News

Contrived Scarcity in Collecting

By Bob Warrington

Like any market-based commercial enterprise, the sports collecting hobby operates on the theory of supply and demand. Put simply, the theory defines the effect that the availability of a particular product and the desire for that product has on price. Generally, low supply and great demand increase price, while great supply and low demand decrease price.

Why does a Rube Waddell autograph sell for a considerably higher price than a Bob Feller autograph? Demand exists for the autographs of both of these Hall of Fame pitchers, but the abundant supply of Feller’s causes its price to be a fraction of that paid for the comparatively scarce Waddell’s.

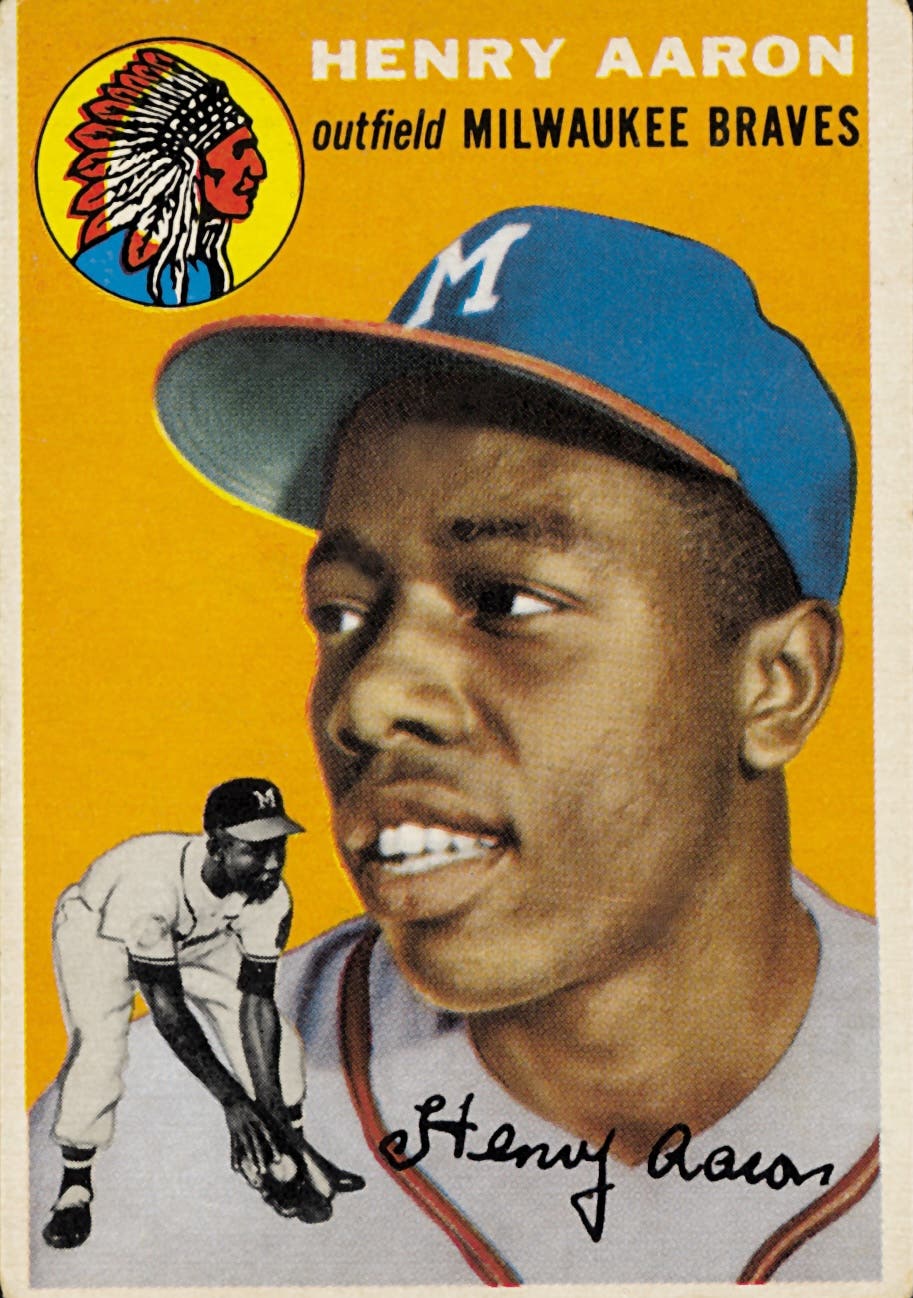

Evidence abounds that the laws of supply and demand are at work in the sports collecting hobby. The theory forecasts, for example, that as demand increases price goes up, which attracts new suppliers who increase supply bringing prices back down. Baseball card production illustrates – painfully for some – how this phenomenon has impacted price trends over time.

