Sports Card Dealers

MARKET ANALYSIS: What does the decline in sports card values mean for the hobby and The National?

Two NBA superstars had their rookie cards reach record prices in 2021.

Michael Jordan’s 1986-87 Fleer PSA 10 sold for $738,000 in December of last year, while LeBron James’ 2003 Topps Chrome Refractor PSA 10 hit close to $300,000.

But by the middle of 2022, those two cards had cooled off briskly.

Jordan’s iconic card (unsigned) was selling for a little over $200,000, while James’ rookie had dropped below $50,000.

Those two cardboard gems offer a glimpse into the current sports card market as the 42nd annual National Sports Collectors Convention (The National) gets underway in Atlantic City, N.J.

COVID-19 brought the craze of the sports card market into sharp focus as the majority of the last two years have provided astronomical growth within the hobby.

“Obviously, it’s been a down year for sports card prices and the drop in sports card prices has accelerated over the last few weeks,” Sports Card Investor founder Geoff Wilson told Sports Collectors Digest in mid-June.

Sports Card Investor tracks different indexes through its Market Movers software. Its SCI 500 index — 500 of the most prominent but accessible cards of all time — is down 12.4 percent year to date, with about half the losses coming in June.

“We’ve definitely seen the drop in card prices accelerate recently, and cards that are not iconic are down more,” Wilson said. “A lot of ultra-modern, a lot of prospects, a lot of cards that are not necessarily sought after, we’ve seen some of those cards drop a lot more significantly this year.”

The National Schedule: Broggi expects another historic crowd

There are exceptions, of course, with some ultra-modern cards not hitting a downward spiral. Wilson noted there’s a group of key NFL quarterbacks — namely Joe Burrow, Justin Herbert and Josh Allen — that collectors are buzzing about heading into the upcoming season. Their prices are holding steady, and in some cases going up.

