Wilt-Chamberlain

Collectable making dreams come true for collectors, fractional investors

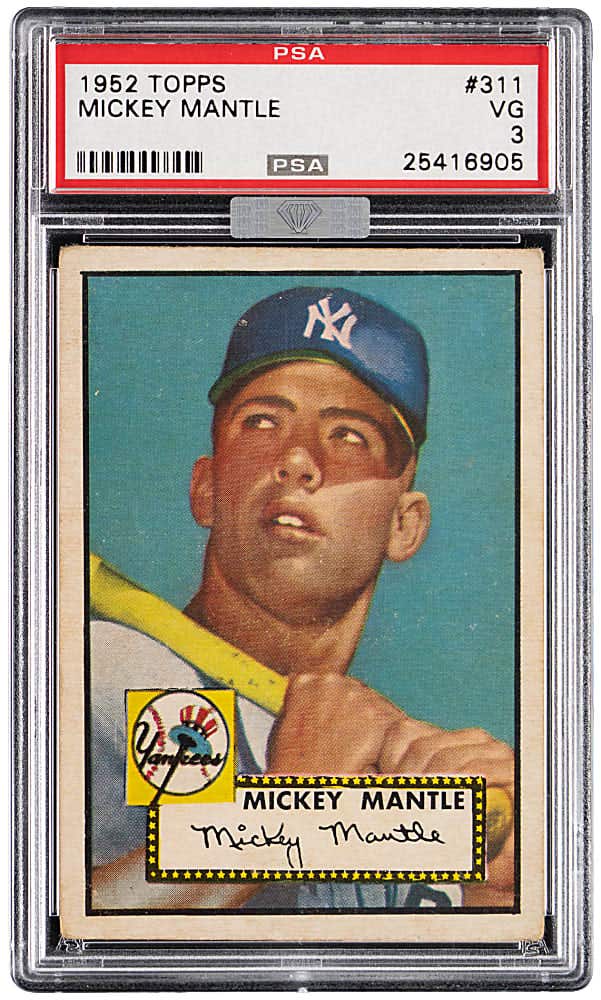

For most sports card collectors, owning a 1953 Topps Mickey Mantle PSA 10 is a pipe dream.

There are only two “The Mick” cards from that year in existence graded equally that high, and the price tag stretches well into seven figures.

For everyone who fantasizes about that beautiful piece of American sports cards lore, a company new to the hobby since the pandemic card explosion is giving the average collector an opportunity to live out that dream.

Collectable, which went live last September, dubbed itself at the time the first and only ownership platform exclusively dedicated to sports. Investors are able to buy shares in high-end sports cards and memorabilia — similar to putting money into the stock market — and see how prices fare over time.

Collectable has had an impressive first seven-plus months. At the end of April, Collectable will have unveiled 90 offerings available for fractional ownership. The first week, the company gave investors an offering of the aforementioned Mantle.

Collectable made 40,000 shares available at $25 per share. Once those shares hit $1 million, the card was fully funded. The Mantle broke the record for the all-time largest fractional ownership IPO in history at $2.5 million; the consigner retains 60 percent of the shares. That same card is now trading on the secondary market for $3.2 million.

“It’s a very different approach to the hobby,” Collectable CEO Ezra Levine said. “In our view, it’s not a substitute for visually collecting stuff. We like having physical items, too. The problem is, the best opportunities for investment happen to be at price points that are really unaffordable for the average sports fan, for the average investor. So, what we’re doing is we’re opening up the market for everybody.

“The average sports fan would never have the ability to invest $2.5 million into one card, it’s only the wealthiest of the wealthy who have that ability. Now, through what we’re doing, you can move shares of it. You don’t need $2.5 million; all you need is $25. We think it’s a really cool thing for the industry, for the hobby.”

In just its first seven months, Collectable has consigned over $50 million worth of high-end sports collectables and has grown its investor base to over 30,000 unique investors and collectors on the platform.

