News

Fanatics plans to take complete control of distribution of sports trading cards

As expected, Fanatics plans take complete control of the distribution of sports trading cards once its new licensing agreements with MLB, NBA, NFL and the league’s respective players associations kick in, according to a report in the Wall Street Journal.

News surfaced last month that the sports apparel and merchandise giant had acquired the rights to produce baseball, basketball and football cards beginning in 2023 when the company’s license with the MLB Players Association begins. The company’s rights deal with MLB begins in 2026, as does it deals with the NBA, National Basketball Players Association and the NFL Players Association. The NFL has not yet announced a deal with the new company, which will be called Fanatics Trading Cards, according to the Wall Street Journal.

The WSJ reported Wednesday that Fanatics plans to expand its reach into the secondary market and become a one-stop-shop destination for the hobby, including primary and secondary sales, card grading and storage. Fanatics has a huge distribution network for its apparel and merchandise business and plans to sell trading cards directly to collectors and consumers.

The moves would have a profound impact on local card shops, retail stores and distributors who currently supply cards to retail outlets.

“With Fanatics owning the rights, they are fundamentally going to change the experience for the fan and collector in a way that the existing rights holders just haven’t done,” Greg Mondre, co-CEO of Silver Lake, which recently invested in Fanatics, told the WSJ. “Hopefully, we’re going to expand the audience of people that access these cards, that trade these cards and want to collect these cards.”

Fanatics Chairman Michael Rubin outlined his vision for the new company Thursday on CNBC.

“This is really about a completely different vision for where the trading card industry should go,” he said. “I think if you are going to think about the collector experience, it is pretty brutal today. You’ve got to buy primary cards with so many people kind of in the middle of it that you buy primary cards and you sell secondary cards somewhere else. You get your cards graded by another party, you need to store them with someone else. … This is about our vision to create an incredible collector’s experience, bringing all the pieces together.”

According to the WSJ report, Fanatic’s new trading card company has received $350 million in Series A funding, boosting its value to $10.4 billion. The investment accounts for about 3.4 percent of Fanatics Trading Cards.

The three major sports leagues and its respective players unions will own about 14 percent of the company, WSJ reported, with Fanatics retaining 80 percent. Fanatics is owned by founder and CEO Michael Rubin, who is also a co-owner of the NBA Philadelphia 76ers and NHL New Jersey Devils.

According to the WSJ, the three leagues and its players chose to partner with Fanatics because it plans to sell directly to consumers and control the business, with the leagues and players getting a larger piece of the pie. Fanatics’ deals with the leagues and players are all reportedly for 20 years or more.

According to the company’s new investors, Fanatics Trading Cards plans to create a new way of selling and distributing trading cards, controlling the market by cutting out the middle men and secondary markets.

“We see a market that has the potential to be disrupted in a way that improves consumer choice, improves consumer experience and also expands the opportunity for the rights holders,” said Deven Parekh, a managing director at Insight Partners, another new investor in the company.

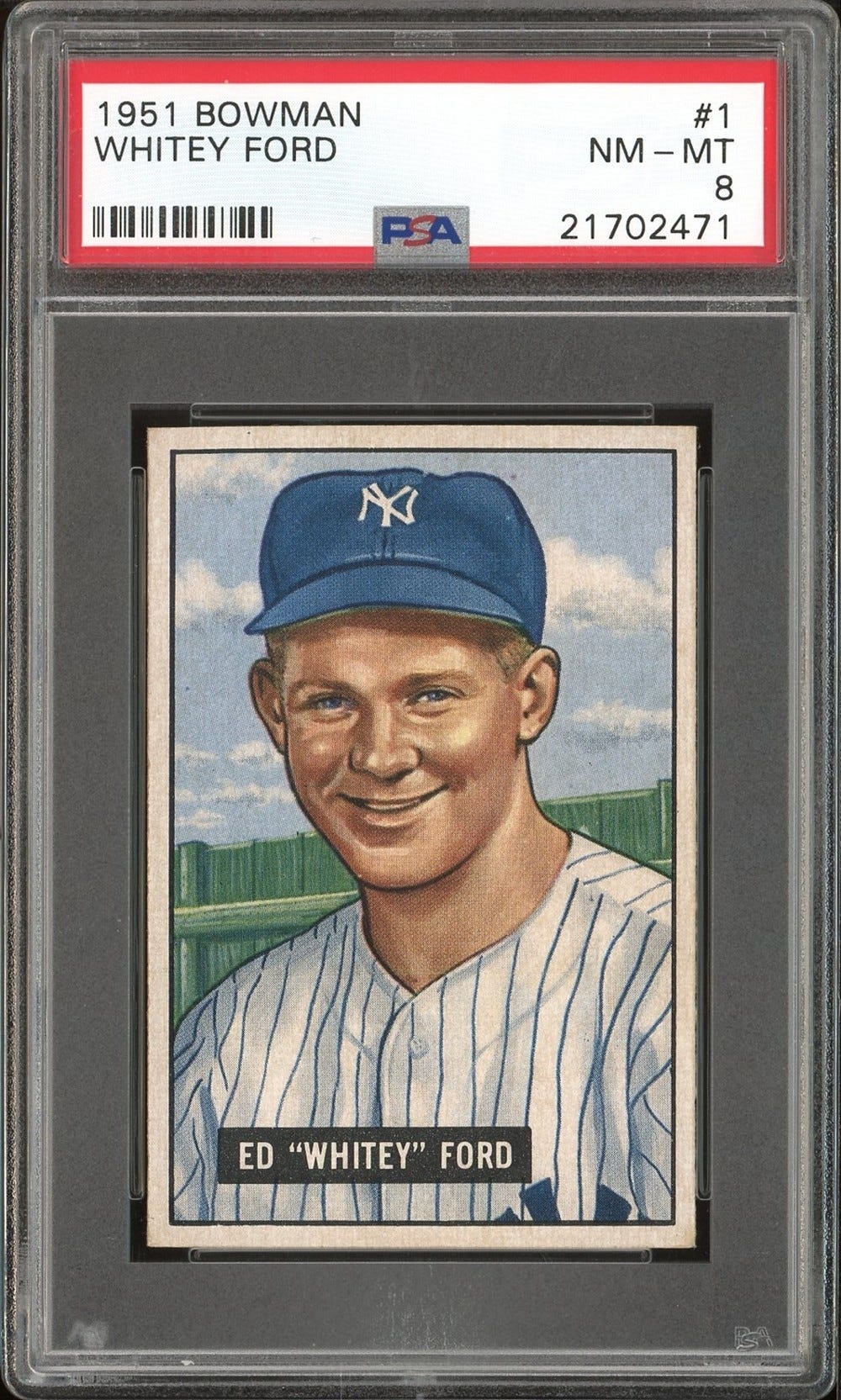

Fanatics new licensing deals will mean the end of an era for Topps, which has produced baseball cards since the 1950s, and Panini, which has held the NFL and NBA rights for the last decade. Representatives from those companies, which were both on verge of going public, have yet to release details about their future plans without baseball, football and basketball cards.