News

Heritage Auctions enjoying ‘extraordinary year,’ trending toward another big result

The consignment experts at Heritage Auctions have seen a lot in the past 18 months of the sports collectible boom.

But when a 1969 Reggie Jackson rookie card sold for more than $1 million during its February Platinum auction, they knew they were in the midst of an historic run.

A Jackson rookie card from the Dmitri Young Collection, graded Gem Mint 10 by PSA, sold for $1,005,600, a significant indicator of how far the hobby has evolved.

“That was one of the most eye-popping results from our February Platinum,” Heritage VP of Sports Dan Imler said during an April 28 State of the Industry Zoom conference. “It was not entirely unexpected, but still incredible nonetheless.”

The Jackson card, a high-end, low-population card, was yet another example of a highly-graded iconic card setting a remarkable record and representing another startling surge in the market.

“This is a pop 1 of an iconic 60s rookie card. This really proves that when there is one seat at the table, anything can happen,” said Imler, whose company has benefitted greatly from the explosion of the hobby. “When you look at card prices, per grade, the multiples and the ratios of 9s versus 10s, usually it is fairly consistent, but when you get into a situation like this where you have an iconic rookie card, 1 of 1, anything can happen.”

As the market began to surge to new heights, the value of Jackson’s rookie card, with a grade of 9, rose to $30,000 and then $50,000. Then, in February, a PSA 10 stunned the collectible world by topping $1 million. The next day, a PSA 9 of the same card sold for $99,000, showing once again the power of the market but also the wide disparity between a card graded 9 and one that earns a 10.

“That was just an unbelievable result,” Imler said. “But it’s a trophy card, and there’s only one person who can claim it and claim ownership. That’s just a really good test when you get these iconic pop 1s, ultra-low 1 of 1s. That was a spectacular result.”