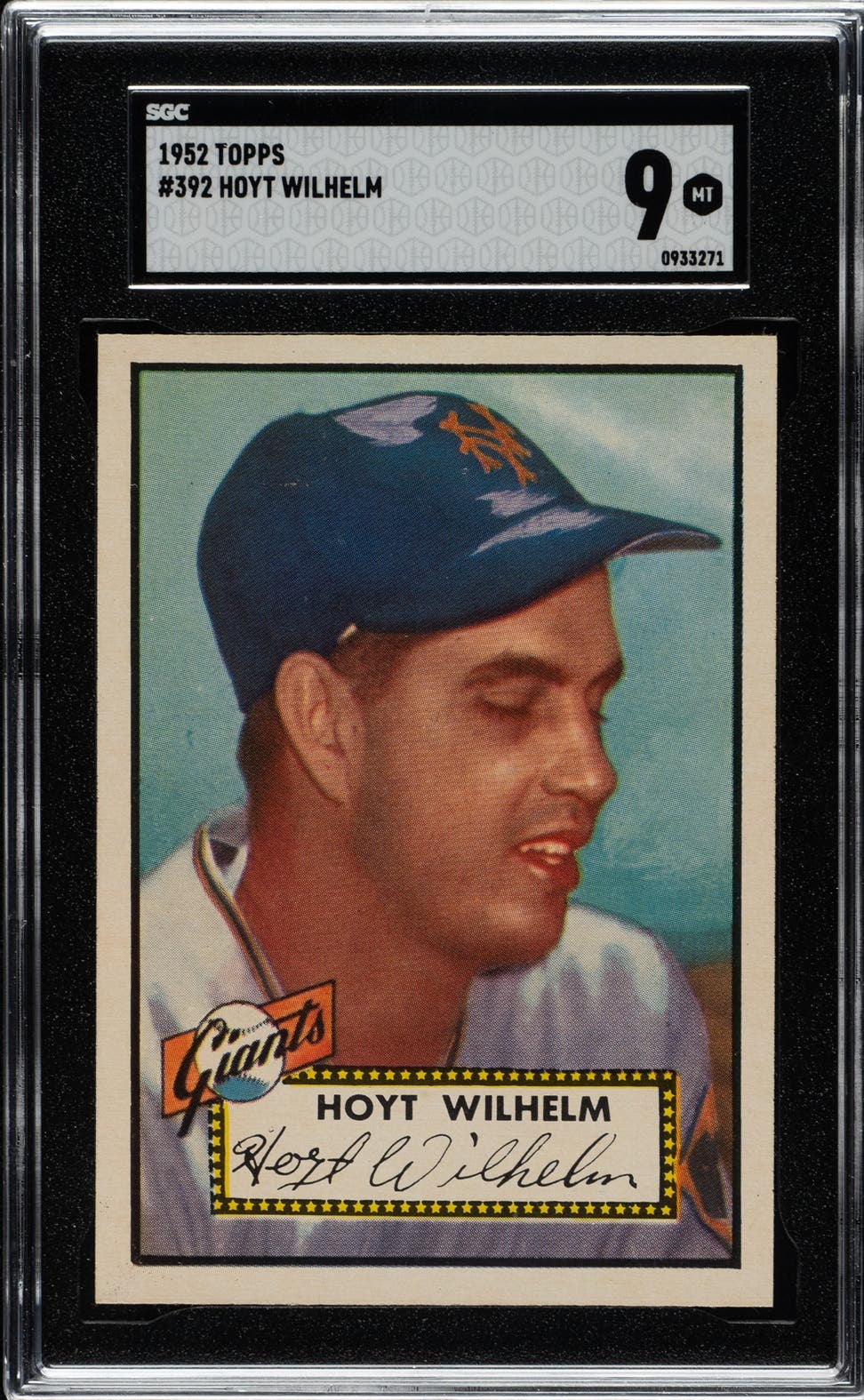

In response to rising card prices, the number of card manufacturers and their card production grew in the late 1980s-early ’90s. The resulting upsurge in supply caused once-escalating prices for cards to plummet as overproduction exceeded demand. What had previously been touted as a legitimate investment and hedge against inflation left collectors holding a glut of cards worth very little.

But the sports collecting hobby is not a perfect reflection of the theory of supply and demand. Price determination is affected by other factors at work. For example, the supply of vintage sports items cannot be expanded in response to rising demand. This statement refers specifically to the known supply of a product. A number of cases exist where existing supply grew not through new production but by the discovery of previous production. In the 1970s, to cite one case, a warehouse find of 1953 Philadelphia Athletics yearbooks expanded known supply and made available for collectors Mint/Near-Mint specimens of the publication in plentiful numbers. This is why these yearbooks in superior condition are more numerous and relatively less expensive than Mint/Near-Mint A’s yearbooks from prior and subsequent years – another instance of supply and demand operating as the theory predicts.

Looking again at Feller and Waddell, neither is signing anymore, so an upturn in prices for their autographs will not lead to a proliferation of suppliers and supply. While ownership of their autographs almost certainly will change hands to some extent as sellers cash in on higher prices, the overall supply remains fixed. (In writing this, one must acknowledge, as the hobby’s history has shown, that rising prices can swell the generation of autograph forgeries, another unfortunate factor that distorts the laws of supply and demand in sports collecting.)

Manufactured scarcity

When identifying factors that affect market conditions in sports collecting, the contrived creation of product scarcity is especially notorious because of the misleading effect it can have on price determination. The practice is chiefly disadvantageous for collectors because the illusion of rarity distorts product valuation as a function of the relationship between supply and demand.

There is nothing new about manufactured scarcity in a market-based enterprise, nor is it unique to the sports collecting hobby. The concept’s infamy is rooted in the difference between the appearance and reality of rarity. Fostering and then manipulating the perception that an insufficient supply of something exists engenders the understandable but unfounded belief among people that a product they own is worth more – often far more – than actually is the case.

