News

Industry experts have some advice for Fanatics and its new trading card company

Since Fanatics’ licensing deals with the three major sports leagues don’t go into effect for a few more years, industry insiders worry about what that means for Topps and Panini and how they’ll react to losing the official rights to produce baseball, football and basketball trading cards.

Fanatics, the world’s largest producer of officially licensed sports apparel and merchandise, has acquired the exclusive rights to produce sports cards from MLB and the NBA, as well as the MLB and NBA player associations and the NFL Players Association. The new deals will reportedly go into effect in 2023 (MLBPA) and 2026, when the current Topps (MLB) and Panini (NBA and NFL) deals expire.

Sports Card Investor Geoff Wilson hoped that news of such landmark licensing changes would have broken six months before the official transition and not years in advance. That’s just hurting the market in many different ways, he says.

“I do fear that we could be entering a situation with Topps and Panini where they could be overprinting, could be trying to squeeze every possible dollar they can out of the hobby, knowing that the cliff for their ability to produce cards of the three major sports is coming,” Wilson said. “I fear we’re going to see a lack of innovation. What is really the purpose of creating innovative new products if there’s a life cycle that they’re not going to be around for much longer? I think all of those things are a shame.”

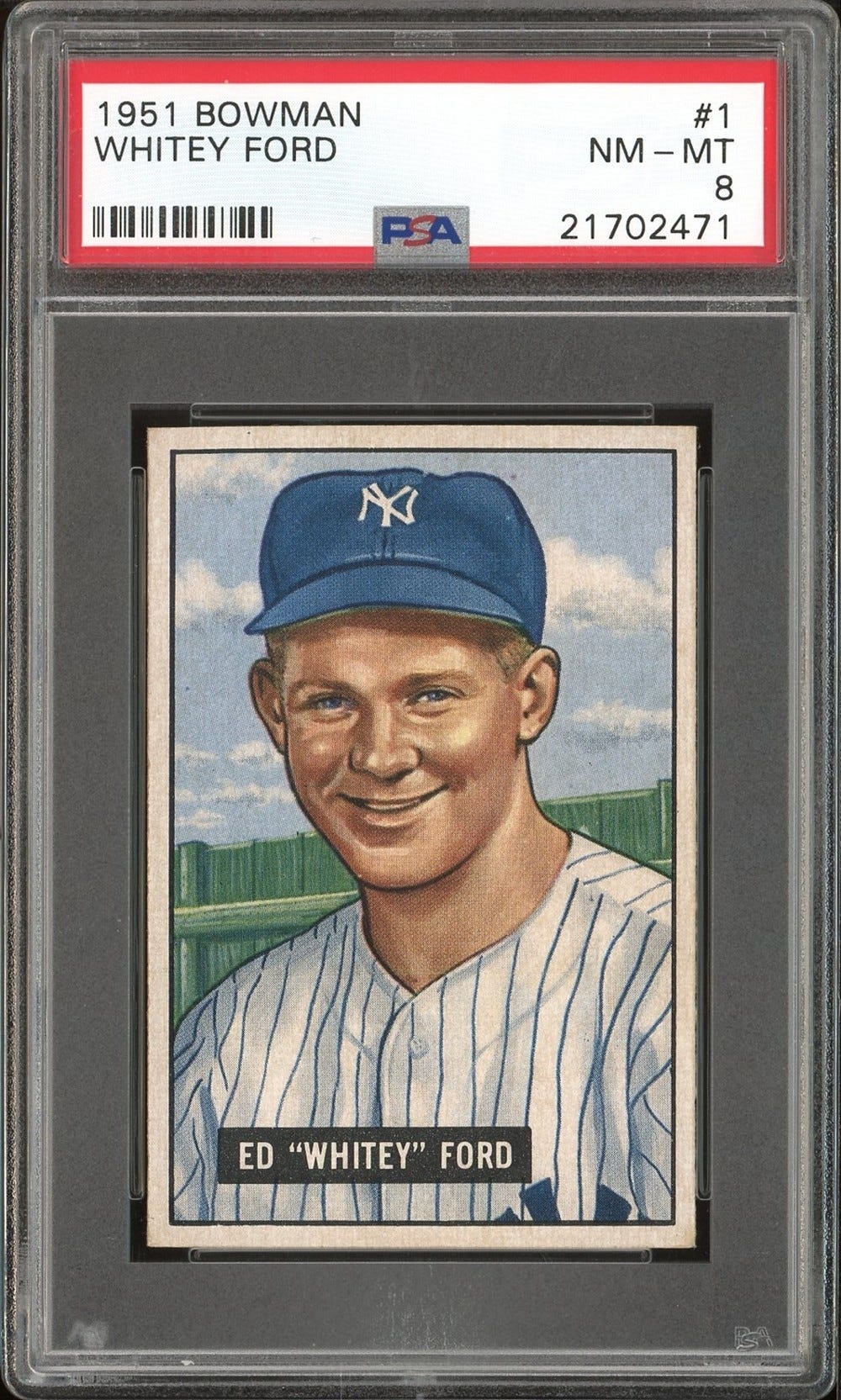

Topps, the hobby’s most iconic brand, is celebrating its 70th year producing baseball cards and has had the official MLB license since 2009. Panini has had exclusive NBA rights since 2009 and NFL rights since 2016.

Collectors Universe CEO Nat Turner, whose company owns the hobby’s largest card grading company (PSA), is excited about Fanatics’ move into the hobby, but admits he’s a little nervous about the next few years.

“Is Topps and Panini going to kind of throw in the towel and not try hard?” he wonders. “Or, worse, overproduce to kind of monetize the license while they have it? I hope those things don’t happen.”

With Fanatics taking over the exclusive rights from the nation’s three largest sports leagues, Wilson believes the change could be big for another sport.

“I do think it’s a good thing for soccer cards, because I think that’s the main thing Panini and Topps are both going to have left,” he said.