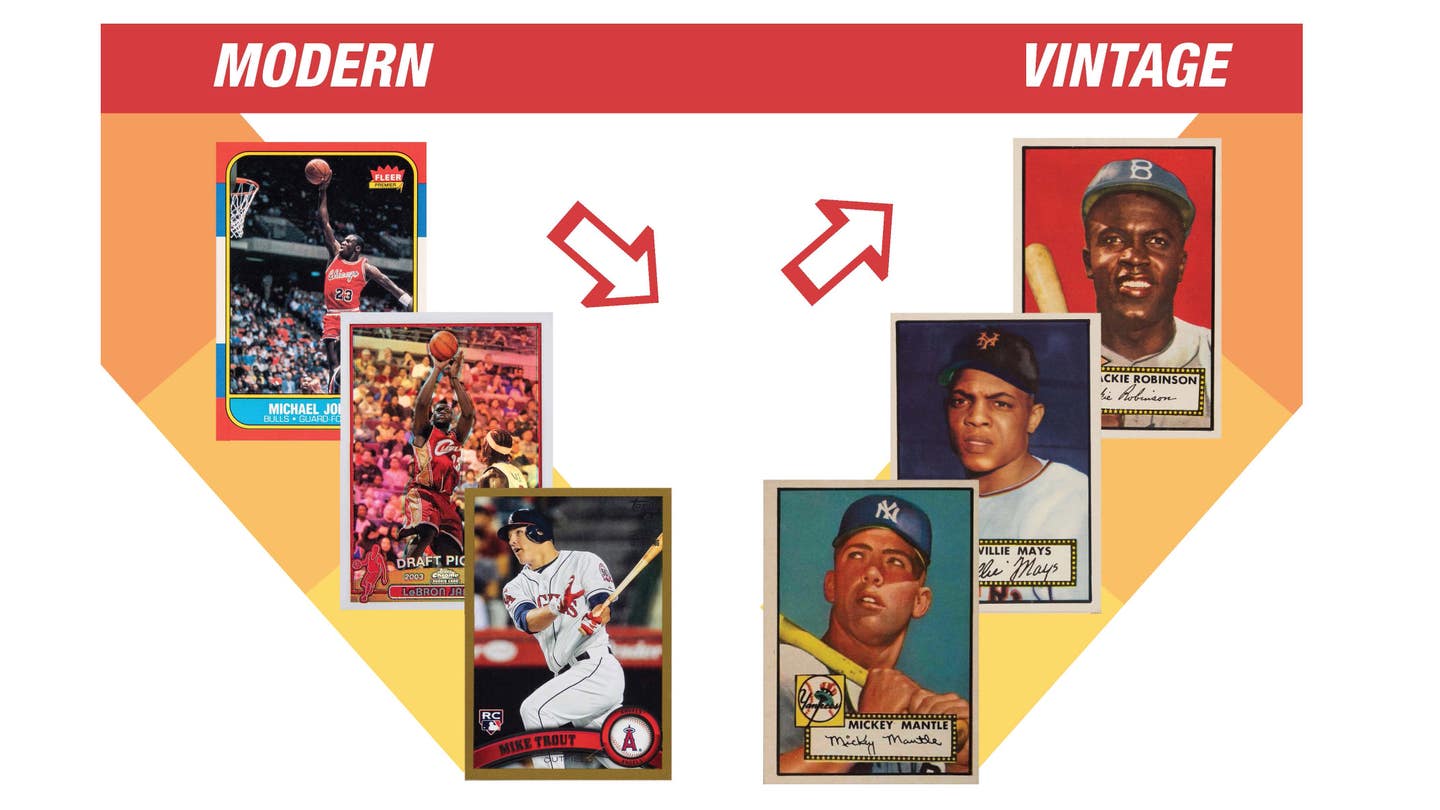

According to industry experts, the dip in prices is being realized mostly by ultra-modern and modern cards, especially singles. Vintage cards, for the most part, are stable, as are desirable unopened wax.

“What we’ve seen is that modern card assets have a high correlation to things like the crypto markets, high-growth tech stocks, and other speculative asset classes. It's a younger collector and investor participating in the modern market," Collectable CEO Ezra Levine said. “On the vintage side, it appears more isolated from macro factors, though not immune. What we’re seeing on the iconic vintage stuff is rock-solid performance. Sure, is there a little slippage? A little bit, but I think relatively speaking, the vintage collector is probably a very different collector than the modern collector.”

Even with the decline in prices of two of the top names in all of sports, Levine is quick to point out that prior to “The Last Dance” premiering in April 2020, Jordan PSA 10 rookies were selling for $30,000-$50,000.

“If you zoom out a little bit, that’s still up four times in two years,” Levine said. “And there’s been a lot of supply that’s hit the market. There’s been more turnover of that card in the last two years than I would argue that has ever hit the market within such a short, concentrated period of time.

“I think people can turn to that as an example of all the bad that’s happening. Obviously, some people do look at that card as like the unofficial index of the hobby. I look at that and I see good things. In a period of time, it’s gone up four times and there’s been a ton of supply that’s hit the market and it’s still holding up really well relative to where it was a year and a half ago, two years ago. I find that encouraging.”

Derek Grady, Executive Vice President, Heritage Sports Auctions, also sees plenty of positives with the current state of the hobby.

“I think the hobby’s really good,” Grady said. “I think a correction may have been needed in modern with items going up 10, 20 times, and just the craze of the modern. Obviously, that’s going to correct itself. Any time you see prices like that out of whack, markets correct themselves.

“The vintage is still really strong. The pop reports aren’t going up on the vintage, 9s and 8s and high-end vintage. Any grade Ruths and Mantles and Jackie Robinsons, Willie Mays’, those cards are still solid. You’re not seeing any pullback on quality material like that. Where you’re seeing it is on the modern … maybe some of the modern wax. But the vintage stuff is still great.”

Mike Moynihan — a big vintage collector who hosts the podcast Golden Age of Cardboard — recently unveiled his Vintage 100 Index for baseball cards. Post-war to 1980s cards, it tracks prices from Jan 1, 2019 for PSA grades equivalent to the decade the card was issued (e.g. 1960s cards look at PSA 6s).

“All they’ve done is just steadily climbed,” Moynihan said. “There was a peak in 2021, but we found that if you took out the Mantle rookie, Mays rookie, Aaron rookie and the Jackie Robinson rookie, there wasn’t a bubble, it just kind of went up slowly. I think there’s a lot of people that came in in 2020, got all enamored with the shiny stuff and then went, ‘Oh, wait a second. Vintage is a lot more stable, maybe I’ll start dabbling into that.’ They’re just seeing the sustainability of that, the less volatility of that and that’s attractive to people.”

Mill Creek Sports (Mill Creek, Wash.) owner Scott Mahlum said despite the downturn with prices in the hobby, his card shop is doing well, as are other segments of the market.

“We used to buy a lot in the auction houses and they’re still getting crazy high prices,” Mahlum said. “The autographs and the vintage stuff, I haven’t seen any kind of prices coming down on that stuff at all.”

