News

Collectable unveils competitive bidding for investors, fractional ownership of sports collectibles

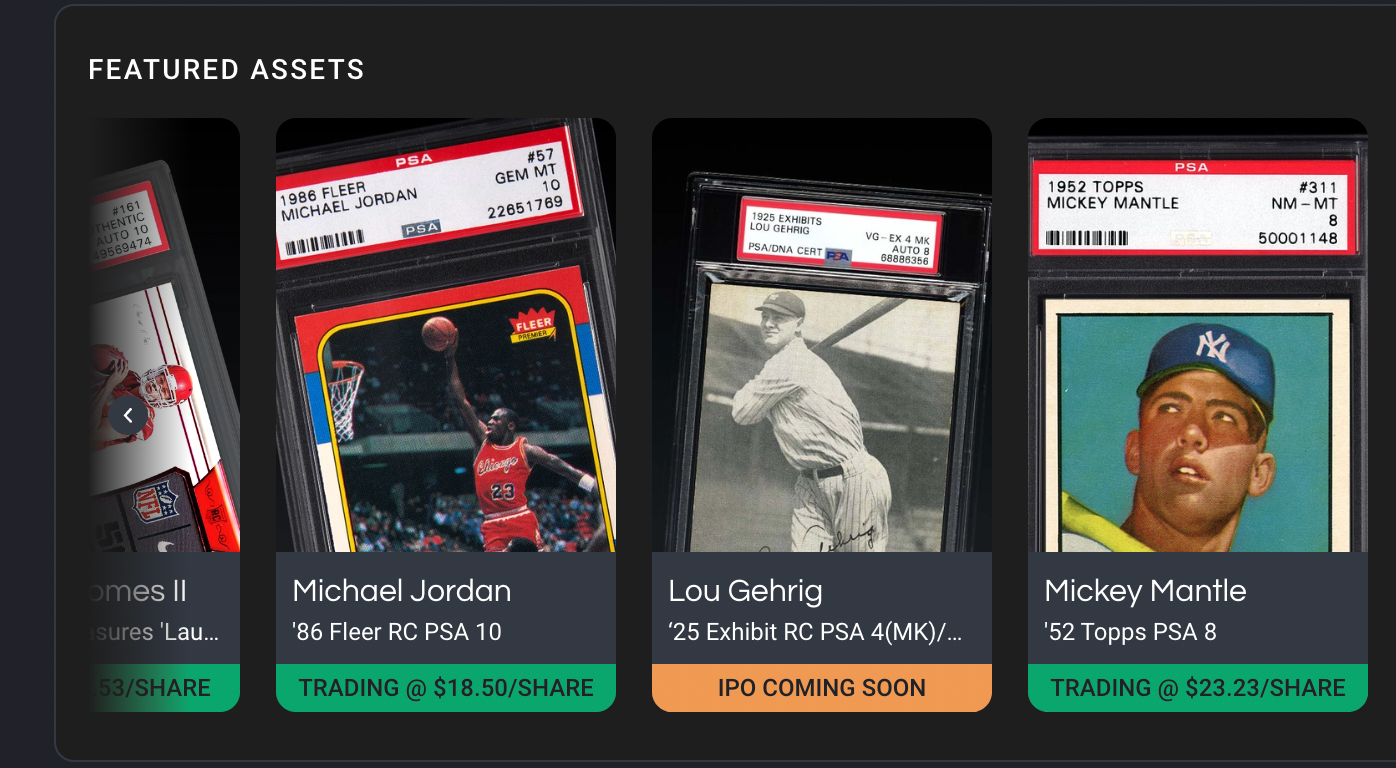

Collectable, the hobby’s leading fractional investment company, is launching an exclusive and innovative competitive bidding process designed to increase demand for iconic collectibles.

The two-round, sealed bid process will provide additional investment and shareholder opportunities for Collectable clients.

The launch also includes Collectable’s first introduction of comic books, graded video games, TCG and sports art to the platform. The launch of the new BWIC (Bids Wanted In Competition) process is part of Collectable’s international expansion efforts as bidding will be available to collectors and investors all over the world.