The United States is hosting the World Cup in 2026, which happens to be the same year Topps and Panini will be in their first year without officially licensed baseball, football and basketball cards. Wilson believes Topps and Panini should place a major emphasis on making soccer cards more collectable and desirable over the next five years.

“I could see them putting a tremendous amount of focus over the next few years on trying to build up soccer cards and trying to really make soccer cards grow to be the market size of basketball cards, baseball cards and football cards,” Wilson said. “I think it’s possible they could succeed at that.”

WILL FANATICS ACQUIRE TOPPS?

Industry experts who spoke with Sports Collectors Digest were all in agreement that Fanatics should make a push at buying Topps or acquiring its brand names. And maybe Fanatics is already in conversation with Topps.

“I hope that Topps still has some place in this industry,” said Collectable CEO Ezra Levine. “Obviously, I think when you think Topps and when you think sports cards, the two are really synonymous with each other. I would hope there is still some place for the Topps brand. I still think Topps’ IPO is incredibly valuable. I think there’s a lot of goodwill embedded there. I think a lot of people are going to be rooting for Topps to still stay in the game in some capacity.”

Turner agrees.

“That was my first reaction, I was just bummed, because as a big baseball card collector, I can’t really imagine Topps without baseball or vice versa. That’s really just more of a bummer than anything,” he said. “I hope they try to do something together; that would be great.”

If Fanatics can obtain Topps’ familiar name, it would keep the brand at the forefront of the hobby for collectors. That could also mean brand staples such as Topps Chrome and Bowman Chrome, which has become synonymous with prospect cards, will carry on the Topps tradition.

“I think that it’s important that Fanatics figures out a way to leverage these kinds of iconic brands that we have in this hobby,” Turner said. “I know that’s tricky. It’s going to be this build-by-partnership question they have to answer. Look, I don’t want to see some brand I’ve never heard of like Fanatics rookie cards. Panini wasn’t in basketball cards before [2009] and we all grew to kind of accept it. As a preference, I would love to see that.”

Turner says purchasing Topps or the Topps brands could help ensure success for Fanatics.

“I think Fanatics can do a really good job if they put their minds to it,” he said. “They have crazy distribution reach through the merchandise business. I think it will be direct to consumer, more than we’re used to. I’m nervous about local card shops and their access of product, I guess, because that is a big source of revenue for those guys.”