Sports Card Investor founder Geoff Wilson is a fan of fractional ownership.

“I think it’s a great thing for the hobby,” Wilson said. “I think it allows people to own a piece of a card that is kind of a holy grail card that they otherwise never would have a chance to own, and it allows them to invest in it as well. Oftentimes, those really high-end cards can make better investments over the long run, so it makes that more accessible to the everyday collector and investor.”

Longtime sports cards collector Tim McGhee is excited that Collectable is offering such resources to the general collecting community. He believes it’s an important step in the hobby.

“I think the fact that fractional ownership has been done in the art world and other collectibles in the past shows that there is a market for that type of ownership model,” McGhee said. “I think when you combine that with the fact that the sports card and memorabilia market has done really well during the pandemic, which is sort of counter intuitive, I think the timing is phenomenal for those guys. A lot of the high-end stuff is going to be out of the price range of most collectors. The ability to say that you have a fractional ownership in some of the nicest collectibles and sports cards and memorabilia is I think going to be great interest to collectors.”

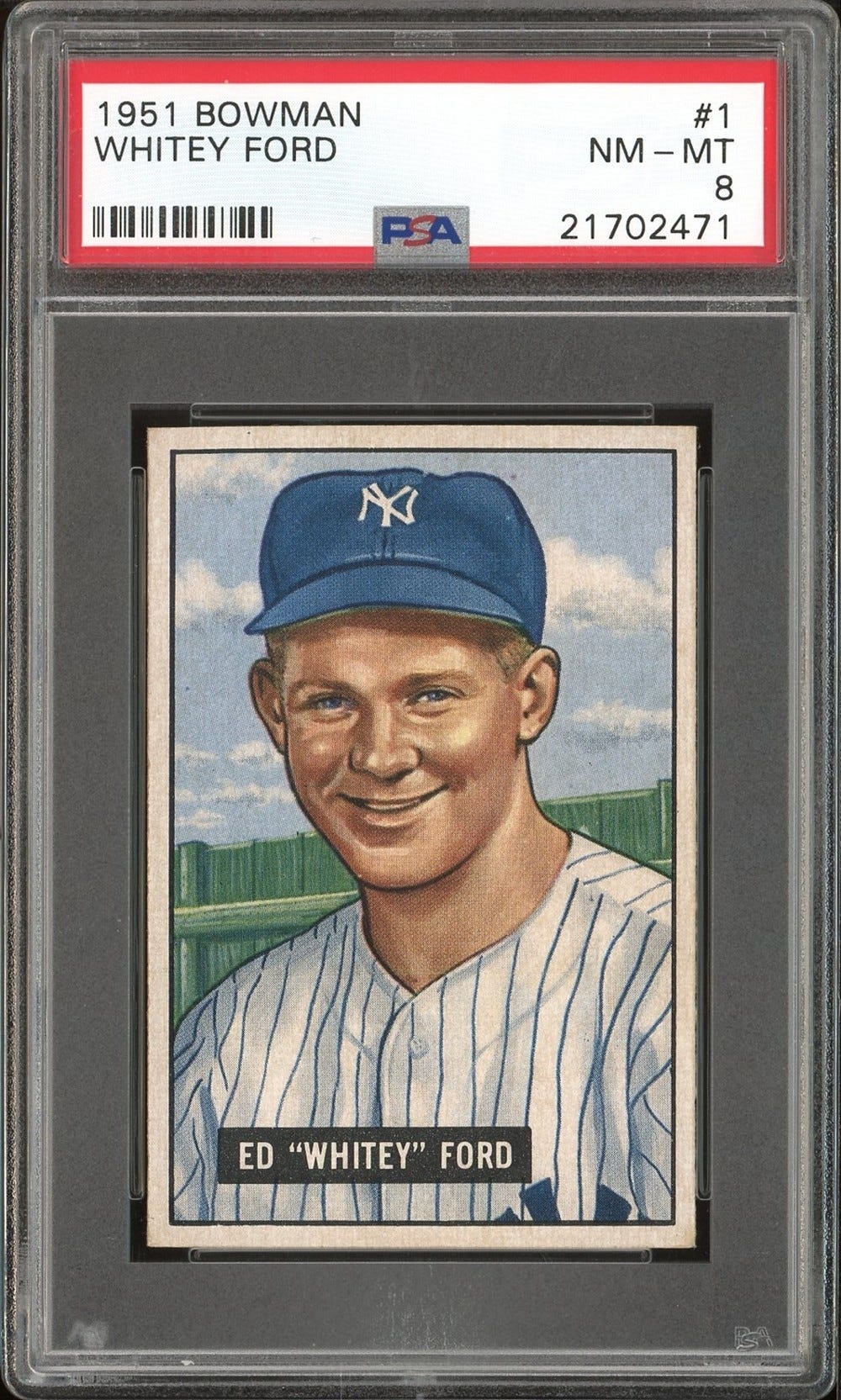

The first three offerings that were made available by Collectable — the ’53 Mantle, a 2003-04 SP Authentic autographed LeBron James card numbered /500 and a trio of Stephen Curry rookie cards – were all sports cards. However, moving forward, without revealing specifics, Levine said the majority of items that will be offered will be game-used pieces, historical sports documents and photographs. One major piece is a dual-signed baseball by Babe Ruth and Lou Gehrig. It will also be a mix of sports — whether that is modern football, modern baseball, vintage baseball and vintage basketball — and a different range of athletes.

“We’re trying to show as much of a breath of offerings as possible,” Levine said.

When Collectable either consigns or acquires an item, it has to get approval from the U.S. Securities and Exchange Commission (SEC) and Financial Industry Regulatory Authority (FINRA).

According to Levine, when Collectable started it had around $30 million in sports cards and memorabilia in its inventory.

“You’ve only seen the very, very tip of the iceberg,” Levine said. “With the exception of the Mantle card, most of our best stuff has not even been listed on the application.”

