News

Are your sports collectibles insured?

Watching from the street, you feel helpless.

The house you put so much time, effort and money into is in flames. You think of everything that has monetary or sentimental value. It’s a crushing blow.

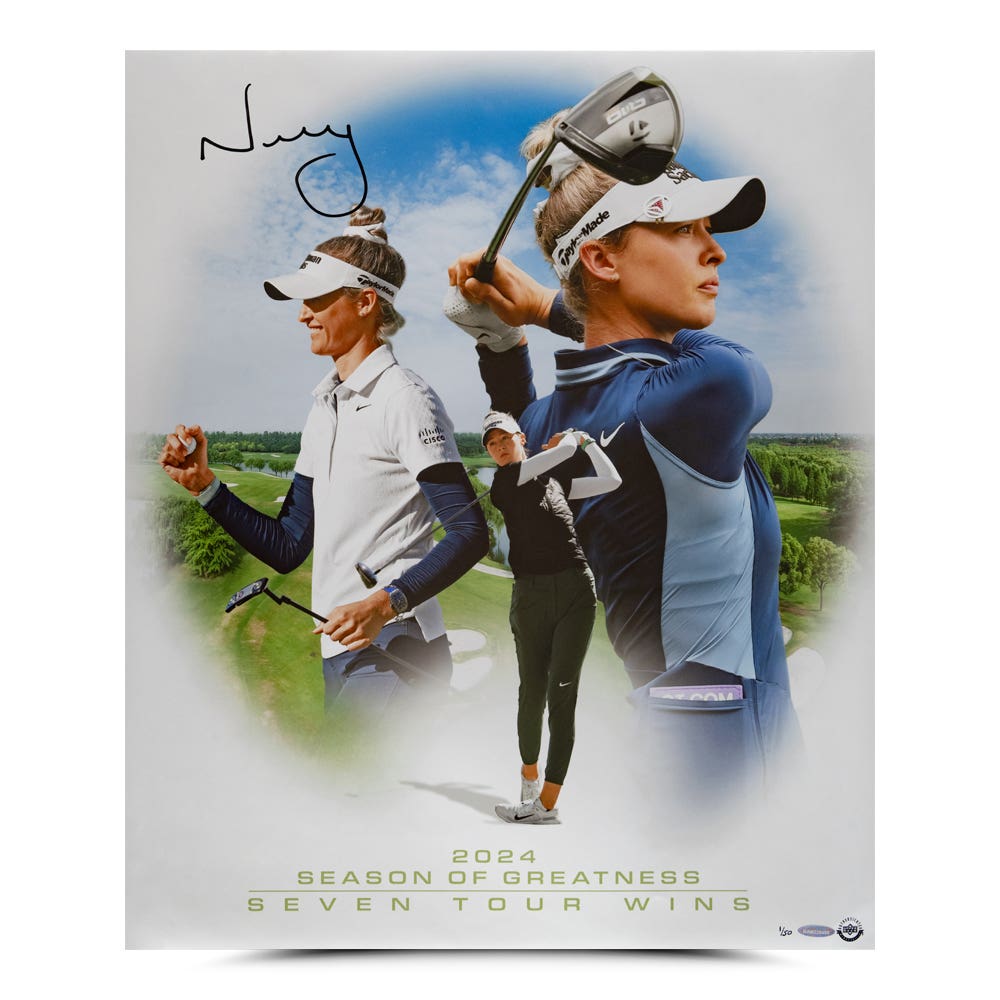

The room that displays your impressive, valuable memorabilia and trading card collection isn’t going to be spared.

That solid homeowner’s insurance policy you took out years ago is going to offer some peace of mind. Personal, one-of-a-kind items can’t be replaced, but some memorabilia and cards can be.

However, one call to your insurance company reveals you weren’t as well prepared for a loss as you thought you were. Collectibles don’t fall under the umbrella of homeowner’s insurance and aren’t covered in the policy, so that $50,000 collection – priceless in your eyes – has been turned into nothing but worthless burnt cardboard.

“It’s pretty dramatic how many people are uninsured or underinsured when it comes to specialized collectible type items,” said James Appleton, who is the director of sales, special risk at MiniCo Insurance Agency, LLC.