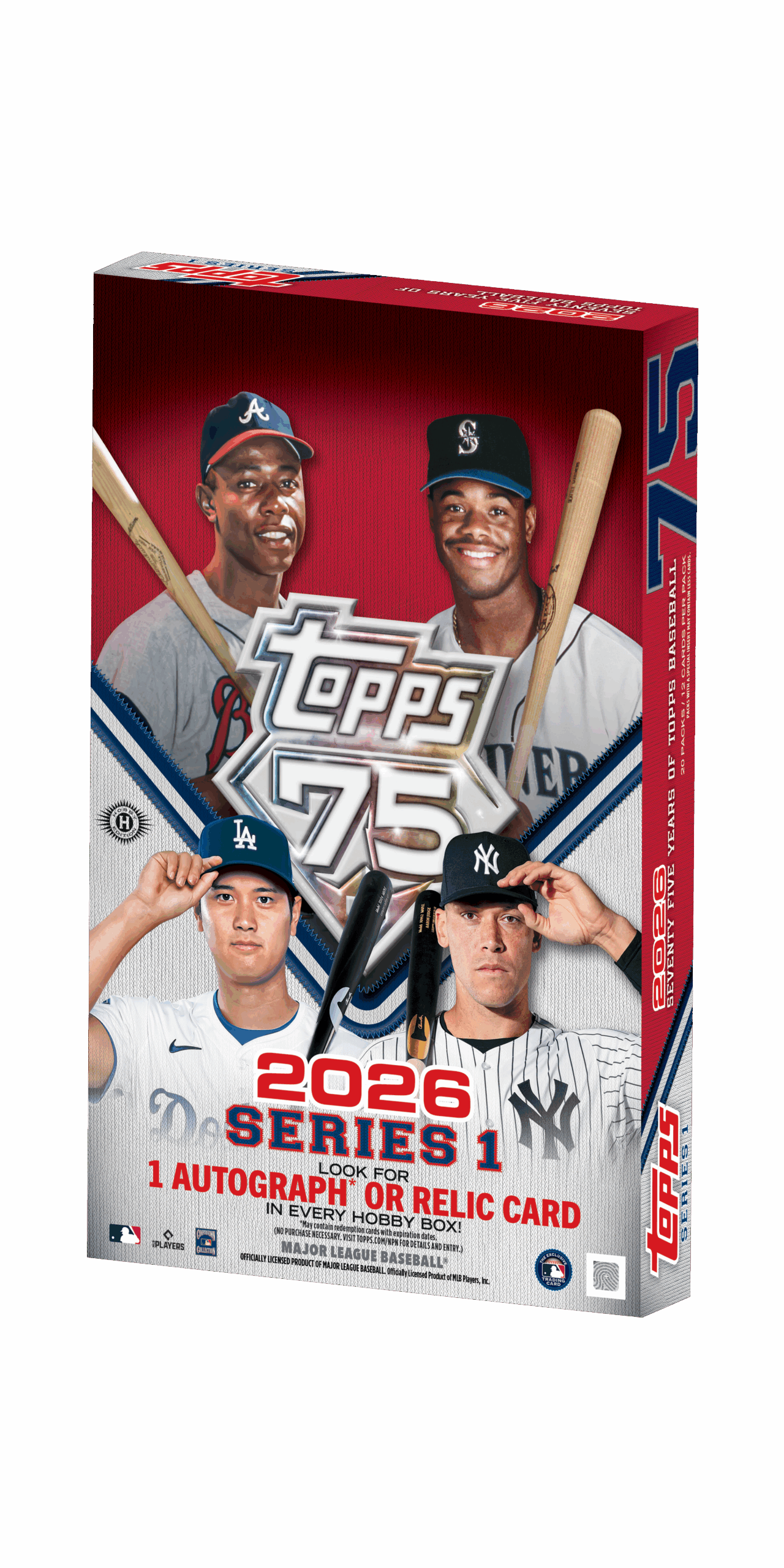

But the practice has become particularly insidious in the sports collecting hobby because the pretense of scarcity is not directly connected to the actual supply of a product; instead, it stems from the fabrication of distinctive packaging in which the product is housed. Scarcity, in other words, is linked to the product-container combination rather than to the product itself.

