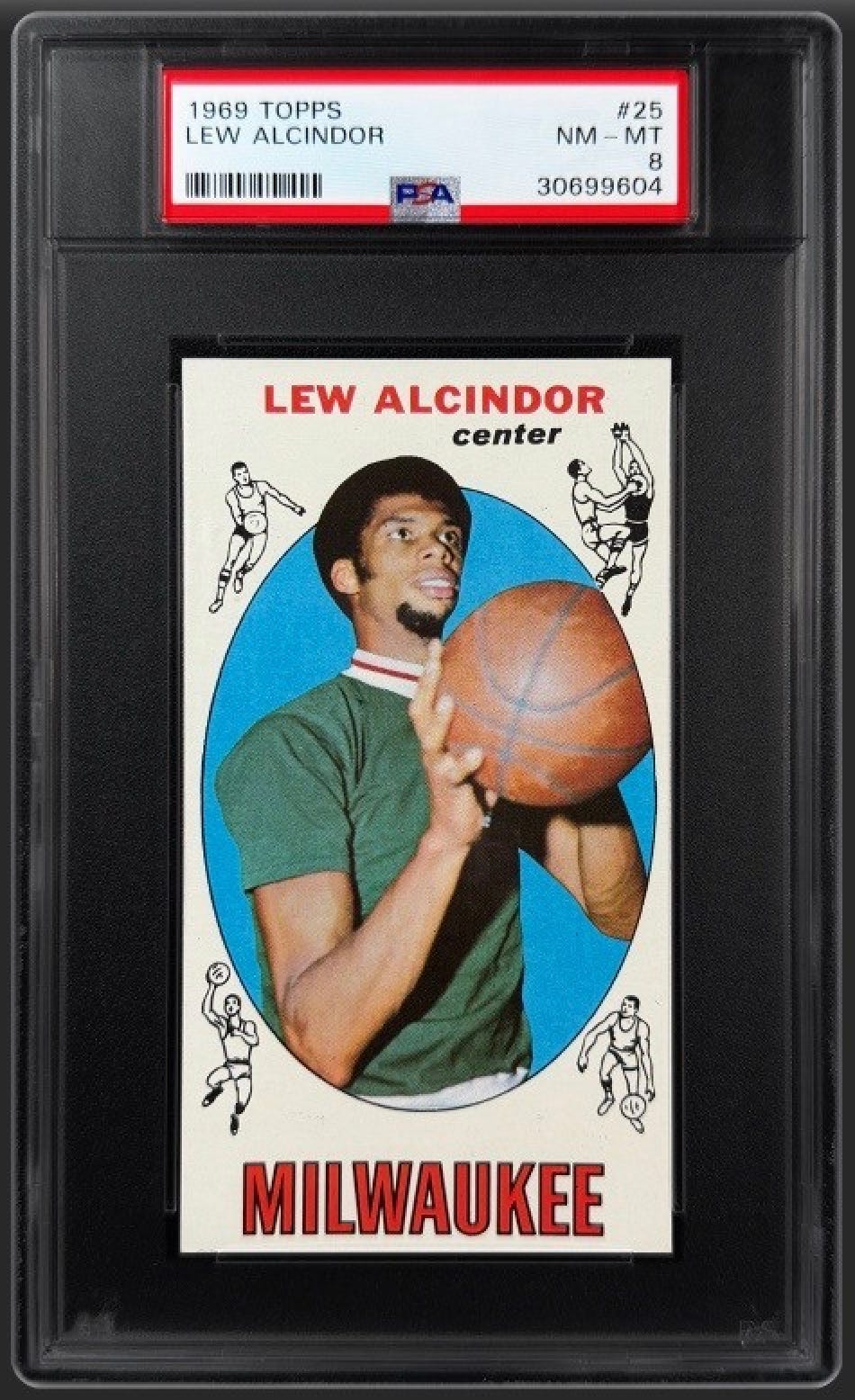

CCG offers authentication, grading and conservation services for much of the collectible industry, including the red-hot sports collectible hobby. Founded in 1987, CCG has expanded its services from collectible coins to sports cards, comic books, banknotes, magazines, concert posters, stamps, trading cards and estate items. According to the company, it has certified more than 62 million collectibles, with a combined fair market value approaching $50 billion.