McGhee didn’t buy into the first few offerings by Collectable, but he’s highly interested in a few pieces of memorabilia that Levine brought up to him when the company was just getting started.

“I’m interested to see what happens with a piece of memorabilia, so I’m going to invest in that,” McGhee said. “But primarily I’m going to invest in cards, baseball cards in particular. But I’ll look at other sports as well.”

McGhee considers himself a mid-range collector. He isn’t shy about dropping five figures for a piece he likes, but he’s not going to spend six figures. That’s where buying shares in an item that piques his interest will come in useful. Until an item is ready to purchase, McGhee isn’t sure how many shares he’ll pick up.

“Depending on how interested I am and how bullish I am on a particular piece, I’ll adjust my investment accordingly, because unlike what I collect in terms of physical product, which oftentimes I hold for a long time, it’s for my collection,” McGhee said. “It’s not necessarily bought for investment purposes. When I invest through Collectable, it is going to be strictly and solely for investment reasons.”

With sports cards and memorabilia hotter than ever, Collectable picked an opportune time to enter the market. The company had been in the works for a while, but Levine said this type of business model is more relevant and needed in today’s hobby more than ever.

“We’re not doing it only because it’s a flash in the pan type thing,” said Levine, who prior to coming to Collectable spent a decade on Wall Street analyzing public and private companies in the consumer, technology, sports and media industries. “I think everyone that’s involved in our company has just seen that this actually has been a really good place to invest your money for long periods of time. It’s really just a way to almost create a new investment opportunity, the same way it’s been done with art for some many years. You can invest in commodities like gold. It’s just another investment opportunity for people who never had otherwise.

“I think rising prices and record prices, it just sort of proves that companies like ourselves are really needed. If nothing is done by this, then people just won’t have the ability to invest in this rise in acting class. It will be the wealthy transacting with the wealthy — constantly, over and over again through auction houses.”

What Happens Once You Buy In?