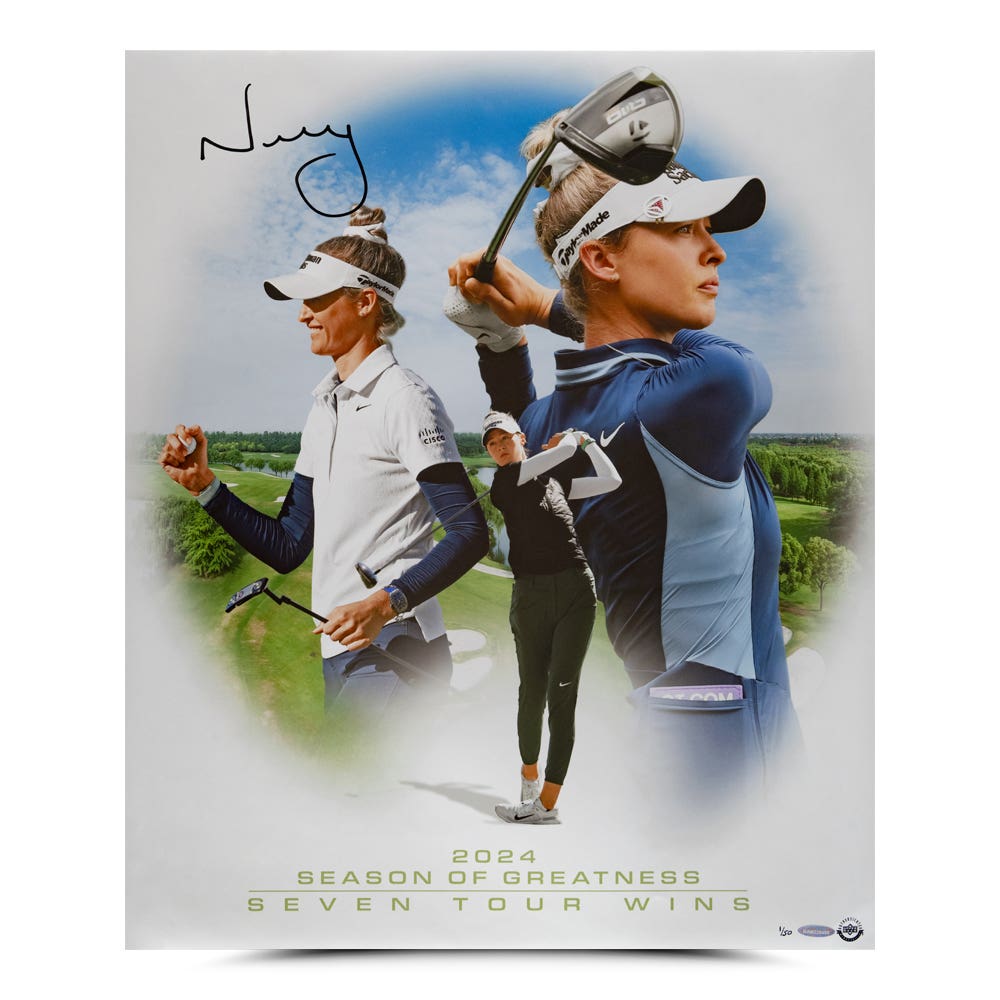

In sports collecting, this scheme is practiced by card companies that encapsulate a product – such as an autograph or jersey or bat fragment – within a card and then mark the card as one of a limited edition. The unmistakable inference is that by being housed within a card that is marked as having restricted availability, the product itself becomes comparatively more valuable.

A case study: Connie Mack’s autograph

Autograph cuts inserted into cards – especially signatures of individuals who are deceased – illustrate most prominently the promotion of scarcity through packaging. An apt case in point is Hall of Fame manager Connie Mack, who had a prolonged and memorable career in Major League Baseball.

Mack started his professional career with the Washington Nationals in 1886, switched to the Pittsburgh Pirates in 1891, and then served as that club’s player-manager from 1894-96. Retiring as a player after the 1896 season, Mack served the next four years as manager of the minor league Milwaukee Brewers. In 1901, he became manager of the Philadelphia Athletics in the newly-formed American League, staying in that role for the next 50 years. After retiring as manager in 1950, he remained as the club’s president until the A’s were sold and relocated in 1954. Mack died in 1956.

This brief review of Mack’s tenure shows that he had a career in Major League Baseball that lasted more than 60 years. Throughout that lengthy period, he was a willing and gracious signer when asked by people for his autograph, which happened frequently. The result of all this is that an ample supply of Connie Mack autographs exists. I’ve seen Mack’s signature several hundred times in the 25 years I’ve been collecting Philadelphia A’s memorabilia. Given his legendary status and Hall of Fame membership, Mack’s autograph is undoubtedly desirable to collectors, but it should in no way be regarded as rare.

Based on my experience and judgment, Mack’s autograph on a piece of paper, index card or GPC should be priced fairly at around $125. This assumes the autograph is in nice shape (i.e., no fading, smudging, staining, paper creases or tears, etc.). If the signature has been assessed as genuine by one of the authentication companies, then the price will increase somewhat to cover the cost of this service.

