News

High-End Collectibles Remain a Viable Investment

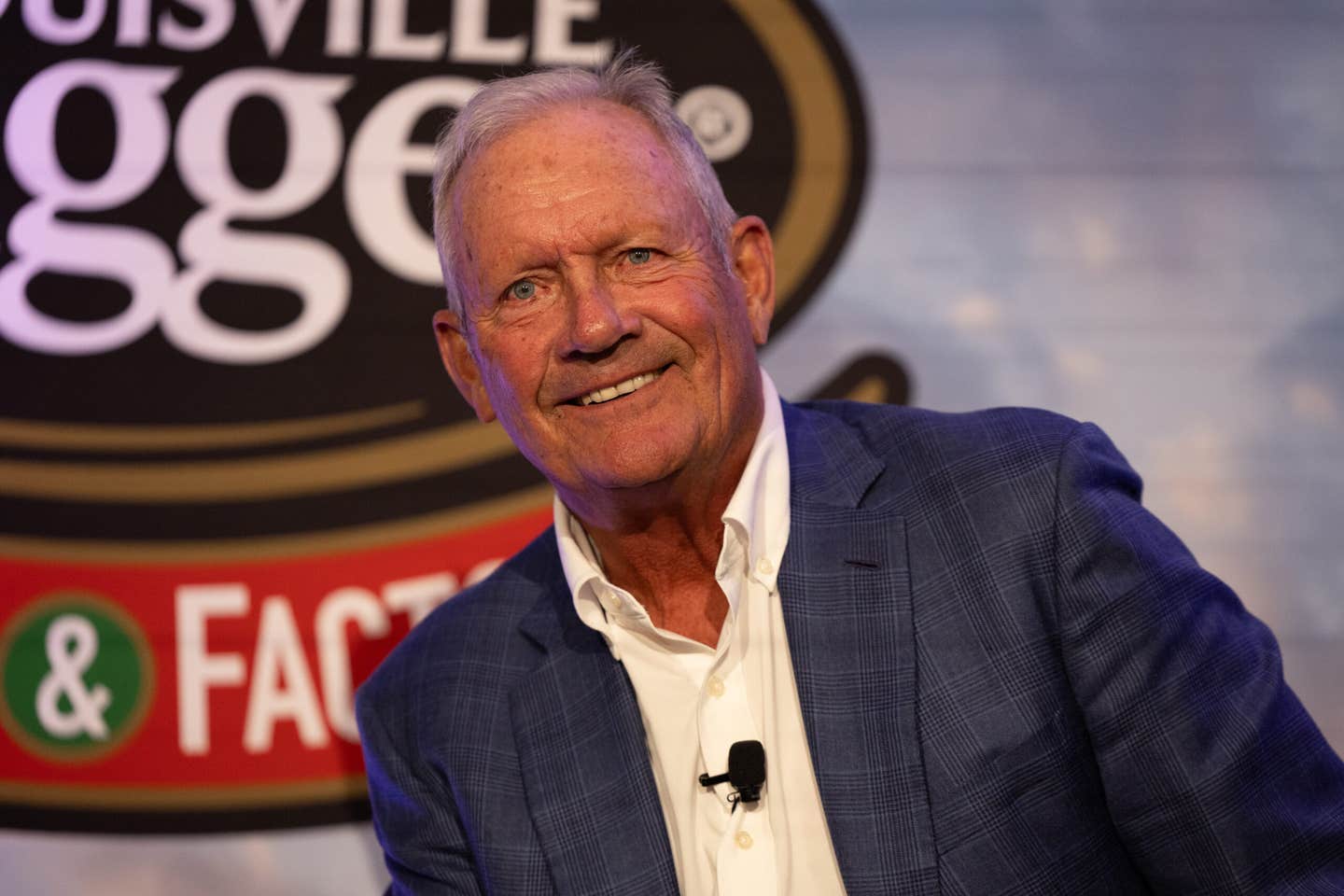

Standing in an L-shaped cubicle of space at a recent memorabilia show in Virginia, dealer Jimmy Strickland of Jacksonville, Fla., didn’t have many customers, but he knew he had the goods.

