Cards

BREAKING NEWS: Congressman calls for Federal Trade Commission to investigate Beckett sale to PSA

Four days after announcing it had acquired card-grading rival Beckett, Collector Holdings is under attack from the federal government.

New York Congressman Pat Ryan has demanded that the Federal Trade Commission (FTC) open an investigation into possible anti-trust violations by Collectors, which owns multiple hobby companies, including three of the industry’s top four grading companies. Ryan’s letter was addressed to FTC Chair Andrew N. Ferguson.

Related Content:

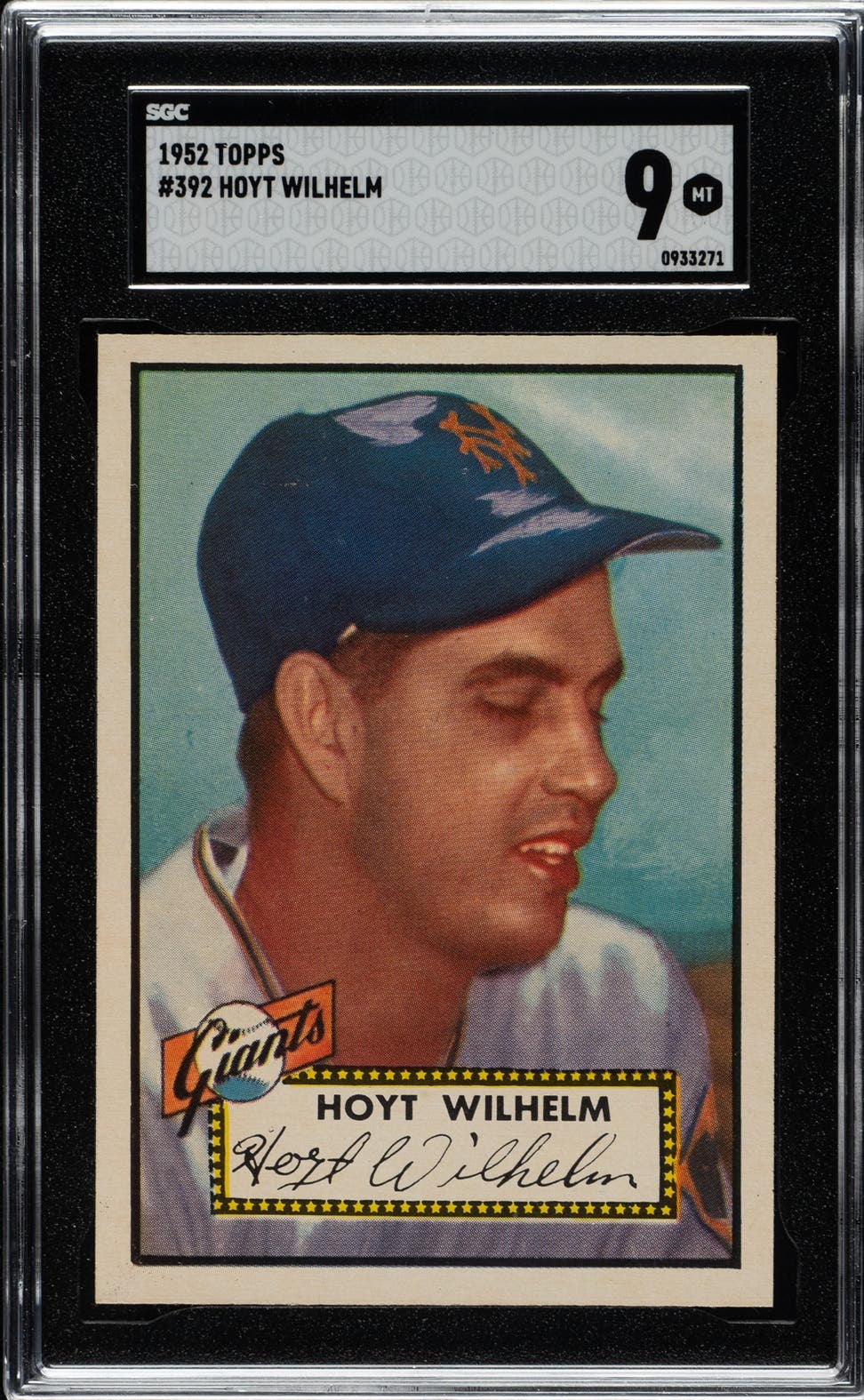

Ryan’s letter, which was released to SCD on Friday, states that through acquisitions of card-grading companies PSA (2021), SGC (February 2024) and Beckett (announced December 2025), Collectors has “consolidated over 80% of grading volume, leaving only one independent competitor. Collectors’ dominance is compounded by vertical integration; it controls grading capacity, pricing analytics through CardLadder, and participates in buying and selling graded cards—creating severe conflicts of interest.

“Even my 4- and 6-year-old boys, who just started their collections, know this behavior is wrong,” Ryan stated in a press release. “Attempts to corner the trading card market are not only deeply unpopular, they are unethical. Kids, collectors and local card stores shouldn’t have to worry that the system is stacked against them, and the FTC needs to step in before this hobby is controlled by one powerful company.”

Ryan said the FTC should investigate whether Collectors now has an illegal monopoly and whether it acquired SGC and Beckett “specifically to eliminate competition, and whether internal documents reveal a deliberate strategy of monopolization.”

Hobby insiders and legal experts have questioned whether Collectors now hold a monopoly after purchasing Beckett.

“The antitrust law is not there to knock out all monopolies whatsoever. It’s to knock out monopolies that interfere with competition or hurt consumers,” said hobby lawyer Paul Lekso. “So, would I say that they’re just a monopoly, period? With that market share, yes, I would definitely say that they’re a monopoly. Now are they to the grounds of illegal monopoly where antitrust should step in? They’re really close.

“As a plaintiffs’ attorney, I’m looking at it.”

Neither Collectors nor Beckett have commented publicly since the initial announcement of the sale. Neither company has responded to requests for comment from SCD.

Other questions that should be investigated, Ryan stated, include:

• Serial Acquisition Pattern: “Whether Collectors’ systematic roll-up strategy violates Section 5 of the FTC Act as conduct that inherently produces the cumulative harms the antitrust laws were designed to prevent.”

• Regulatory Evasion: “Whether [previous Beckett owner] Collēctīvus Holdings functioned as a pass-through entity to evade merger scrutiny, and the extent of Collectors’ involvement in the 2024 acquisition of Beckett.”

• Good-Faith Representations: “Whether the post-acquisition marginalization of SGC was contrary to representations made at the time of the merger, and if those actions warrant a court-ordered divestiture or unwinding of the deal.”

• Erosion of Competition: “How the elimination of independent rivals has directly impacted consumer pricing, service quality, and turnaround times across the industry.”

• Price and Policy Coordination: “What safeguards, if any, prevent Collectors from coordinating pricing, grading standards, and competitive behavior across its three nominally ‘independent’ brands.”

• Barriers to Entry: “What structural barriers now prevent new competitors from entering the market, specifically regarding the control of the limited labor pool of professional graders.”

• Market Manipulation: “How vertical integration—controlling the grading process, the pricing data through CardLadder, and the marketplace itself—creates unique opportunities for market manipulation and unfair self-dealing.”

You can read Congressman Ryan’s full letter here.