There are specialized insurance carriers that provide extra coverage for collectibles. The policies that are available are for individual collectors as well as card/memorabilia dealers. Sports Collectors Digest talked to independent agents from four insurance companies to get their take on what insurance carriers offer and what collectors can expect for policies.

“The reason we exist is the standard homeowner’s or renter’s insurance policy doesn’t cover collectibles or if it does, it’s for a very small amount of trading cards only,” said Thomas Finkelmeier Jr., president of Finkelmeier Insurance Agency, LLC in Wapakoneta, Ohio.

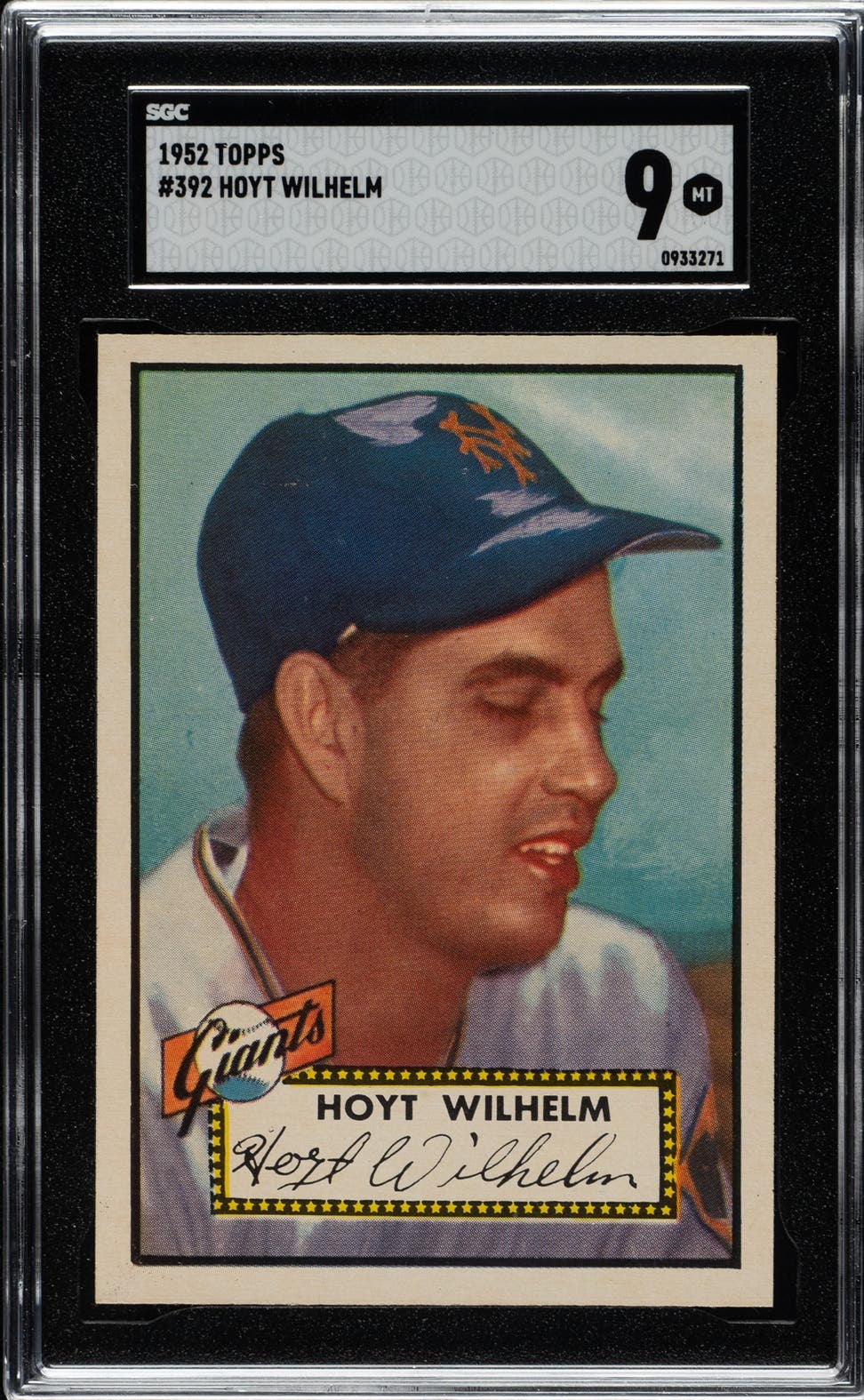

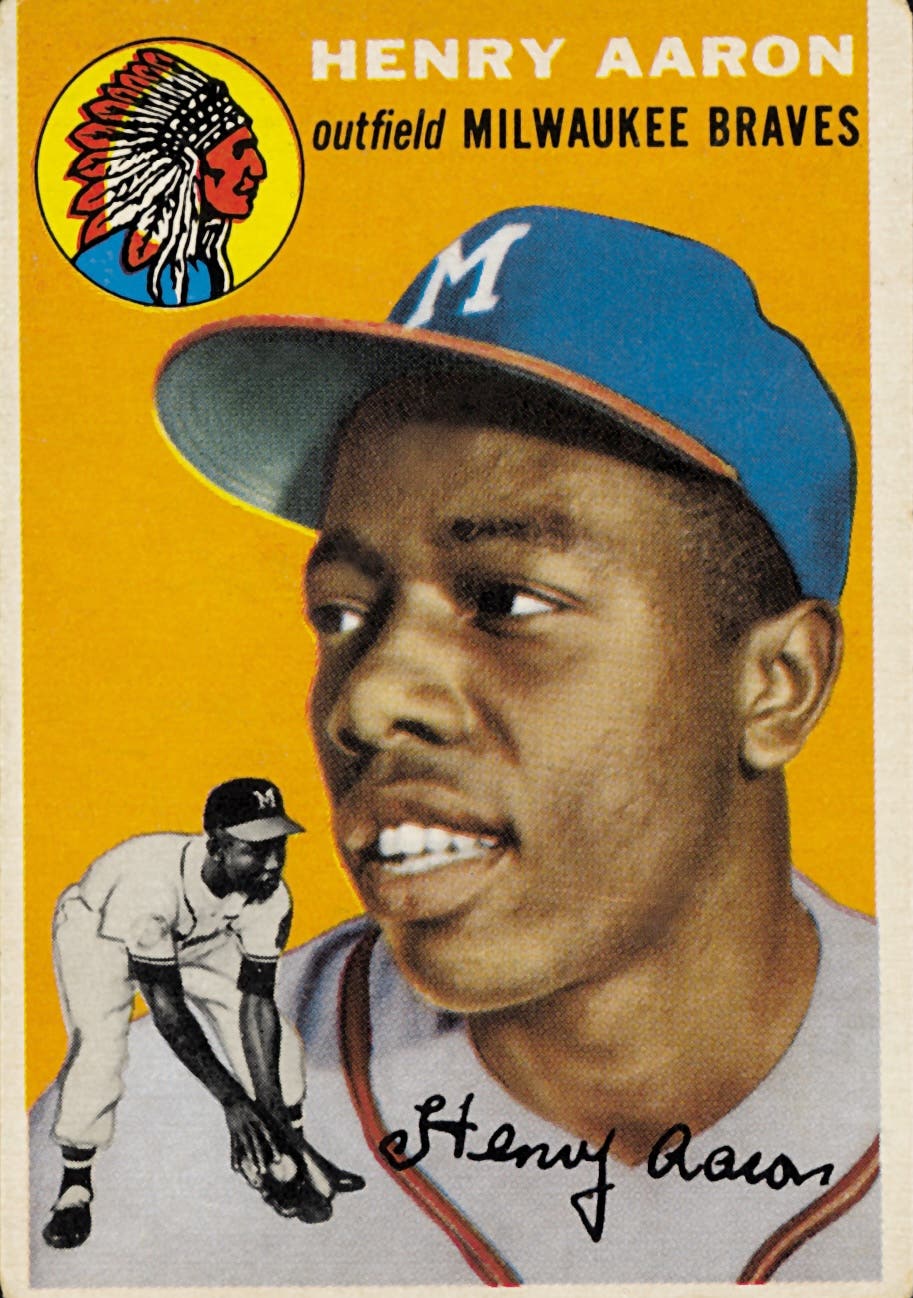

“So typically, any game-worn equipment, tickets, programs, seat out of Fenway Park, whatever, they just don’t cover that stuff, not for its collectible value. They insure it for the replacement cost, and the problem with that—to an insurance company, replacement cost means the cost to replace the lost or damaged item with a similar item of like kind and quality new. So, what that means is if you have a PSA 4 graded ’52 Topps Mantle card, they owe you one brand new baseball card. They don’t owe you a Mantle. They owe you a baseball card. That replacement cost works fine for your television. If you’ve got a 36-inch tube TV, you don’t want that TV, you want a new flatscreen. Replacement cost is great for your household possessions. But when it comes to collectible or antiquity value, it falls short.”

Said Bob Brodwater, assistant vice president at Insurance Collectibles Services in Hunt Valley, Md.: “Some collectibles you can sometimes schedule on a homeowner’s policy with an appraisal. A homeowner’s company will require an appraisal in those cases, and they’ll do limited. Certainly, if you’re talking about high-value collectors, adding everything to a homeowner’s policy isn’t even an option.”