More News: Goldin Auctions sold to Collectors Holdings

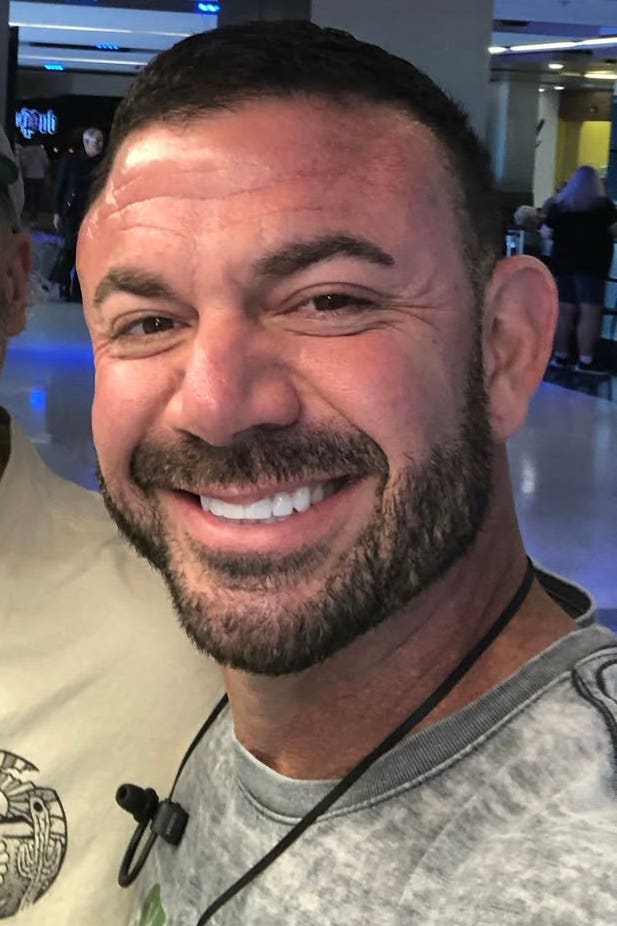

The new ownership group includes former NBA player Andre Iguodala and Daryl Morey, president of basketball operations for the Philadelphia 76ers. Other investors include: Roc Nation; Fanatics Founder and Executive Chairman Michael Rubin; growth equity platform SC.Holdings; Mastry, founded by Rudy Cline-Thomas; and Main Street Advisors, an investment advisory firm to prominent athletes, recording artists and other leaders across entertainment and business.

Blackstone, a $650 billion investment firm, said in a July 1 press release that it will seek to accelerate CCG’s growth, allowing the company to invest significantly in its current and planned services, adding and training new employees, expanding its geographic and product reach, acquiring new technologies and developing its digital presence.

“As thematic investors, we look for exceptional entrepreneurial teams succeeding in growing markets, and CCG is a great example,” Blackstone’s C.C. Melvin Ike said in a release. “We have been closely following the rise of the global physical and digital collectibles industry for several years and we were drawn to CCG because of their leadership role in the categories that they serve, and Blackstone’s ability to grow the platform through both organic and inorganic initiatives. We look forward to working together to help the company continue and even accelerate its impressive growth trajectory.”

CCG’s leadership team will remain in place.

“When I established CCG, I had a vision that we would transform collectibles into an asset class that is trusted by collectors, dealers and investors around the world,” CCG founder Mark Salzberg said. “It has been incredible to be a part of this journey as we achieved and then exceeded these goals. I am excited to join with Blackstone as we enter the next phase of growth for CCG and the collectibles market.”

“We are thrilled to be partnering with Blackstone during this key point in the industry as the collectibles market continues to accelerate and attract new collectors and investors,” Eichenbaum added. “From the moment we met the Blackstone team, we could tell that we shared the same vision for the future of our company and the global collectibles industry.”