The plan early on for Collectable was on every Thursday to offer a new asset for collectors to invest in. Shares can only be purchased through the Collectable app, which is available on iOS and Android devices.

Once an investor purchases one, 10, 100 or a higher number of shares of a card or piece of memorabilia — some items will be capped on how many shares an individual can buy — that offering has to reach fully funded status. From that point, there is a 90-day lockup period where there is no buying, selling and trading of shares. After that period, transactions can be made via a secondary marketplace. Collectable has partnered with Templum Markets, LLC, as its secondary market once an offering becomes available for buy, sell or trade.

“There are two ways to make money: If you buy it at $25 and on the secondary market it trades for $35, just like buying Amazon stock at $10 and selling it at $20, it’s the same thing,” Levine said. “You can decide when you want to buy it and sell it. The other way is we do have the ability to entertain offers to acquire the collectable item outright. So, if we list it for $2.5 million and somebody says, ‘I’ll buy it for $4 million,’ we’ll take like a poll with the shareholders and see if they want to sell at that price. If more people say that they do want to sell it, then we’ll sell it and we’ll pass along profits pro-rata to your ownership level in that item.”

For example, in mid-October last year, Collectable offered to collectors a 2017 Panini Flawless Emerald Patch Auto Patrick Mahomes in a BGS 9.5. The card reached all-in offerings at $135,000 and later sold for $182,500 — that had a return of 35.2 percent to collectors who bought in.

The unique business plan Collectable has implemented can be in some ways similar to what shareholders do in purchasing stock from the only publicly-owned professional franchise, the Green Bay Packers.

“It’s similar in the sense where all Packers fans have the ability to say they’re an owner of the Packers, which is really cool. It’s really, really cool to be able to say that,” Levine said. “I don’t know specifics about exactly how that’s structured, but from what I’ve heard, it’s just you own it in title, you don’t really have any way to make money with it. It’s just something cool to say and give to your grandkids or your children.

“What we’re trying to do is we’re actually trying to give people opportunities to make money. The memorabilia and sports category with trading cards is actually proven to be a really attractive place to invest your money. It’s similar in the sense that you have that pride of ownership and everyone can say they’re the owner of some of the best items in sports, whether it’s the Packers or Mickey Mantle or whatever.

“But I think the difference is, A, we have the ability to hopefully make money over time. And, B, we’re going to have a secondary market where people can trade their interests over time. It will be liquid, it will be dynamic and hopefully people can have both — the pride of ownership and the cool factor, but also have ways to make money from their investment.”

Collectable’s unique approach has also made some investors think this could be a form of a Ponzi scheme. But Levine adamantly squashes that belief, and with solid reasoning.

“Anyone who says it’s a Ponzi scheme hasn’t done their homework,” Levine said. “Our entire business model is completely transparent. You can go on SEC’s website and look at everything about our business model, our fee structures, how the companies are created themselves. To me, a Ponzi scheme is something that’s not transparent, that’s not regulated. We’re as transparent as you possibly can be.

“I understand it’s a very different way to do this and these days unfortunately in the memorabilia category, everyone’s conditioned to think that everything is a forgery or there’s a lot of bad actors in here. I’m not surprised that people have that critique. I think it’s unfounded because literally you can go and look at everything about our business model online. But ultimately, we’re a very different way of doing things.”

That different way of doing things is attracting plenty of collectors as well as meaningful partnerships with professional athletes.

Emmitt Smith, the NFL’s all-time leading rusher, got involved in his own authentication company, the PROVA Group, which launched in July 2020. His impetus for starting the company was because he’s realized how many forgers are out there in the market. He also wants to play a role in Collectable.

“Emmitt is coming at this from two angles. One, is from the athlete side of things,” Levine said. “Athletes, obviously, their involvement with the memorabilia category has been through auction houses, maybe through eBay, maybe through licensing agreements with companies like Panini or whomever. The issue that Emmitt saw firsthand was that athletes don’t really have a lot of ways to share in potential financial upside of this. They’ll sell it at a certain price or they’ll give away their rights at a certain price and that’s that.