Mahlum has noticed prices for such modern stars as Luka Doncic and Giannis Antetokounmpo continuing to slip.

“New wax is still really strong, the interest is there. Definitely singles are down, I’d guess 30 percent and maybe even 40 percent. It was kind of to be expected,” Mahlum said. “Everything went up so fast over those couple years when COVID first came out and everyone was investing. It also doesn’t help that the stock market’s been tanking and interest rates are going up, so people are getting a little tighter and not throwing around money as much as before.”

CORRECTION OR ECONOMY?

With card prices skyrocketing during the pandemic, that was tough to sustain. Along with record-high gas prices, elevated inflation for goods and services and a turbulent rollercoaster ride on Wall Street, it’s been a difficult time for collectors and investors.

It’s been a perfect storm of sorts for hobby prices to return to some normal levels.

That begs the question: are card prices dipping due to a correction in the market, economic fear or possibly a combination of both?

“It’s a combination of things,” Wilson said. “I think it’s maybe a little bit of a continued correction from some of the peaks that things hit. I do think the concerns about the economy have accelerated the recent dip. You’ve seen cryptocurrency fall dramatically, you’ve seen NFTs fall dramatically, you’ve seen other forms of alternative assets fall, and then of course you’ve seen your traditional assets, like stocks, fall pretty swiftly as well. I think the recent fall, the acceleration of the pace of the fall over the last 30 days is largely tied to greater economic concerns and people wanting to get cash out and worry that the market is going to have a long-term suffering period.”

Wilson also noted the seasonality of the sports seasons can also play into the price changes. May and June are traditionally a slower period for sports cards because it’s the end of the basketball and hockey seasons, football training camps haven’t started yet and baseball just completed its first half.

“I think it’s a combination of all those things, definitely,” Mahlum said. “Even our sales overall are back down to pre-COVID numbers. It’s definitely getting back down to kind of a reality, I would call it, or back to a normal where we used to be.”

With pennies being pinched by a lot of folks in the hobby, that’s having a direct impact on spending habits.

“For the average person, and for everybody really that’s a collector and a hobbyist, it’s a hobby. It’s an ancillary expense, discretionary expense, and when your discretionary income gets eaten up with necessary things, food, gas, etc., that’s going to eat into the hobby budget,” Moynihan said. “When there’s less money out there to buy things, that’s going to lower prices — that’s just the natural economics of it, the cycle.

“So to me, that’s good. Things were kind of nuts already; the fact that things are coming back down to earth is just expected. Who knew what the circumstances would be, but this isn’t shocking at all. It was on an unsustainable trajectory to begin with.”

While the general collector could be watching what they spend their money on, investors could be doing the same.

“Who’s to say, even if you’re a multimillionaire collecting and you’ve just taken a huge hit in your retirement accounts, that you’re going to put as much money into this,” Grady said. "It’s tough to say, but I think [the economy] has some play in it.

“But I think when you see a Jordan 10 in every auction, when you see some of these cards, LeBron refractors or Mike Trout and people just buy them to flip them and not necessarily collect, so the more that’s in the market, it’s going to bring down the prices.”

Levine said there is data to suggest that at least the high end of sports collectibles is very resilient relative to other areas of the market.

“What we’re seeing at Collectable, our market I think is down seven percent this year. Relative to the equity markets and other markets, that’s terrific, relatively speaking,” Levine said. “I do think those factors [what’s going on in the economy] are correlated. Obviously, if people are being pinched in other areas, there’s just not as much money to spend on sports cards and sports collectibles. I think that’s normal and natural.

“But overall, in spite of all the macro headwinds and in spite of all the uncertainty, I think underneath the hood there’s a tremendous amount of good going on and I’m very encouraged by it.”

HOBBY INTEREST REMAINS HIGH

Wilson is optimistic for the long-term growth of the hobby. His company continues to release video and written content multiple times per week, and hobby-goers can’t get enough of every little tidbit of information.

“We’ve definitely seen an overall softening. Now I will say to counter, though, is interest remains very high,” Wilson said. “I do not believe we have seen a mass exodus of people’s interest. I do not believe we’ve seen people say, ‘This is not for me anymore.’ I think people are just getting fearful about money and want to be more prudent about their financial choices, but they’re still consuming tons of content about sports cards. They’re still going to card shows, they’re still showing up at card shops.