Collectors participating in major sports auctions and on eBay tend to support this estimate, as evidenced by prices realized:

- In its November 2010, live auction, Hunt Auctions sold a Connie Mack autograph on a 2-by-31/2-inch blank heavy stock card, signed in fountain pen with the signature rating 8 out of 10 and an LOA from JSA, for $150.

- An eBay offering in late November 2011, of a Mack autograph on lined notebook paper with PSA/DNA certification was bought by a bidder for $149.

- Three Connie Mack cut autographs listed by different sellers on eBay in late November 2011 – two with PSA/DNA certifications and one with a Forensic Documents Services certification – did not sell at “Buy It Now” or “Opening Bid” prices of $220, $259 and $265, respectively.

As these examples show, based on current market conditions, $150 is a reasonable figure in estimating the value of a simple Mack autograph with an accompanying certificate of authenticity. Collectors will pay that sum but reflect good judgment in being unwilling to go much above it.

The question then becomes, “What effect should inserting Mack’s autograph in a card and characterizing the card as “1 of 1” or one of a similarly small number have on its worth?” The correct answer is: None! The container in which a Mack autograph is housed is irrelevant to the supply of his autograph and should have no impact on price determination as a function of demand for his autograph.

Yet owners of Connie Mack cut autograph cards do not believe this is the case. A late November 2011 eBay search revealed multiple instances of Mack cut autograph cards produced by various card companies being listed at prices far exceeding those cited above. The “Buy It Now” or “Opening Bid” figures for some of these cards were:

- 2011 Upper Deck Exquisite Cuts Connie Mack Cut Signature “3 of 3” – $799

- 2010 Obak Legend Cuts Connie Mack “1 of 1” – $999

- 2008 Upper Deck Connie Mack Autograph Cut “2 of 2” – $599

- 2007 Upper Deck Connie Mack Autograph Cut “3 of 6” – $899

- 2007 Upper Deck Connie Mack Autograph Cut “6 of 6” – $599.

Tracking these items on eBay showed that none of them sold, which should not be surprising to anyone with knowledge of the fair market value of Mack’s autograph and of the difference between illusory and actual rarity. From the perspectives of prevailing market conditions, transactional trends over time and the laws of supply and demand, nothing justifies these inflated asking prices for Mack’s cut autograph.

Why then did sellers believe these items could command such prices? There are two related reasons.

First, sellers are prone to think their items are worth significantly more than prevailing market conditions would indicate. That is why they find eBay one of the saddest places in the world. It is where their dreams of the value of items they’re attempting to sell go to die. Cold reality confronts fanciful imagination on eBay, and reality always wins.

For example, a late November 2011, search on eBay using the keyword “Phillies” and a “Buy It Now” or “Opening Bid” price of at least $100 produced a listing of 8,814 items.

Running that same inquiry again, but refining the search by requesting to see only those items for which one or more bids had been tendered, shrunk the list to 12 items. The dramatic difference between sellers who believed they had something worth a minimum of $100 and buyers who agreed with them affirms another critical lesson of the laws of supply and demand – a product is worth only what someone is willing to pay for it.

Second, the aura of exclusivity companies have created about their autograph cut cards in marketing them (e.g., “1 of 1”) exploits the cravings of sellers who yearn to believe they have pieces worth considerably more than market conditions and price precedents would justify. Characterizing available supply in terms of such scarcity creates an expectation among sellers that demand will compel collectors to pay prices for cards with autograph cuts in amounts otherwise deemed excessive. In other words, while no collector with any understanding of the market would pay $999 for a Connie Mack autograph cut, that same cut encapsulated in a card with “1 of 1” printed on it legitimizes for sellers a $999 asking price (or prices at similarly stratospheric levels).

In reality, the opposite is true. Cutting an autograph so it can fit in a card should diminish its value because the original state of the autograph has been changed. Just as an autograph cut from a check is never as valuable as the entire check, any autograph removed from its original venue should never be as valuable as an autograph in which the signature and its setting remain unaltered.

