News

Topps going public through merger, iconic company valued at $1.3B

Topps is going public through a merger with Mudrick Capital Acquisition Corporation II, a special acquisition company that is valuing the sports card giant at $1.3 billion.

The news was first reported Tuesday by The New York Times and CNBC.

Topps’ chairman Michael Eisner, the former Disney CEO, will remain as chairman, while Michael Brandstaedter will remain as President and CEO. Mudrick Capital and funds and accounts managed by Gamco Investors and Wells Capital Management are expected to invest an additional $250 million in the SPAC, CNBC reported. Private equity firm Madison Dearborn Partners is expected to sell most of its ownership in Topps, but The Tornante Company, Eisner’s firm, will roll its entire equity stake into the new company, which will continue to operate under the Topps name.

The deal is expected to close in the second or third quarter of this year.

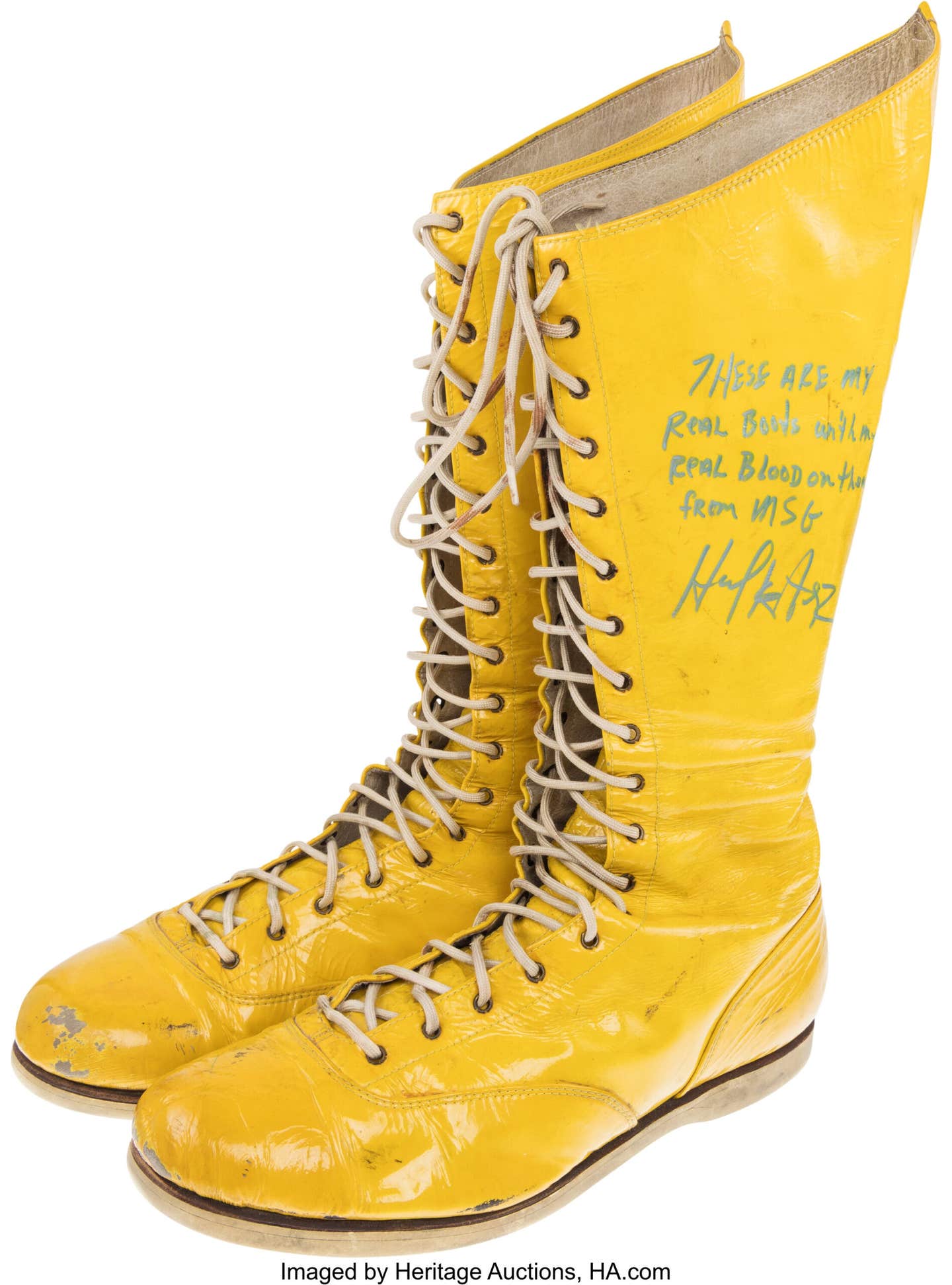

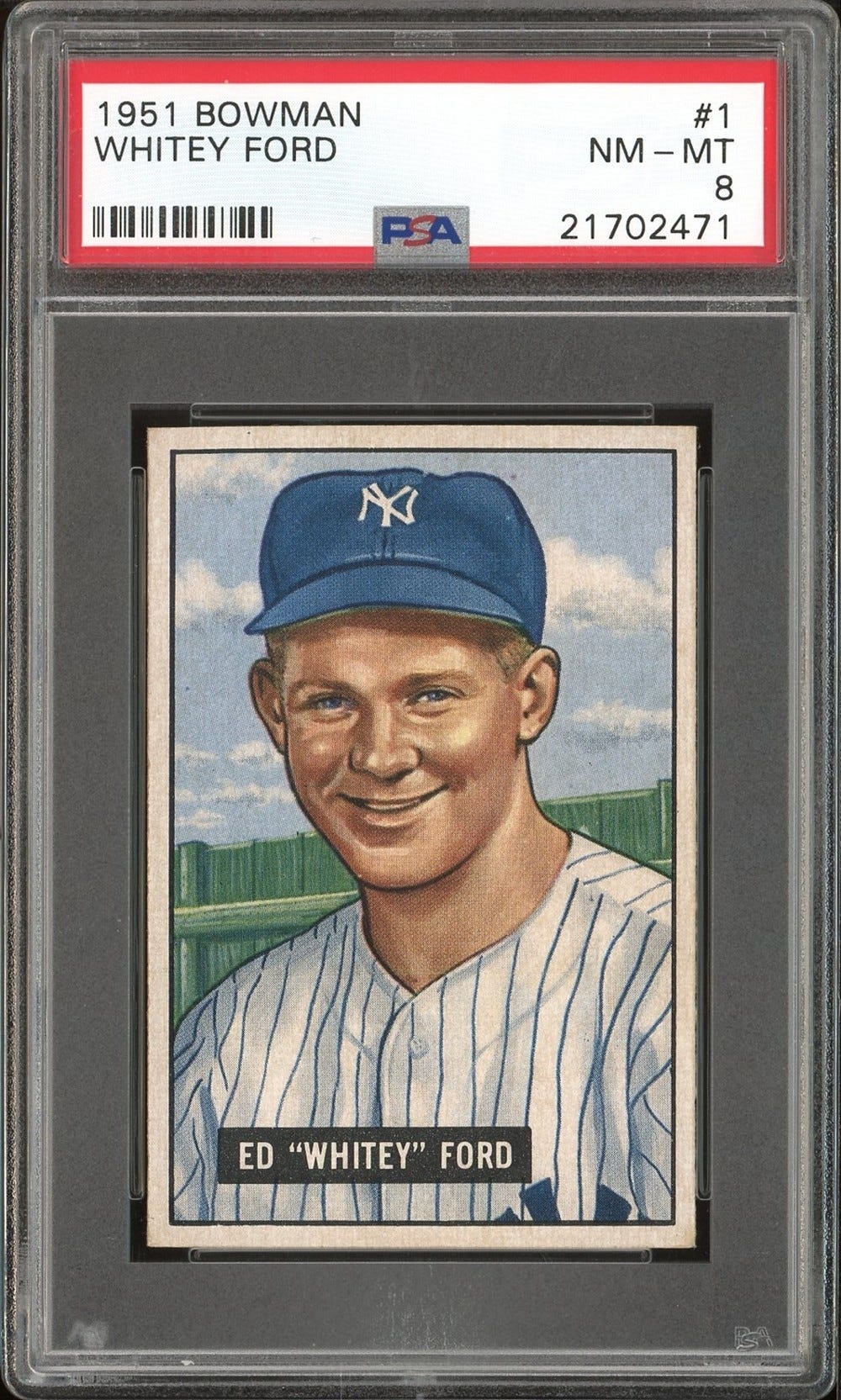

Topps is one of the nation’s oldest and most successful trading card companies and has exclusive rights from Major League Baseball and licensing partnerships with MLB, the MLB Players Association, WWE, Formula 1 and two pro soccer leagues.

The company's net sales soared to $567 million in 2020, a 23 percent increase and a record high for the company. The company was publicly owned until 2007 when Eisner's Tornante Company partnered with Madison Dearborn Partners to purchase the company for $385 million.

Eisner told CNBC that Topps decided to go public because of the flexibility and limited distraction to management.

