What's It Worth?

HOBBY TECH: New companies having big impact on sports collectibles industry

When the COVID pandemic hit in 2020, the card collecting industry shifted a number of gears.

Spawned from the resurgence in the hobby came technological advances and companies relying on artificial intelligence (AI) to make their new products tick.

LUDEX, Card Boss and Card Ladder are three companies all fueled by their owners’ passion for the sports cards hobby and their desire to invent tools to advance the industry.

The three companies got their start in different directions but all have reached the same end goal. This is the story of how the trio is trying to make it in this cutthroat industry.

LUDEX: SCAN = PRICE

After nearly a quarter century working in stock trading, Brian Ludden stumbled upon a change-of-pace career where he could have a shared interest with his son.

At the onset of the pandemic, Ludden was curious how much his trading cards he collected as a kid from about 1980-92 were worth.

He realized there wasn’t a quick and easy way to look up card prices.

“I saw an industry that was really ripe for technology,” Ludden said. “I came from an algorithmic trading background. I had a company at the CME (Chicago Mercantile Exchange), the Chicago Board of Options Exchange and the Chicago Board of Trade, and I saw a lot of parallels between how trading went from pen and paper to algorithmic trading. I said, ‘Wow, this could be a huge opportunity. It’s an untapped market, it’s a big market and if I could solve this problem, I think there’s tons of upside.’”

Also See: Top 10 LeBron James cards for collectors

LUDEX, LLC was invented in June 2020. It’s an app that allows people to scan sports and trading cards to identify their prices.

Ludden rounded up approximately 100 investors who believed in his vision to help make the product a reality. It wasn’t an easy process by any means for Ludden to launch his app.

“It took a long time,” he said. “We’ve probably almost failed three or four times of running out of capital or just can’t solve the problem. But in the end, we got a really good product that I’m proud of. It’s 28 different proprietary AI models that identify all the cards, including parallels.”

Ludden said the app recognizes base cards really well and captures prices quickly. But the pesky parallels weren’t so easy to detect.

“It’s the complexity of all the different colors, variations, refractors,” he said. “Then the hard thing is, if you hold it one way, it looks like one card, and you hold it another way, it looks like another card. And you’ve got people on their phones taking pictures, the light hits the card and it makes the card look like something different. That was such a hard solve. But I knew if we didn’t have that, we didn’t have anything.”

LUDEX’s official launch date was in November 2022, so the app is still quite new. Ludden isn’t at liberty to divulge how many subscribers his company has, but it’s over a half-million.

The main reason LUDEX is growing so fast, he said, is because the market is so big.

“It’s way bigger than people think it is,” Ludden said. “So if you can have a marketing budget as modest as we do and add 1,500-2,000 people a day, that’s a big market. LUDEX is all about education. If people don’t get information, what card they have or how much is it worth, then they lose interest. LUDEX members can list a card on eBay in 30 seconds. That piece of technology, our eBay connector, is the one that people are really embracing and have given great feedback.”

LUDEX, which is based in Chicago and has 17 employees, has received recognition for its innovative product. The company was named one of four finalists for the Rising Star Award for the 1871 Momentum Awards this year. The award is presented to an early-stage company in Chicago that is positioned to grow into a leader in its market.

Ludden was honored his company was a finalist.

“As an entrepreneur, you have to be a visionary and you have to have a vision that exceeds any of the risk that people would think a tech company would be,” Ludden said. “Our vision is becoming reality.”

CARD BOSS INSTEAD OF GRADING

Card Boss owner Shaun Rogers has a similar story in terms of how his company was conceived.

Rogers was a card collector as a kid and had his cards stashed away at his house. When COVID hit, Rogers’ two young boys were looking for something to do and discovered their dad’s old cards.