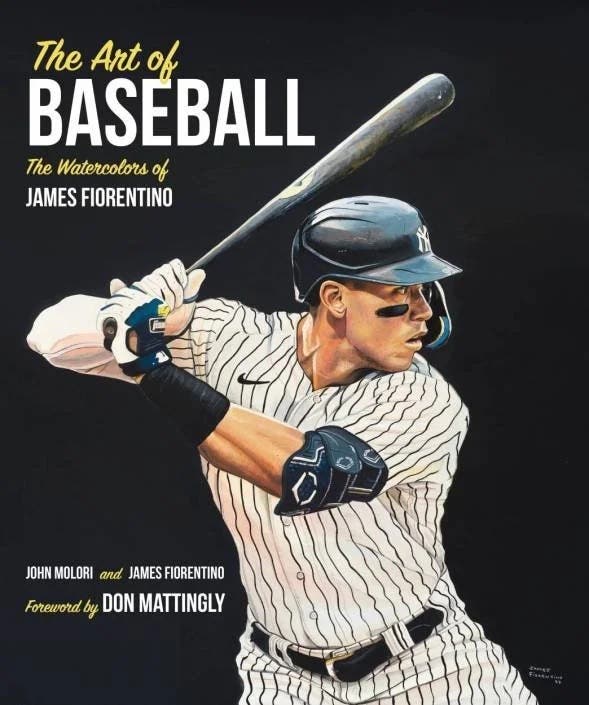

Strickland was flanked by a display of premium sports artwork that included a terrific selection of LeRoy Neiman limited-edition seriagraphs. He pulled out a recent Neiman price sheet and read off values that make the eyeballs pop: Mickey Mantle, $12,000, Ted Williams, $12,500, Joe DiMaggio, $17,500, Muhammad Ali, $7,500.

It might seem odd, the common senses plead, that pricey sports collectibles could have a budding market at a time when a deep recession threatens the world economy. But in times of financial peril, higher-end sports memorabilia tends to find itself in a surprising bull market. When all else fails, adding rare, limited-edition and vintage sports treasures to your portfolio has proven to be a fairly sound investment.

“These are all key pieces and they don’t change hands very often,” Strickland said, waving a hand across the Neiman prints like the lovely model of a game show. “I think what’s happening with the economy right now could be a good thing (for dealers and auction houses).”

Strickland certainly won’t get an argument from the hobby and sports business experts, who say “investments of passion” such as luxury cars, jewelry, antiques, coins, wines and sports memorabilia have almost become recession-proof. “It’s still sports and it’s still an escape,” said Rick Ellington, managing editor of SportsBusiness Daily.

“I think you can expect a trend for at least the immediate future where real high-end sports merchandise will continue to sell and go to auction at the same prices or above than we’ve seen in the past. But the value will be in the rare and vintage materials. The modern stuff is where you’ll see the brunt of the economy’s impact.”

The Big Ticket

Sitting at his desk in Silver Spring, Md., poring over some recent achieved values, president Bill Huggins of Huggins & Scott Auctions wholeheartedly agrees with Ellington. “Our fall auction was off 10-20 percent and that was three days after the whole Wall Street thing blew up,” he said.

“But the big-ticket items did well, exceptionally well. We had unique items that sold at 20 times their expectation.”

The past 35 years have been the most turbulent in monetary history and the interesting parallel is the U.S. sports memorabilia industry has exploded to a $1 billion business in great part during times of a weaker economy. In 1979, when high interest rates and the Iran Crisis led to rampant inflation, sports collecting buying and selling began emerging from flea markets and yard sales into big-money ventures such as autograph shows.

A recession after the “Black Monday” stock market crash of 1987 led investors to prospecting key rookies and vintage cards. Another recession in 1991-’92 coincided with an explosion in game-used materials. Actor Charlie Sheen paid $93,000 for the infamous baseball that Bill Buckner booted in the Red Sox’s historic loss to the Mets in Game 6 of the 1986 World Series. That transaction escalated the idea of sports collectibles in portfolios and helped set off a wave of sports memorabilia auction businesses.

The first big sale of the ultra-rare Honus Wagner T206 card also took place around the same time. Price: a then-stunning $451,000. The card has since changed hands several times and sold for $2.8 million in 2007.

Now investors face the most troubling financial times since the Great Depression. They are looking for “grounders,” or investments that hold or steadily gain value to help balance a volatile portfolio and protect from inflation.