Collectors certainly don’t want to be left in the dark when it comes to insuring or underinsuring their prized possessions.

Steven Becker, the vice president at Antiques & Collectibles Insurance Group in Cornelius, N.C., suggests when someone contacts him about collectibles insurance that they first check with their homeowner’s or renter’s insurance company about the limit for collectibles.

“People think if they have a $500,000 home and my personal property has a $250,000 limit on it and my collections valued at say $100,000, well that’s going to be covered under that because $100,000, of course, is less than $250,000,” Becker said. “What people don’t realize is that typically for jewelry, furs, fine art, antiques, collectibles, typically all homeowners policies have sub limits for those categories. The majority of homeowners policies we have seen for collectibles is a $1,000 sub limit. We’ve seen some policies that go up to $2,500 and I think I’ve seen just a couple that actually have a $5,000 sub limit for collectibles. But the standard limit is $1,000.”

Finkelmeier has dealt with collectible insurance for individuals for over 25 years. He has noticed that when a collector has hit about the $20,000-25,000 range for a value of their collection, that’s when they seem to think they have a collection worth insuring.

“The collector who’s got $11 million worth of sports memorabilia at home, he’s made provisions for that. Those kinds of folks are insured,” Finkelmeier said. “It’s the more modest collections that have grown a little more slowly where someone will step back and say, ‘Hey, wait a minute. I’ve got some pretty good money there.’ What really puts that on their radar is if they have like a LeBron (James) rookie card or something. They’ll see a news article in say SCD and say, ‘Oh, man. I didn’t realize that was worth what it is.’ That’s what will get them thinking about it.”