“The strong emotional connection between the Topps brand and consumers of all ages is truly foundational, and, when combined with our growing portfolio of strategic licensing partnerships, creates a profitable business model with meaningful competitive advantages,” Eisner said. “Equally important, the management team at the helm of Topps, which we’ve been building for the last 14 years, is outstanding, with deep roots in sports and entertainment, digital, gift cards and confections.

"Through this transformation, Topps has enjoyed a strong partnership with Madison Dearborn Partners. With the support of our new partners at Mudrick Capital, the company will continue its long history of innovation and global expansion, bringing consumers the best of collectibles and confections products while successfully extending into new verticals and emerging categories to take advantage of digital content innovation and high growth opportunities across the globe. That is why I’m not selling a single share of Topps stock in this transaction.”

Topps expanded recently into nonfungible tokens and mobile apps designed to connect collectors. NFTs are recorded on a blockchain, similar to cryptocurrencies. Just like rare baseball cards, NFTs are considered unique and can’t be duplicated.

Topps also owns several other businesses, including such iconic candy brands as Bazooka.

“Topps is an 80-year-old company with decades of rich tradition and history, but very much built for the 21st century,” Brandstaedter said. “We partner with some of the world’s most iconic brands, and we are in the business of creating powerful consumer connections every day. The strategies we have implemented in recent years, including building a digital business that has deepened consumer engagement, have driven excitement and innovation across Topps, fueling strong and increasing revenue with accelerating profitability. The future for Topps has never been brighter, and, with a talented and dedicated management and employee base, we are excited for the road ahead.”