THE FANATICS PLAN OF ATTACK

Fanatics, an $18 billion company owned by Michael Rubin, plans to create a new trading card company headed by StockX founder Josh Luber. Fanatics executives have yet to address its new licensing deals or provide details on its new venture. When the company finally does, some experts in the field would like to hear more about its plans for the future.

“I want to know that this is taken seriously by them, that they’re going to be aggressively recruiting people who know cards and that they’re not going to kind of do away with the past and they’re going to respect the traditions of the hobby and brands,” Turner said. “[I want to know that] it’s not going to be some rough-shot, mass-produced [product], because that is somewhat the perception of the merchandise side.

“There’s lots of facets to the hobby. There’s the entry-level cards, and then there’s high-end products and then there’s everything in between. [I want to see] that they’re going to take all of that into account as they approach it, that their real focus is not just a money-making enterprise. There’s something very important and romantic about trading cards. Obviously, it’s a business but they also need to take into account that this is a lot of peoples’ passions, too.”

Fanatics will have a tight grasp on the trading card hobby starting in 2026. That presents the company with plenty of marketing opportunities, like using players and stadiums to promote its products. It has the capability of attracting everyone from older, high-end collectors to young, new collectors in the hobby.

“I think Fanatics will probably bring more [collectors] in,” said Derek Grady, vice president of sports auctions at Heritage Auctions. “As you’ve seen, this hobby during the pandemic has grown a lot and it’s reconnected some people that were out of the hobby and they got back in and it’s also getting new people in. With cards in stadiums and different promotions they do and giveaways, I’m sure there will be more collectors. I’m sure they have an idea on how — it’s been a successful company.”

Goldin Auctions founder Ken Goldin would like Fanatics to stress that it is going to put out two distinct lines of products to cater to every sort of collector.

“One is going to be a mass-market product that will be aimed toward a younger audience, which we know they’re going to do, and let us know what those products are and print the hell out of it so people can afford it,” he said.

“The flip side is to produce hobby-only product that is strictly for the hobby, doesn’t have a retail version. Strictly for the hobby, limit it to the less than demand in the hobby and keep hobby market and hobby production completely separate from the retail markets and retail production, and I think everybody’s going to be happy.”

Goldin said it’s critical for Fanatics to recognize that there’s two different markets for trading cards.

“Recognize that there’s a market for people that want to pay $500 a box or $5,000 a box and don’t make a cheap version,” he said. “Don’t go out and make a Rolls-Royce for $500,000 ,and then don’t put one on the street so at $49,000 people can drive around in a Rolls-Royce. That kills the brands. That would be my number one piece of advice. To me, that is the single most important thing.”

Grady, who used to be a card grader at SGC, wholeheartedly agrees that there needs to be cards available for the younger generation.

“I’d like to see a budget for everybody, so kids can buy cards,” Grady said. “Make the basic product and, of course, do the higher-end autographed rookies, and I’m sure they’ll do all those products, too. Just keep it so everybody can collect and enjoy, not just investors and rich people.

“That was a rite of passage for kids to be able to, like I did, do lemonade stands and when you sold out of your lemonade, you went back to the corner store to buy more lemonade packets to make lemonade, and you bought baseball cards or football cards. Hopefully, the kids will be able to afford the packs of cards.”

Vintage Breaks and Just Collect Inc. founder Leighton Sheldon says catering to kids is critical for the hobby.

“I’m hoping they take a Fanatics brand, produce its own card set under that brand and have that more toward kids,” he said. “So, in other words, bringing back 99-cent price points or $1.49 price points. That way they’re not watering down the Topps or the Panini brands and they can still have those packs anywhere and everywhere — on their website, in arenas, because, obviously, they’re going to have deals with all the major sports associations.”

As Goldin ponders the impact of Fanatics taking control of the trading card hobby, he believes that 10 to 15 years from now it will prove to be a game-changing moment.

“My hope is that most sports fans will collect trading cards at this point,” Goldin said. “Maybe Fanatics will have a way to tie them to games, tie them to entrances of stadiums. But I think that the consumer base is going to be significantly larger than it is today and that all of us will look back and say, ‘Oh my God, I should have grabbed everything I could have in 2021, because there’s tens of millions of more people that want the product.’”