“Something like a record-setting ball or a graded 10 rookie card is going to continue adding value,” Ellington said.

But there is also another dynamic. A new breed of collectors, aged 45-55, is entering the hobby. Their kids have left home or graduated from college, their mortgages are paid and they are in their peak earning years. They have discretionary funds. Their common memorabilia price entry range, according to the website portfolio.com, is $5,000-$50,000.

“When you buy a house in my area (Washington, D.C.), you get a washer, dryer and Cal Ripken Jr. rookie card,” Huggins grinned.

Beware: The Risks

A down economy is a great preying field for many aspects of investing. Dipping into high-end sports collectibles carries the same objectives and risks as stocks, bonds and mutual funds, except memorabilia is a lot more fun. It’s a tangible item that can be held in your hands or showcased to your friends.

“The reason we invest in the stock market is to make money,” said Joe Orlando, president of the memorabilia grading company Professional Sports Authenticator. “The beauty of our industry is, yes, high-end sports collectibles outperform other forms of investment. But you also have a sentimental component that helps prevent extreme volatility from this market and others.”

In other words, the collector gets very attached to a certain player, team or event. He’s more invested than just dollars and sense. He will likely show patience and hold onto an item through a good or bad economy.

“With these high-end investors,” Ellington said, “they may take a hit on an investment but they also have the mindset of low-risk, low-reward. But as time goes by ... their investments will likely get back or exceed the value of two to three years ago.”

Said Huggins: “I learned over the years, through my card stores and auctions, that the more expensive the item, the easier it is to sell.”

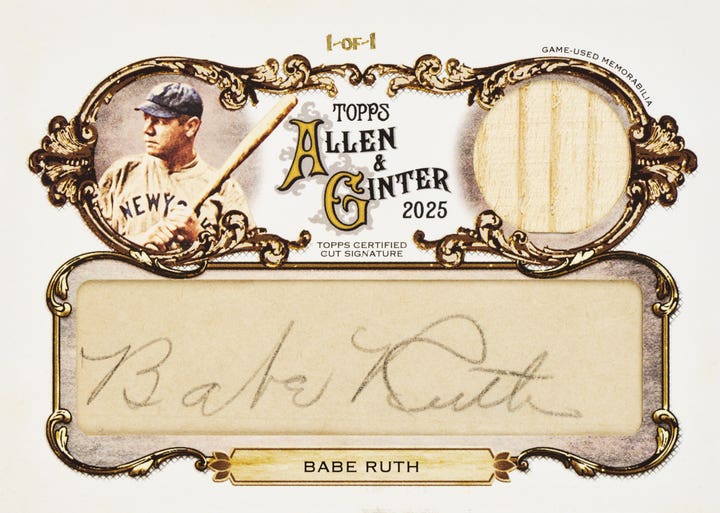

“The real lesson here,” Orlando said, “is it’s always dangerous to spend enormous sums of money on record-breaking items of this nature because, as they say, records are made to be broken. In contrast, when the bat Babe Ruth used to hit the first home run in Yankee Stadium history sold for $1.265 million a few years ago, it came without that ‘record’ danger because no one else can repeat that feat.”

Spot Market Trends

Sentiment can create a frenzy for an item, so Orlando shares simple advice on how to find and invest in collectibles to put into your portfolio: “Buy the best quality, the highest grade of material that you can afford,” he said. “That’s the material that in the long term, good times and bad, will always be in demand.”

Vintage baseball cards are the hobby’s anchor and the mainstream appeal of such hobby classics like the 1933 Goudeys, 1952 Topps, the T206s and a couple of pre-World War II issues always have market and value.

But in these economic times, high-end investors will also be looking for market trends. No, that doesn’t mean more modern cards or active players very often. In fact, many investors haven’t considered any big-ticket items since 1980.

However, there be could be a solid investment opportunity if you notice pricing ticks on, say, the 1941 Play Ball and the 1915 Sporting News cards, or perhaps vintage tickets and game programs from historic events.

“People can laugh it off all they want,” Orlando said, “but we’re seeing the realized prices at auctions. These are facts. Sports investments of high-quality, high-end material are absolutely a viable option for an investor.”