News

Industry insiders react to Fanatics’ sports card deals with MLB, NBA, NFL

Derek Grady claims his wife doesn’t know anything about the trading card hobby, but she had a question for him: “Is Topps really going to stop producing baseball cards?”

Grady, Heritage Auctions’ vice president of sports auctions, couldn’t believe what he was hearing.

“I was like, ‘You have heard this? You noticed it’s Topps?’ So, it just shows you that this is major news that Topps won’t be producing baseball cards anymore. I think it hit everybody.”

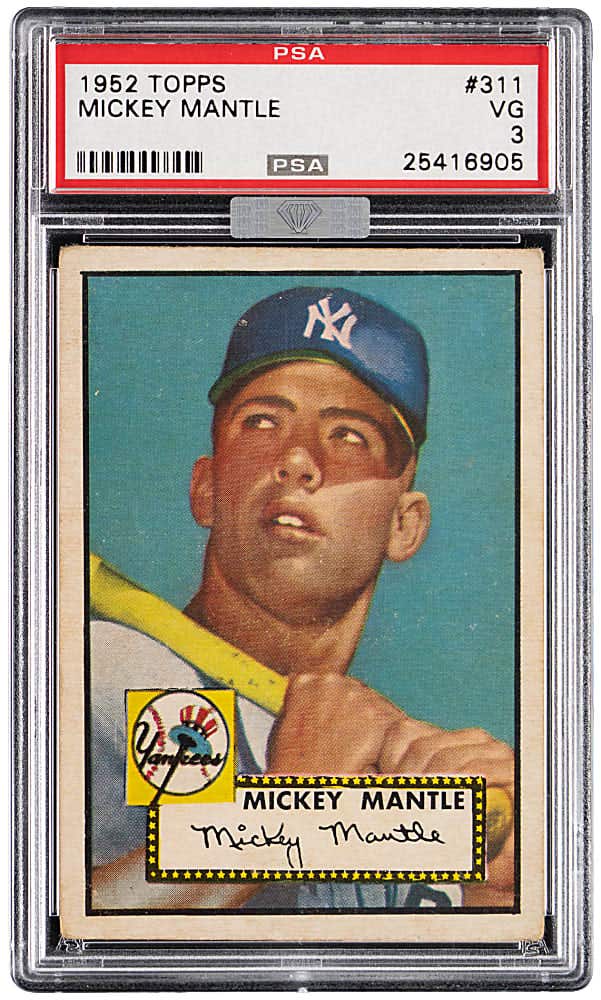

News that Fanatics, the world’s largest producer of licensed sports merchandise, has secured the rights to produce officially licensed baseball cards sent shockwaves through the sports collecting community. Topps is celebrating its 70th year of producing baseball cards and has held the exclusive rights from MLB since 2009.

The deal means that Topps, the most recognizable card brand in the industry, will no longer be allowed to produce officially licensed baseball cards once its current deals with Major League Baseball and the Major League Baseball Players Association end. Fanatics, an $18 billion company, swooped in and was granted the exclusive MLB and MLBPA licensing rights for a new trading card company it plans to form.

In parallel moves, Fanatics has also reportedly acquired the sole licenses for the NBA and National Basketball Players Association as well as the NFL Players Association. Panini has held the exclusive basketball contract since 2009 and football since 2016. Having a league license allows Fanatics to add team logos and league trademarks to its cards.

Fanatics’ MLBPA license starts in 2023 and the official MLB license begins in 2026. The NBA, NBPA and NFLPA deals will all start in 2026. It is not yet known if the NFL has granted Fanatics an exclusive deal.

Fanatics, which also owns the apparel rights for all three leagues, is owned by billionaire Michael Rubin, the co-owner of the NBA’s Philadelphia 76ers and NHL’s New Jersey Devils. StockX founder Josh Luber has reportedly been hired to head up Fanatics’ new trading card venture.

The licensing bombshell, which hit on Aug. 19, caught many in the sports collectible industry by surprise. Sports Collectors Digest spoke with several major players about what these moves mean for the hobby.

“I had heard some rumors about it, but honestly I didn’t believe the rumors just because in my head there’s no way Topps or Panini would allow that to happen, because that’s their livelihood,” Collectors Universe CEO Nat Turner said. “I know Topps and Panini have other businesses, gum and stickers and candy and whatever, but I have to imagine this was a big blow to them.

“In hindsight, Fanatics is a much bigger company than people realize and probably had a lot more to offer and can pay a lot more than those guys‚ maybe more than Topps certainly could. So, I guess I shouldn’t have been that surprised. But to have them all happen — basketball, baseball, football — in one fell swoop is just incredibly impressive on the part of Fanatics.”

According to multiple media reports, the Fanatics deals give all three major sports leagues and its respective players associations equity stakes in the new venture.

Tech entrepreneur and founder of Sports Card Investor Geoff Wilson has a steady pulse on the market and was blown away by the news.

“It came out of left field for me. I was shocked, yes,” Wilson said. “I was shocked that I hadn’t heard anything about it, that it just kind of came out of nowhere. But it seems like Topps was shocked as well as Panini. I think that everyone was pretty shocked by it.”

Topps, which was purchased in 2007 by an investment group led by former Disney CEO Michael Eisner, was on the verge of going public through a merger with Mudrick Capital, a deal valued at $1.3 billion. Topps Chairman Andy Redman said in a statement that the iconic company was unaware that MLB and the MLBPA were negotiating with other companies, saying it was “abruptly informed that a deal was completed, finalized and exclusive with Fanatics.”

According to the MLBPA annual report, Topps paid the union $20.4 million in 2020. The Fanatics deal with MLB and the MLBPA is more than 10 times larger than any the union has ever agreed to, according to ESPN.