So, if someone buys specialized insurance just for their card collection and memorabilia, what’s covered under a typical policy?

Fire, theft, damage, burglaries and robberies all fall under all-risk scenarios, said Brodwater.

Anything that could be preventable isn’t covered. That includes autographs faded by light because a collector stored items in a room conducive to sunshine and over time the signature slowly vanished. Also, mold, mildew and fungus are not covered because those events didn’t happen overnight, but over an extended period.

Natural disaster can be a gray area for insurance policies.

“Certain companies, if they write in a state like Florida with coastal exposure, will exclude named storms,” Finkelmeier said. “Other companies don’t. If the price is essentially the same, you obviously want the policy that’s going to cover the hurricane, not the one that excludes it.”

Affordable Premium Prices

For anyone looking to acquire collectors insurance, it can be obtained at an affordable price, insurance agents stress.

For a personal collector with a small collection valued at $20,000, a policy can be purchased for as low as $75 annually, Finkelmeier said. For a $75,000 collection, the price per year for insurance is just $150. Bump that up to a $500,000 collection and the premium goes up to $1,850.

“Just like anything you buy in bulk, the guy who has an $11 million collection pays less per $100 of insurance than the guy who has a $20,000 collection,” said Finkelmeier, who isn’t just an insurance dealer but is a collector himself.

An insurance policy for a dealer for $100,000 coverage can range from $500 to $1,000 per year based on location, Finkelmeier noted. The policy rate drops rapidly after the first $100,000 of coverage. A $500,000 dealer policy might be around $2,300 annually.