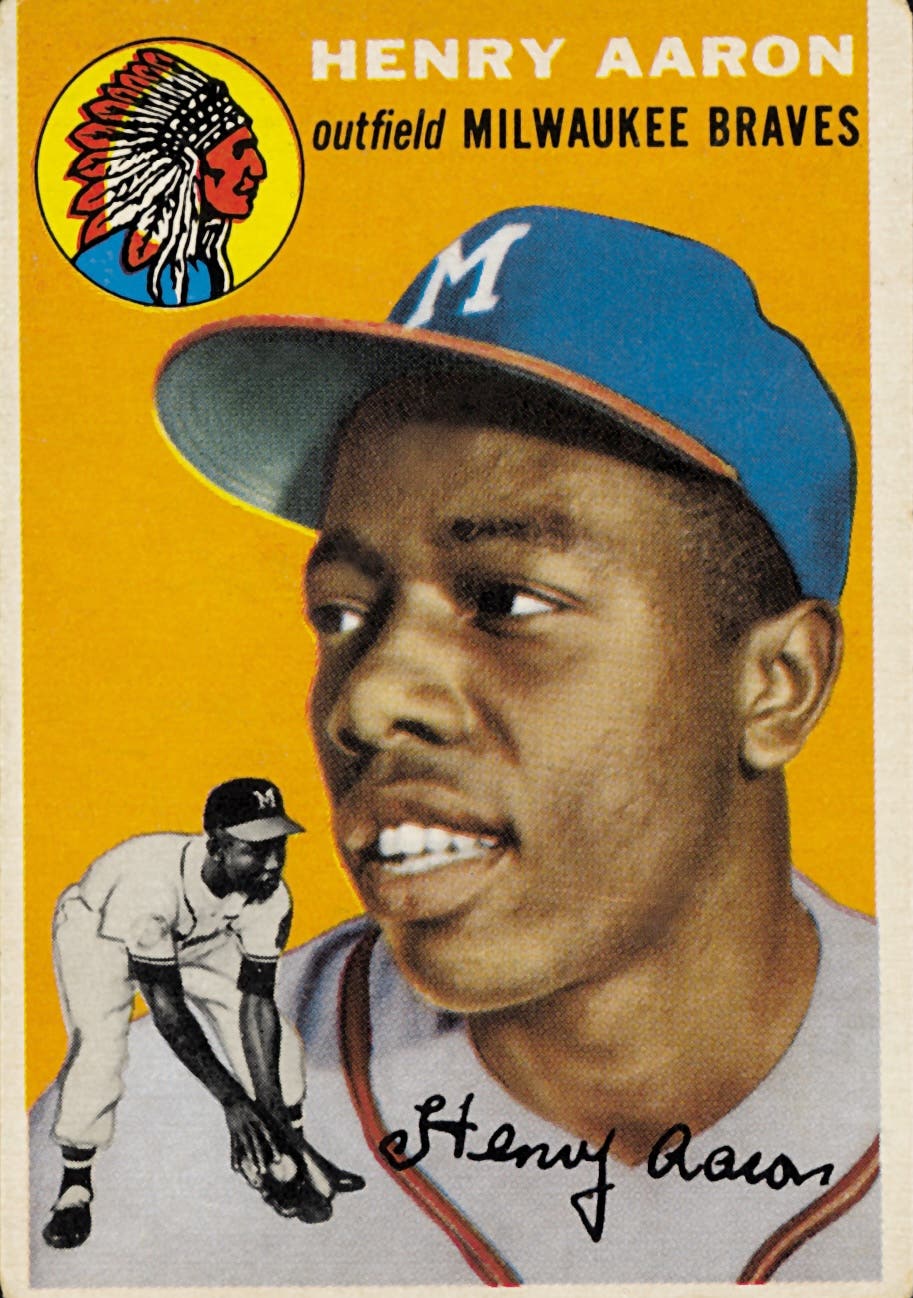

Rogers recalls pulling out his 1983 Topps Tony Gwynn rookie card that looked absolutely perfect. He thought about sending it into Professional Sports Authenticator (PSA) to get it graded.

“I was sure it was going to get a 10,” Rogers recalled. “I bought one of those really cheap grading kits; it was like $12 on Amazon. It had a pair of jeweler loupes and like a measuring tool. I did that and I still thought I was going to get a 10. I sent the card into PSA, paid like $70 because I didn’t have a membership at that point, and it took like three months to come back. From the time that I sent the card in from the time I got the card back, I discovered this company Card Boss.”