Steve Grad, the principal authenticator at Beckett Authentication Services, was also shocked by the deal, but added: “I’ll tell you this, I’ve known the Fanatics storm has been coming just because we have a close working relationship with some of their real high-ups there, we have for years. Beckett works closely with them on a lot of stuff, and I kind of felt this was coming.

“I also think that nothing’s really going to stop them. When [Fanatics is] worth $18 billion — Topps, their IPO is screwed.”

Vintage Breaks and Just Collect Inc. founder Leighton Sheldon, who grew up collecting Topps cards in the 1980s and ’90s, was initially sad when he heard Topps may no longer be part of the collecting mix in the future.

“I kind of feel like motherhood and apple pie and Topps kind of go all together,” Sheldon said. “But I thought about it, and truth be told, change can be nerve-racking, but at the same time … there’s going to be all this money put down and invested in the future of the card industry as we know it.

“For years, we all dreamt of like, ‘Hey, I wish an athlete would take an interest in cards, because they’re just so cool.’ And so, I think you’re going to see a lot more athlete and sport integration at the highest level for cards and I find that to be extremely exciting. I have no idea how many new customers can come from that, but I think a lot.”

Said Dan Wulkan, a partner at Memory Lane Inc.: “I think based on all this new money that’s come into our hobby, I think it was time for someone to kind of — I don’t want to use the word spruce it up — but bring some life to new eyes and a new group of people that have only been bringing really neat stuff to the market.

“I think [Fanatics has] a great pulse on the market and they’re extremely reputable. I think that with the people behind Fanatics, the industry will only continue to explode.”

After acquiring the exclusive rights from the nation’s three major sports leagues, Fanatics certainly has the financial backing to produce beautiful cards and give collectors what they desire. And with partnerships with both the leagues and player unions, it should be able to do all sorts of promotions to push card sales. The options could be limitless.

“I could see, for example, when you’re watching Sunday Night Football 10 years from now and they’re introducing the starting lineup that they’re showing the cards of each of the players,” Wilson said. “That type of marketing for the sports card hobby is going to just take it to the next stratosphere. Also, Fanatics has massive budgets, much larger than what Panini and Topps have, so I think that alone, they’re going to bring a lot more attention to marketing.”

When Goldin Auctions founder and chairman Ken Goldin heard the licensing news, he felt sad for all the hard-working folks at Topps and Panini. Goldin has worked with a number of those people in the past. But he knows the news is big for the industry.

“It could certainly be an exciting time for the hobby,” Goldin said. “Fanatics has a tremendous reach that will undoubtedly … grow the customer base. The fact that the leagues and the associations are investors and co-owners in it means they will be invested in making sure that they promote it and it grows the base. In theory, it means [Fanatics] should have access to more game-used items, so we won’t see something on the back of a card that says, ‘This item is not associated with any player, event or team.’”

Wilson had two main thoughts right away when he heard the news.

“First of all, sad for the tradition of the hobby, but on the other hand, wonderful for the long-term potential of the hobby,” he said. “I’m really excited about it and the reason why is because I love the fact that the sports leagues are going to have ownership of this, because I think that will compel them to promote sports cards heavily in their broadcasts and in their marketing in the future.

“I also love the fact that Fanatics is investing so much money, because it shows how certain Fanatics is that the sports card hobby is going to continue to grow and thrive. I think it’s a really good sign for the future. I think it’s going to be messy for the next few years and it could be a little turbulent, but if I look 10 years out, 15 years out, I think this will be one of the most impactfully positive things possible for the sports card hobby.”

Collectable CEO Ezra Levine agrees that the Fanatics investment forecasts a bright future for what has transformed into a not-so-small hobby anymore. According to Verified Market Research, the sports card market was valued at $13.8 billion in 2019 and projected to reach $98.7 billion by 2027, a growth rate of 23 percent.

“I think it’s a really bullish sign for the industry just in the sense where the value of these licenses and the interest level in these licensees are obviously in hot demand,” Levine said. “I think any time a company like Fanatics — and we’re even seeing it too on our end with the IMG endeavor and UFC and MGM and Draft Kings — all these big multibillion dollar companies with global reach who are heavily invested in the sports world period are showing real increased interest in sports collectibles and the hobby.

“I think it’s a real encouraging sign for the continued growth of the industry and I think it kind of shows just an evolution and maturation of the industry from sort of this nice little hobby to real industry or a real market. Some people are going to love that, some people are not going to like it.”

Turner, a self-proclaimed optimist, thinks change is good. But with change inevitably comes uncertainty.

“Personally — this is me purely as a collector and nothing to do with PSA — I have been somewhat disappointed certainly on the Panini side, like sticker autos and jersey patches that aren’t even for the player, photography that’s reused across sets, just like 100 parallels and not much creativity,” Turner said. “So, I generally think change is a great thing.”

Turner, whose company owns the hobby’s largest card grading company (PSA) and recently purchased Goldin Auctions, admits he’s a little nervous, however, about the next few years.

“Is Topps and Panini going to kind of throw in the towel and not try hard?” he wonders. “Or, worse, overproduce to kind of monetize the license while they have it? I hope those things don’t happen.”

Wulkan believes Fanatics is going to bring a lot of life to the industry because of the high-quality cards it’s going to produce.

“I’m sure they are going to be really exquisite and the quality is going to be really high,” Wulkan said. “I think that by them owning all of the licenses, they’ll be able to possibly do meet-and-greets that you can get in packs of cards. I think they’re going to bring a whole new excitement to the world of collecting and I really think it’s going to be exciting to see what they have in store for the future.”