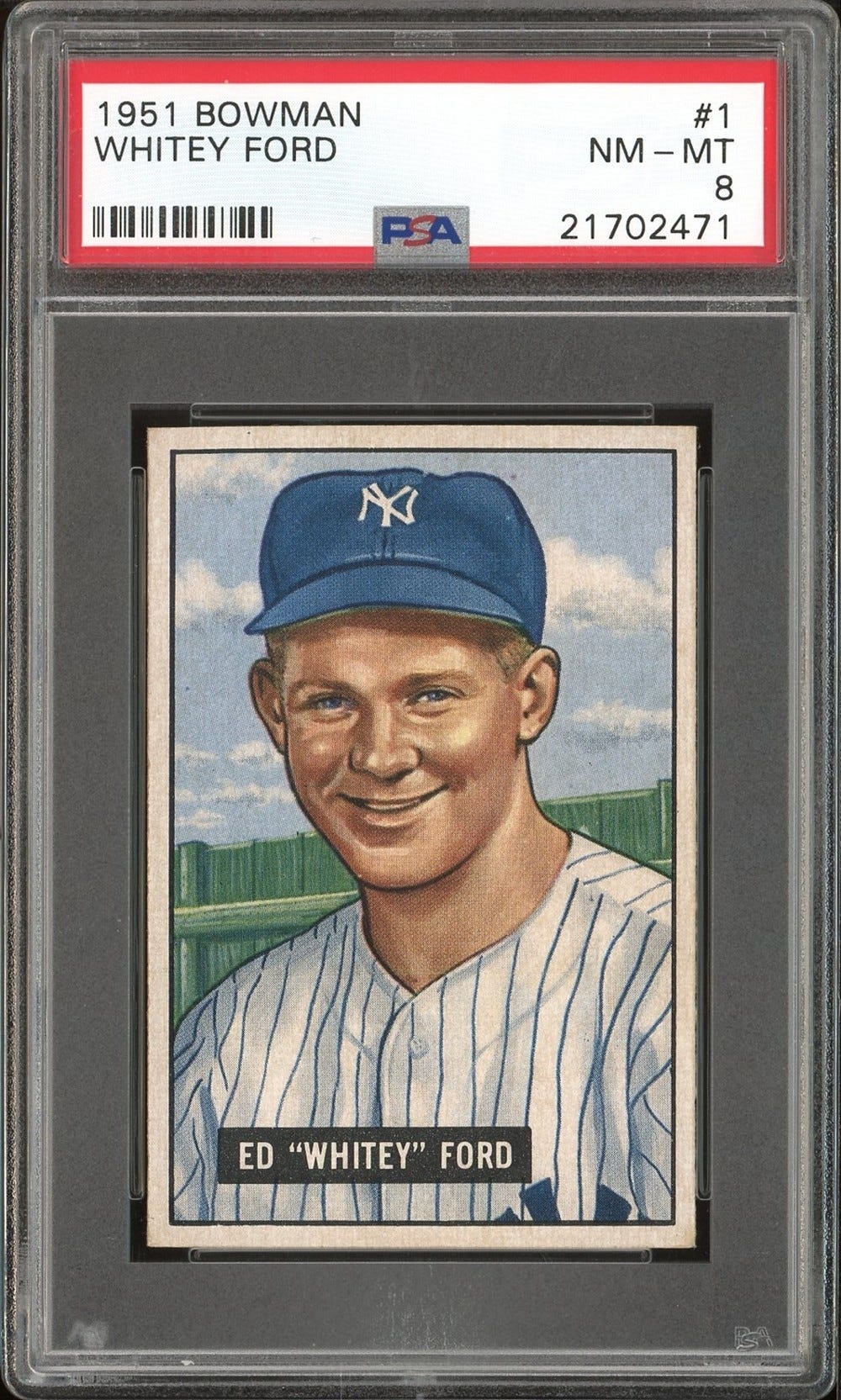

Heritage and other auction houses have enjoyed many spectacular results in the past few months, routinely producing record sales during new monthly auctions. Heritage is wrapping up another successful event, with its May 6-8 catalog auction expected to set more records. A 1916 M101 Sporting News Babe Ruth card, graded NM 7, has already reached $3 million, while a T206 Sweet Caporal Honus Wagner has topped $1.6 million. Cards featuring Mickey Mantle, Willie Mays and Jackie Robinson are also trending up.

“This has far and away been the most extraordinary year in our industry that I have ever experienced, and I’ve been doing this 25-plus years,” Imler said. “The market has always kind of steadily increased over time, with peaks and valleys along the way. … But this last year has been meteoric. It’s been crazy.”

While the industry enjoyed a surge in interest during the pandemic, with long-time collectors rediscovering their beloved hobby, Imler also attributes the swell to an influx of new buyers investing in the market.

“And not just people putting their toe in the water, but people coming in at a really high level,” he said. “Usually when new buyers come into the market, they kind of start small and work their way up, but we have seen, really with every auction, just an influx of new buyers at a high level, and that’s really, really pushed them up at an incredible pace.”

With the market fueled by so many new investors, sparking a rise of cash-rich collectors and companies buying up valuable collectibles and selling shares of high-priced items, it has many pure collectors nervous, causing them to question whether the market can sustain the current trends. Imler warns they are right to be cautious.

“It’s pushed the market forward, but it also … from a stability standpoint, it is a little suspect,” he said. “If you have people getting into this just to make money, buying something just with the goal of looking for the next guy in line willing to pay more, you are a little susceptible to the ups and down, because if it is really all about the money, as soon as things may pull back a little, you don’t have the pure love and the pure collector mentality, then the investors are going to run for the hills and sell, sell, sell.

“You need at least a good, solid base of people who are in the middle or more toward the collector side to really sustain the market and push it forward long-term.”

While that base appears to be strong, even high-end companies like Heritage have seen things start to level off a bit.

“Nothing goes up in a straight line forever,” Imler said. “I think probably with our February platinum auction, which was just absolutely off the charts across the board, a $30 million-plus auction, it just really, really hit an unbelievable peak. We have started to see things level off a bit since then, which is only natural.

“I would call it a correction but a moderate, healthy correction, and one that will kind of set the table for things to keep going up from here.”

Jeff Owens is the editor of SCD.