When Rogers received the Gwynn card in the mail, it had graded a PSA 8. In that grade, the card was worth about the same as a raw version.

Rogers purchased a subscription to the Card Boss website — a pre-screening grading tool that gives collectors and investors an idea what grade a card would receive if submitted to a third-party company — and decided to crack open the Gwynn card.

Rogers ran the card through Card Boss, and it came back an 8.

Intrigued by that finding, Rogers took 11 more of his cards and pre-graded them. He then expedited shipping those 11 cards to PSA. When Rogers got the slabs back, he was pleasantly surprised by Card Boss’ accuracy.

“Ten of the 11 got the same grade and the one that didn’t was one grade off,” Rogers said. “At that point, I ended up going to the ‘Contact Us’ on the Card Boss website. Dumb luck, kind of destiny style, the lady that owned the company lived like 20 minutes from my house.”

The two met at a restaurant and chatted. The owner had designed the software to help her son, but was ready to sell. Rogers, who at the time was a vice president of sales for a medical device company, jumped at the chance to own Card Boss.

“I’ve always had kind of like an entrepreneurial mindset, coupled with the passion for the hobby, and just the two kind of came together,” Rogers said.

Rogers says Card Boss is a great way for collectors to potentially avoid wasting money sending cards to grading companies if they are coming back 7s or 8s instead of 9s and 10s.

“That Tony Gwynn’s a great example. Had I known it was going to be an 8, I would have never sent it in,” Rogers said. “Let’s say you have 10 cards you want to send in — I know there’s promotions for companies in different months — but on average you’re probably going to spend $40 a card. You have 10 cards at $40 a card, and by the time you pay the $40 cost per card plus insurance and shipping and all the other stuff, you’re probably going to be a little over $500. So what you should do is grade those same 10 cards, pre-grading with Card Boss. Hey, maybe half of the cards are going to grade the way you want and you should anticipate getting that grade. So then you just send five cards in and you save half the money.”

When Rogers dove into Card Boss, AI software and all the technical aspects were solid, but the company wasn’t marketing its product and the logo needed a makeover, noted Rogers. Card Boss also didn’t have an app for phones. Rogers changed that quickly.

“We’ve got this really cool tech, [but] how do we build around it?” said Rogers, who was walking around this year’s National Sports Collectors Convention promoting his company. “That’s what I’ve been doing for the last year.

“Card Boss uses artificial intelligence to grade trading cards. Our process removes human error and bias, is reproducible and gives the most accurate assessment of true card condition.”

Using the Card Boss app is easy, Rogers explained. Subscribers are given a 5-by-8 black card stock with a white border that is slightly larger than a normal-size trading card. In the four-step process, you first place the trading card to be scanned in the white box. After taking a picture of the front and back of the card and cropping it, the card is uploaded and sent off for grading. It takes about five to 10 minutes for a grading result to appear.

A full grading report is available for each card. The report breaks down individual grades for the card’s centering, edge, corner and surface — similar to what Beckett Grading Service (BGS) does for its slabs.

Since purchasing the company, Rogers has used Card Boss on over 600 of his own cards and then submitted them to PSA. He said the accuracy rate is between 88-91 percent.