“There’s been a lot of athletes who are like, it would be great if we can have some skin the game as well. Through our platform, they’re able to list their own memorabilia, their own collectors’ items and retain partial ownership of it, and then do things to kind of get investors interested — do shareholder events, do Zoom calls, do giveaways, do all these things that are kind of like feed it back to the shareholders to get them excited about their offerings.”

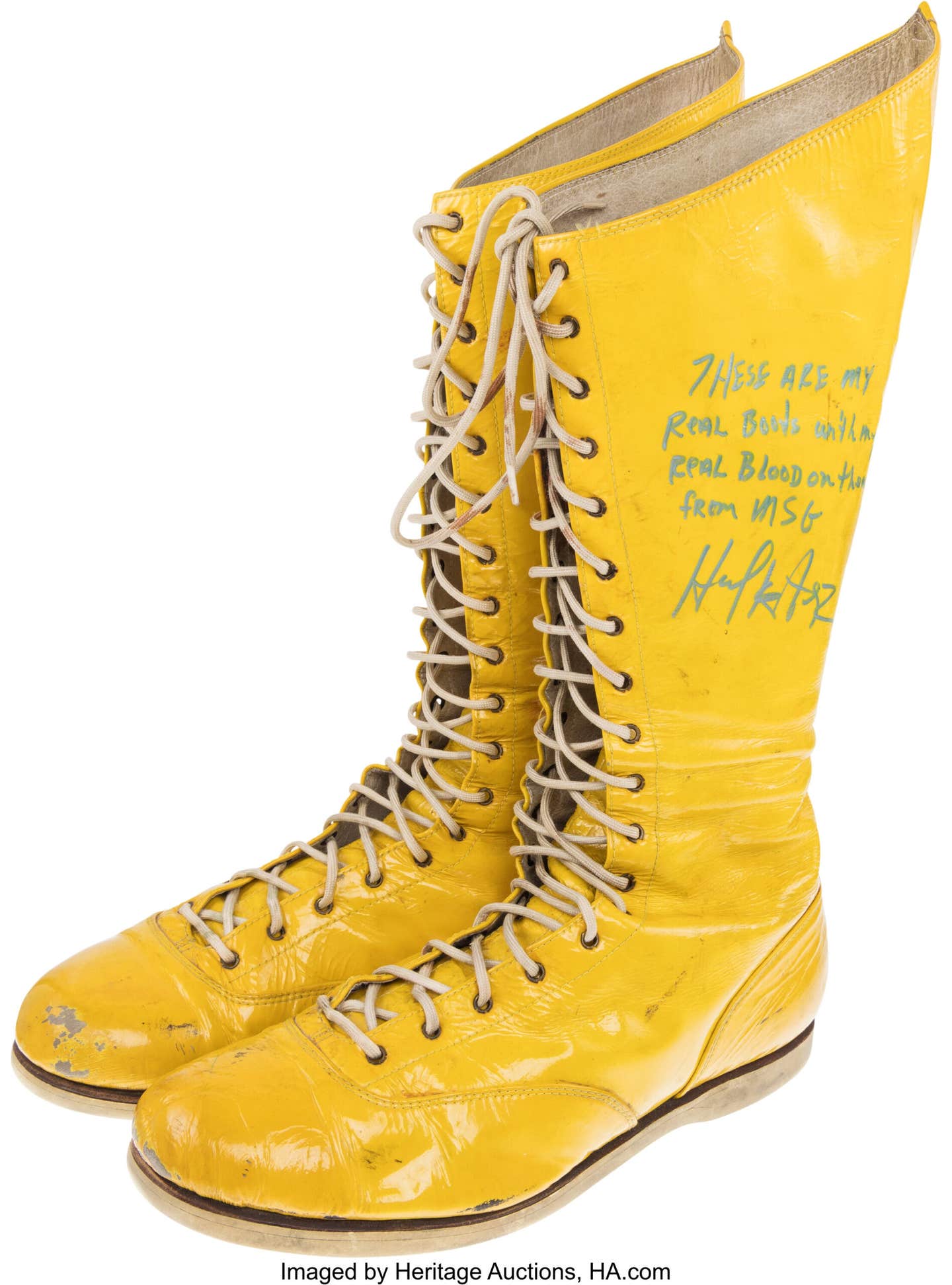

Big Memorabilia Offerings On The Way

In the first 85 offerings available for fractional ownership, shareholders accepted five buyout offers and have received about nine or 10 on other items.

Levine has noticed a trend with shareholders when they received a buyout offer. The investors have been willing to reject offers and hang onto items as they continue to rise in price.

“It’s been really interesting,” Levine said. “I think at first what we saw is that we were such a new platform that people, when they had the opportunity to make a little money, they accepted it, because they just didn’t know better or they didn’t have a lot of confidence in us as a young start-up.

“The more that we stay out there and we stay relevant and we grow the platform and we show that we can produce returns in other ways besides buyout offers, then I think people are willing to leave their money in for longer. Again, there could be opportunities to make a quick a buck, but, really, we’re in this because we believe that this is a long-term viable, alternative asset class.”

Collectable has some phenomenal pieces it will be offering in the near future.

Levine is excited to announce that on Sunday, May 2, Wilt Chamberlain’s home jersey from his rookie season in 1959-60 will be offered. The all-cost is $1.275 million and the IPO is set at $956,250. Each share costs $10.

Chamberlain wore the jersey for every home game in which he won NBA MVP by averaging 37.6 points and 27 rebounds.

“It’s photo-matched to a game at Madison Square Garden where he dropped 52 points,” Levine said. “There are a lot of amazing images from Getty, which show him walking off the court and everyone’s clapping. It’s a very cool piece.”