“This can vary widely based on location in the country, how much shipping they do, how many off-site shows they do, if any, etc.,” Finkelmeier said.

Through Insurance Collectibles Services, Brodwater said a $25,000 policy for an individual collector has a price tag of about $175 a year. For a $100,000, the annual premium will be about $550.

“We’ll insure any collection from $10,000 to $10 million,” Brodwater said. “I would say the vast majority of people are in the $25,000 to $100,000 range.”

At MiniCo Insurance Agency, LLC, costs differ according to zip codes and disaster areas. In Phoenix, where the company is based, to add insurance on a $100,000 collection, it will cost $350 with a $0 deductible. Appleton said if security features are added to the policy – fire alarms, deadbolt locks, burglar alarms – the price goes down to $324 a year.

With the card and memorabilia market being so hot right now, insurance companies are constantly adding new clients. It’s one of their fastest-growing segments.

Paying Out For a Loss

If an individual or dealer who is insured has an item that is destroyed for some reason, insurance companies determine the payout price by what is called agreed value or fair market value.

Insurance companies will talk to experts, use price guides and other means to figure out what the fair market value of an item was the day it was damaged.

“Let’s say you had a signed Kobe Bryant jersey and let’s say the value of it was $500, and it burned up Jan. 1,” Becker said. “What happened not too long afterwards (Bryant’s death) and now that jersey would be valued at $2,000. If it burned up on Jan. 1 and the insurance company is waiting on documentation and he had passed away before the claim got settled, it would still be based off of the Jan. 1 time period because at that point in time the value of that signed jersey was only $500.”

Becker frequently suggests to collectors to keep any eye on the market value price of their collections. With fluctuating values of items, someone’s collection might be worth more than the coverage amount they have on their insurance policy.

Appleton said the less savvy collector that doesn’t truly understand the value of their collection will jump right in and pull a number out of thin air and want to insure it for that amount. That isn’t the right approach to take. Appleton suggests a collector make every effort to have all their cards graded and documented to show provenance, because it’ll be up to them to prove their value.

Traveling with Cards and Memorabilia

When an individual collector or dealers inks a policy for collectors insurance, items are insured anywhere the person might take them.

So, for instance, if someone traveling to the National Sports Collectors Convention brings a few cards and they are stolen, insurance will kick in.

“Basically, anytime it’s on their person, it’s covered under their transit coverage,” Brodwater said. “That coverage also applies to sports memorabilia dealers and we’ll cover their full inventory that they bring to The National or other conventions throughout the country while it’s on site.”

If a collector is at the show and has a few ex-professional athletes sign a baseball bat and basketball and that person is robbed at gun point, insurance will cover it. Or a collector buys a $5,000 card at The National and it’s taken, it’s a good time to have insurance.

“That’s going to be covered because they bought the particular pieces,” Becker said. “The policy includes coverage of items for up to 30 days without them having to name the particular piece stolen.”

Say a collector has mailed 10 cards to Professional Sports Authenticators (PSA) to get authenticated and graded, if anything happens to the cards during the shipment, that is covered under the collector’s policy. If PSA happens to damage a card, that’s on the company to take care of with its own insurance policy.

If FedEx loses a package or any damage is sustained to the particular piece in transit, that’s going to be covered. That also applies to an online auction purchase by a collector or the collector buys an item at a show and has it shipped home.

For dealers, the transit coverage is a huge deal since most frequently ship a lot of times. It’s that peace of mind that comes up big and is a major selling point.

For any collectors or dealers who don’t have insurance, the independent agents suggest to contact independent agents instead of going directly to an insurance company. Finkelmeier noted it’s the same price, but an independent agent will be able to offer advice on which company to go with.

“I would tell anybody who wants their collection to be insured to get it done,” Finkelmeier said. “Everybody that contacts us, obviously we keep a record, it is not uncommon for us to finally sell somebody insurance that contacted us a couple, three times over a several year period before they finally say, you know, I’ve had this application here and I wanted to do it, but then this happened and that happened.

“We always recommend, if you want the peace of mind to cover your collection with a company that knows exactly what you have and will pay you based on what the fair market value is, then pick up the phone and get it done.”