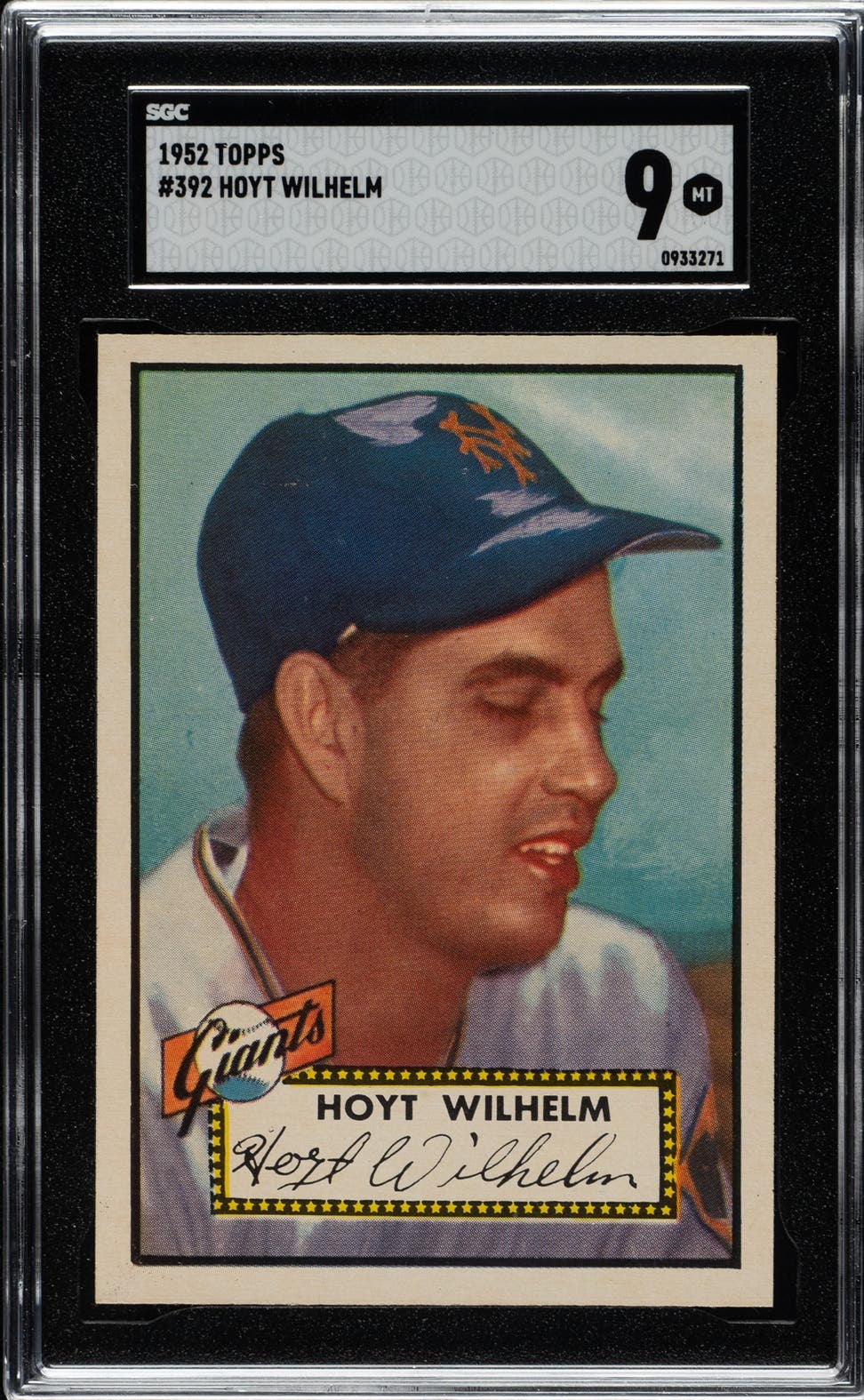

One card breaker who uses Card Boss recently told Rogers he sent 12 cards for grading to Sportscard Guaranty Corporation (SGC) and 10 came back with the same grade as Card Boss. SGC is known for being the most stringent on its grades amongst third-party companies.

Rogers said he has cracked a number of PSA, SGC and BGS slabs and they all came back from Card Boss with accurate readings.

Rogers has high aspirations for Card Boss, which had about 125 paid subscribers through mid-October.

“I want to be able to become the go-to screening tool,” Rogers said. “We’re not interested in slabbing cards. There’s no reason to try and compete with PSA or SGC or Beckett, that’s not our model. Our focus and strategy is to be the industry-leading screen tool.”

CARD LADDER CLIMBING

In 2020, Chris McGill was creating a publication for analyzing sales data on specific cards when he zoomed in on a list of about 20 Michael Jordan cards. He sent his findings to a select group of people through email.

What followed was an idea by McGill and friend Josh Johnson.