“I can tell you statistically, these last few months have been some of our best months ever in the history of Sports Card Investor in terms of people watching our videos, people interacting with our website, people interacting with our apps. We’re seeing extremely high numbers on people consuming sports card-related content. What that tells me is there’s still a high degree of interest.”

Moynihan’s podcast is going strong as well.

“The hobby’s not going anywhere,” Moynihan said. “People are like, ‘Oh, is this the death of the hobby?’ No. It’s never going to be the death of the hobby. It ebbs and flows like everything.”

The current state of the hobby doesn’t alarm Mahlum. He said the vast majority of friends in the hobby aren’t too concerned, either.

“I don’t see a lot of people giving stuff away and slashing prices and trying to get ahead of this curve,” Mahlum said. “I just think people are rolling with it. I think most [dealers] are pretty good financially after the last couple years. I think the only people that may be panicking and stuff are the people that are new to the hobby and got into at those high levels the last couple years. It’s some 20- and 30-year-old kids that did it like a stock market, and it’s not. It’s kind of a reality check for them, I imagine.”

IMPACT ON THE NATIONAL

Mahlum, who's company will be setting up at The National for the 25th year, is looking forward to the show.

Because he has to travel cross country with his merchandise, he won’t be bringing nearly as many items as he did for last year’s show in Rosemont, Ill. But he plans on bringing as many unique, high-end pieces as possible.

“For me and a lot of other people, it really comes down to your inventory and what you have,” Mahlum said. “Do you have the stuff that’s hot? Do you have the players that are hot? Any kind of fresh inventory — last year we had a collection of 3x5s that were fresh to the hobby. There were two or three Babe Ruths that were graded 10 and all sorts of Ty Cobb and Wagners. It was a crazy collection, and we got that just a week or so before The National. If you have something like that or if you have something new, it sure helps your overall numbers.”

Industry experts are curious how current card prices and the economic pinch will impact The National. That’s one of the big questions entering what could be one of the largest shows in its history.

“I think the prices at The National on the modern, it’s going to be where the market is, wherever VCP says, eBay says here’s the market on these modern rookie cards,” Grady said. “You’re going to find some stuff that you picked up and you speculated on that you hit out of the park if the guy takes off. I think you’re going to have a lot of quality material on display, even though most high-end vintage finds its way into auctions and not so much on dealers’ tables.”

Wilson doesn’t think this year’s National will have the same level of buzz as last year’s. However, that’s not deterring too many folks from traveling to Atlantic City.

According to NSCC Executive Director John Broggi, as of mid-June, ticket sales were double the amount at that same point last year. The 2021 show registered the second largest crowd ever, attracting nearly 90,000 attendees.

“Part of that is last year it was like the first time many of those new collectors or investors had gotten into it through the pandemic, last year was their first opportunity to ever go,” Wilson said. “From the last National to this National, I don’t think that many more new people have gotten in. I think the rush of new people came prior to last year’s National.

"I think you’re going to see not quite the same level of buzz and excitement around The National, particularly since the market has been soft. However, I think an event like that is always a great catalyst for reconnecting people with cards and the community around cards and it often can kind of spike interest around cards around that event."

Wilson also believes The National could be the catalyst to reignite the hobby.

“It’s also good timing, because assuming the economy doesn’t like totally take a horrible tumble, I really think this fall football season is going to be a hot time for cards," he said. "There seems to be greater interest today than I’ve ever seen before in football cards. I think it’s driven by the high number of young, budding quarterback stars in the NFL that people like to collect their cards.”

Having The National run at a time when card prices have dipped creates an opportunity for collectors to pick up some product they might not have been able to afford at the previous National.

“I’m excited about seeing where prices are and seeing how much dealers are willing to deal,” Moynihan said. “I think that cash is going to be king so to speak in the sense that dealers need to move through their inventory. I hope they’re going to be willing to deal, and I think if you come ready to spend you can find some good deals.”

“For every person that is upset the prices have come down, I think you might find two collectors who are thrilled that it’s come down,” Levine said. “We hear it all the time that when things were elevated, when things were at their peak, we heard from a lot of people that it was a turnoff — that they were being priced out of the market, has this hobby gotten too expensive, there’s too much money in it.

“Now, I think collectors are a passionate breed, collectors are a very sticky consumer. If there’s one thing we know collectors love, it’s the hunt for a deal. So I think the true collectors will really show themselves at The National. I think people will be bargain hunting and looking for great stuff that they love and they can hold for long periods of time.”