Collectable will also be unveiling a Babe Ruth 1916 Sporting News M101-4 blank back card. It is one of just two PSA 7s and is the highest grade in existence. Levine said on April 26 that the price on that is $3.69 million, but that price could change upon offering. Levine noted Heritage Auctions has a similar M101-5 blank back PSA 7, valued at $4 million, at auction that closes on May 6. Collectable is keeping a close eye on that sale.

“It’s awesome,” said Levine about offering the rare Ruth rookie. “Our mission from Day 1 has been to kind of open up access to sports fans and collectors of all income brackets all across the country and hopefully soon all across the world. The quality of the assets that we’ve been able to bring to the market is really exciting and I think it’s really led itself to Collectable early success.”

Also on the horizon are a few Negro League assets, a Tom Brady Contenders Championship Ticket auto, as well as a LeBron James 2003-04 Upper Deck Exquisite rookie patch autograph BGS 8.5 numbered to /23. A similar card, in a BGS 9, was sold on the PWCC Marketplace for $5.2 million on April 26.

“We look for items and assets that are historically and culturally significant — ones that are iconic and ones that we think are fair prices for both the consignors and the buyers,” Levine said. “It’s no guarantee, but it’s ones that we think over time will have some room to appreciate for shareholders.”

McGhee believes Collectable has great potential for the future. With the way the sports card and memorabilia market is currently thriving, this young company can ride that wave with its investors.

“I think a lot of what’s going to determine their success is, number one, the continued growth of the collectables industry in general, which I foresee continuing,” McGhee said. “When you look at auction prices, realizing when you look at case breakers, when you look at new product, all of those indicators, it’s pointing in a very positive direction for the sports card memorabilia industry in general.

“Number two, I don’t want to speak for other people who are going to invest, but I would imagine in fractional ownership most people are probably going to be doing it for investment purposes, because you’re never going to be able to take physical possession of the cards, so it is going to be for investment purposes. I think if people can realize good return on those investments, then that’s going to bode very well.”