Collectable’s version of the process, which is frequently used in public financial markets, has been tailored to investment-grade collectibles across various categories. The competitive bidding process features a proprietary fractional ownership component called Group Bidding, which allows verified accredited investors to jointly bid on assets in the auction. For the first time in history, individual bidders will compete head to head against a group of investors for the opportunity to own premier collectible assets.

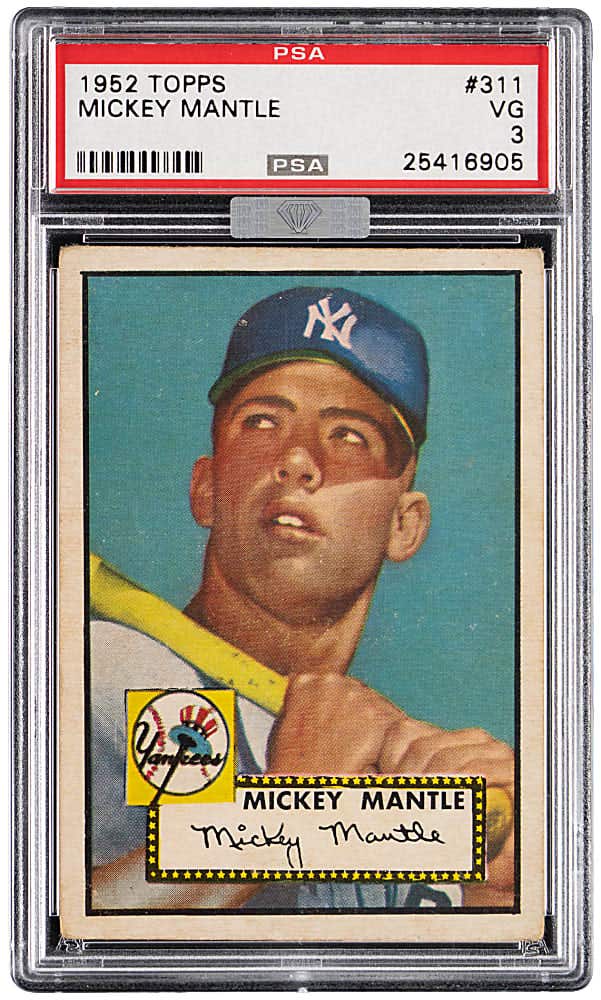

The inaugural BWIC will feature collectible heavyweights such as a 1952 Bowman Mickey Mantle card graded SGC 10; an original Cy Young rookie card from 1890-92; an original Type 1 photo used to create Jim Brown’s iconic rookie card; high-end graded comics, including Superman #1 and Batman #1; a trio of graded Super Mario Bros video games; a Dragon Ball Z black label set; and other select assets from Collectable’s fractional ownership platform.

“Collectable’s mission is to elevate the collectibles asset class through enhanced access, liquidity, and optionality for both buyers and sellers,” Collectable CEO Ezra Levine said. “Bids Wanted in Competition is a time-honored financial markets approach to valuing, and ultimately transacting, esoteric assets. We believe it fits nicely within the collectibles arena, and we’re excited to roll out our proprietary and unique capabilities combining components of traditional collectibles auctions, financial markets and fractional ownership.

“In addition, BWIC should provide an engaging and structured process to increase liquidity and shareholder value for our fractional investors.”

The first BWIC is slated to open at the end of January. Transactions will include a 20 percent buyers premium fee and a 1 percent Seller Listing Fee beginning in July. Collectable anticipates hosting the competitive bidding process on a quarterly basis, at minimum. Individual bids will be available to all collectors and investors. Group Bids are available to verified accredited investors based in the U.S. over the age of 18.

Collectibles emerged as a burgeoning alternative asset for both institutional and individual investors during the recent sports collectibles boom. Sales of global collectibles are expected to grow from $412 billion to $692 billion over the next 10 years, according to market research firm Market Decipher.