“There seemed to be a demand for that sort of in-depth research on the pricing history of these cards, and that’s sort of where he saw the trends moving on the prices,” said Johnson, who has about 15 years of tech and web development experience. “He wasn’t like outright predicting the next sale price, but he was kind of indicating this is the direction it was heading. He came to me and asked for help on how can I sort of automate some of this stuff. Is there any tool you can build that helps me punch in these numbers and I can see them on graphs, etc.

“I just sort of made something for him quick and dirty, and then we were like, ‘Hey, we might have a product. I think people might enjoy this.’”

The duo added cards to their system, verified sales, and put together graphs. The concept and popularity grew from that point on.

Card Ladder launched in 2020 and has had a slow and steady climb.

“We never really have had like this big boom, sort of like the hobby did explode in late 2020 and early 2021, so we definitely saw a growth that kind of correlated to that,” said Johnson, who is Card Ladder’s chief technology officer. “But I would say for our business model specifically, we’ve always been kind of a slow, up-and-right-moving company. We’ve never been one to like dump a lot of money into marketing and get these quick boosts for users. We’ve kind of wanted to bring along people slowly and keep them more long term.”

What started as a small project focused on a small subset of cards has morphed into an all-encompassing platform. In November 2021, Collectors — the parent company of PSA — contacted the Card Ladder founders. The industry giant wanted to purchase the small upstart, and a deal was reached.

Having Collectors’ name attached to the company has been helpful. It also took a lot of pressure off Johnson and McGill since it now had financial backing and could take some risks with their product.

“It’s given us access to some resources and data that we didn’t have previously,” Johnson said. “It’s given us access to the credibility of PSA, and I would hope that PSA would say the same. That sort of dual partnership has been really beneficial for us. We see PSA as the leader in the grading space and we see ourselves as the leaders in the pricing data.”

Johnson said Card Ladder was the first such product to offer sales history.

“That’s kind of been our big thing and most people are really excited about that,” he said. “I’ve seen a couple other companies come out with like the same idea — put all your sales on one page for people to be able to use AI to search them and come up with pricing. I know that’s a thing, but I would say we were the first to do that and make that popular.”

Card Ladder, which has just six employees, manually verifies sales and checks to make sure things make sense in terms of removing shill-bid auctions and making sure everything looks clean and organized.

It uses technology to automate and speed up the process and create sales indexes for every player and different card categories. It’s CL50 Index, a handpicked group of 50 cards that it tracks the pricing over time, has become like a S&P 500 for trading cards.

“The index is really where our power tech and data has come into play, and we use that to really drive the rest of the technology throughout the application, especially in terms of predicting pricing and coming up with estimated values of collection cards,” Johnson said. “We’re leaning into those indexes and using the historical movement of cards to predict and tell where it’s going to be in the future based on what it did in the past for a specific player or category that it falls into.”

TECHNOLOGY THE FUTURE

Ludden believes technology in the hobby is in its infancy and has the capability of enhancing card collecting in many different ways.

Technology is the future of the hobby.

“It’s hard to believe that it wouldn’t be considering every single industry that’s ever existed has gone to the tech side,” Ludden said. “I think there’s some companies out there that recognize that if they want to be relevant into the future that they’ve got to have some kind of tech stack around it.”

Johnson has a different take on technology in the industry. He believes it has been overused in the past few years and the hobby is coming down from a high.

“I think there was too much technology in this space during the boom and there was too much excitement and it kind of overcorrected,” Johnson said. “Now we’re leaning back a little bit into the collecting aspect, because if you really boil it down, this is still a physical collecting space and there was a strong desire to like bring tech in and really ramp things up. It worked in a lot of aspects, a lot of great, new businesses popped up, a lot of great ideas have stuck, as they should.

“But a lot of them have fallen away. Some of the tech has corrected back and we’re using a little bit less of it. The future, I kind of just keep seeing it as more like big-data type things, like understanding the historical sales of all these things and like trying to predict the future.”

— Greg Bates is a freelance contributor for Sports Collectors Digest. He can be reached at gregabates@gmail.com.