In all fairness to companies that produce autograph cut cards, they never claim their cards are valued at the exorbitant levels sellers imagine. They merely invoke an appearance of rarity by promoting the cards as unique (“1 of 1”) or as one of an extremely limited edition (“1 of 3”). Companies use this ploy to promote sales of card lines containing autograph cut specimens. Pliable sellers, all too eager to substitute chimerical thinking for empirical evidence in setting their prices, ask for sums that have little basis in reality.

This is not to say the venue on which Mack’s signature appears is meaningless in estimating value. Nothing could be further from the truth. For example, a Connie Mack autographed Hall of Fame (HOF) postcard by Artvue sold in Hunt Auction’s November 2011, Louisville Slugger auction for $4,000. Why so much? Because Mack’s signature on such a postcard is “uncommon,” as was noted in the auction catalog.

As this example illustrates, the scarcity of an item on which a signature is inscribed impacts its value significantly. The great worth of a Connie Mack-signed HOF postcard is based on its rarity compared to more frequently seen articles bearing Mack’s signature.

Will a cut Mack autograph attached to his HOF postcard attract a price similar to the amount paid for the item sold in Hunt’s auction? Of course not. The HOF postcard sold by Hunt’s was actually signed by Mack. The other is nothing more than an inauthentic concoction produced by mating a Mack cut autograph with his HOF postcard. A disingenuous person can purchase 50 Mack autograph cuts, affix them to 50 of his HOF postcards, and then seek to sell them as “uncommon” Connie Mack autographed HOF postcards. But that is a deceptive practice, as is any ruse based on presenting a product as something it is not.

To avoid vilifying just card companies, it is important to note that spurious claims of rarity can extend throughout the realm of the sports collecting hobby. This point can be illustrated by returning to the autograph of the previously-mentioned Bob Feller.

In the November 18, 2011, issue of SCD, a dealer offered Bob Feller-signed baseballs with LOA for $79 apiece. Suppose an individual purchased one of these Feller-signed baseballs for that amount and then placed the ball in a cube holder an artist has painted with a unique design that included the notation “1 of 1.” Can that person rightfully proclaim the ball/cube combination as scarce based on the distinctively painted cube in which the autographed ball is held rather than on the uncommonness of the autographed ball? Does the exceptionality of the ball/cube combination justify a selling price that is five or 10 times above the $79 paid for the autographed baseball? Does placing the ball in the cube make Feller’s autograph more scarce than it otherwise would be? If you answered these questions with anything other than a resounding “No!” it is to your advantage to reexamine your views.

Understanding scarcity

Much care must be taken in interpreting scarcity as a valid indicator of value. Virtually any autographed piece can be construed as “1 of 1” if the definition of what qualifies as being one of a kind is warped sufficiently. Any seller can claim that a Connie Mack-signed GPC is unique because it is the only one that was mailed on a specific date to a specific address. A knowledgeable collector would dismiss that assertion as a perverted interpretation of uniqueness and dismiss it as a legitimate factor in estimating price.

This is not to suggest that people who acquire autograph cuts from packs of baseball cards aren’t fortunate. They are in most cases. If you buy a pack of cards for $5 or $10 and discover a Connie Mack autograph cut in it, then you’ve obtained his autograph at a fraction of its current market price. If you believe that the autograph cut – by being housed in a card – is worth far more than the autograph cut’s current market price, then you will be disappointed unless you find a buyer who lacks an understanding of the effect of supply and demand on price determination and is ignorant of the difference between real and contrived scarcity.

Don’t succumb to the siren’s song of contrived scarcity in valuing products. It’s sure to result in self-inflicted wounds. The pitfalls of duplicitous portrayals of rarity can be avoided by collectors who can distinguish between factors that drive price determination as compared to those that distort it.

Enlightenment begins by understanding the theory of supply and demand and how it’s applied to the sports collecting hobby.

Bob Warrington is a freelance contributor to SCD, and a Philadelphia baseball historian, writer and collector.