Collecting 101

Fixing the problem of brand proliferation

As consumers, we've come to demand a lot of choices when we go shopping. We want 100 channels of cable television, 18 flavors of Gatorade, 55 kinds of shampoo, movie theatres showing 10 different films, thick crust, thin crust or something in between when we're in the mood for pizza. When it's time to go shopping, it always seems the store that offers the most choices is the store that will always attract the most customers.

But when it comes to collectibles, too many choices is not always a good thing. If you need proof, look no further than the sports trading card market. There are fewer collectors involved in the hobby today than there were 10 years ago, fewer card companies making cards and fewer card shops selling cards. While there are a variety of factors for why the market is smaller today than it was in the past, one of the biggest culprits in the eyes of many industry veterans has been the proliferation of new products.

And like the overweight man who gets the warning from his doctor to lose some weight or die, the card industry seems intent on putting itself on a diet to shed some of its excesses in an attempt to get itself healthy once again.

An evolving problem

Exactly how many products it took to cross the line into "too many" is impossible to identify. Prior to 1981, most collectors had never bought a baseball card made by anyone other than Topps. When Fleer and Donruss were granted licenses to compete in the baseball card market in 1981, there were suddenly three sets per year instead of one. When Sportflics, Score and Upper Deck joined the card market over the course of the decade, some collectors began to complain that six sets per year were too many.

The same concerns were raised when companies like Pro Set, Score, SkyBox, Pacific, Playoff, Classic and others arrived on the trading-card scene. For the most part, however, it appeared that more choices and the national marketing efforts of these companies were attracting more collectors. By 1993, the trading card companies were selling nearly $1 billion worth of new sports cards every year, or roughly triple what they had been selling just five years earlier.

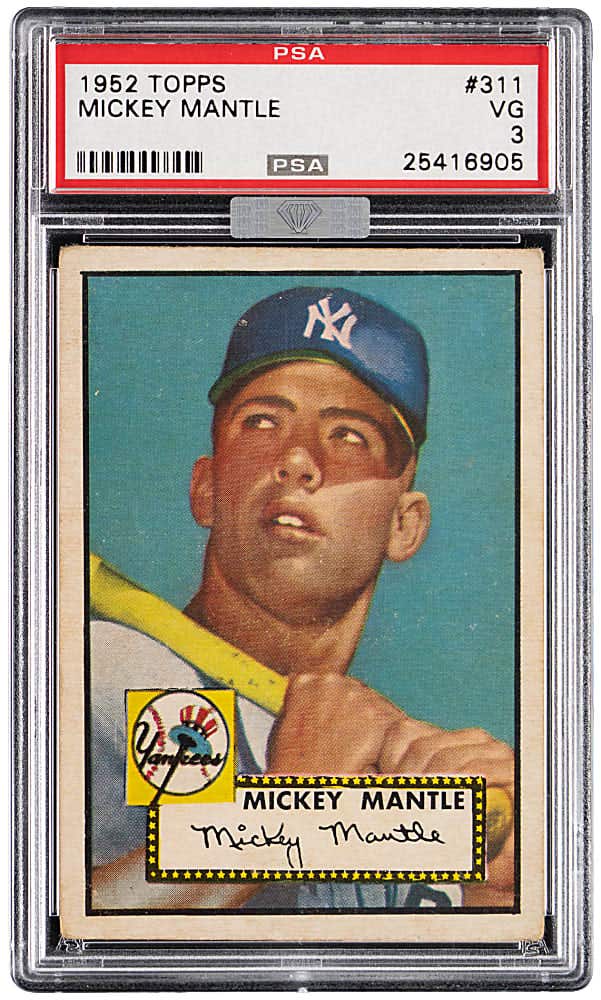

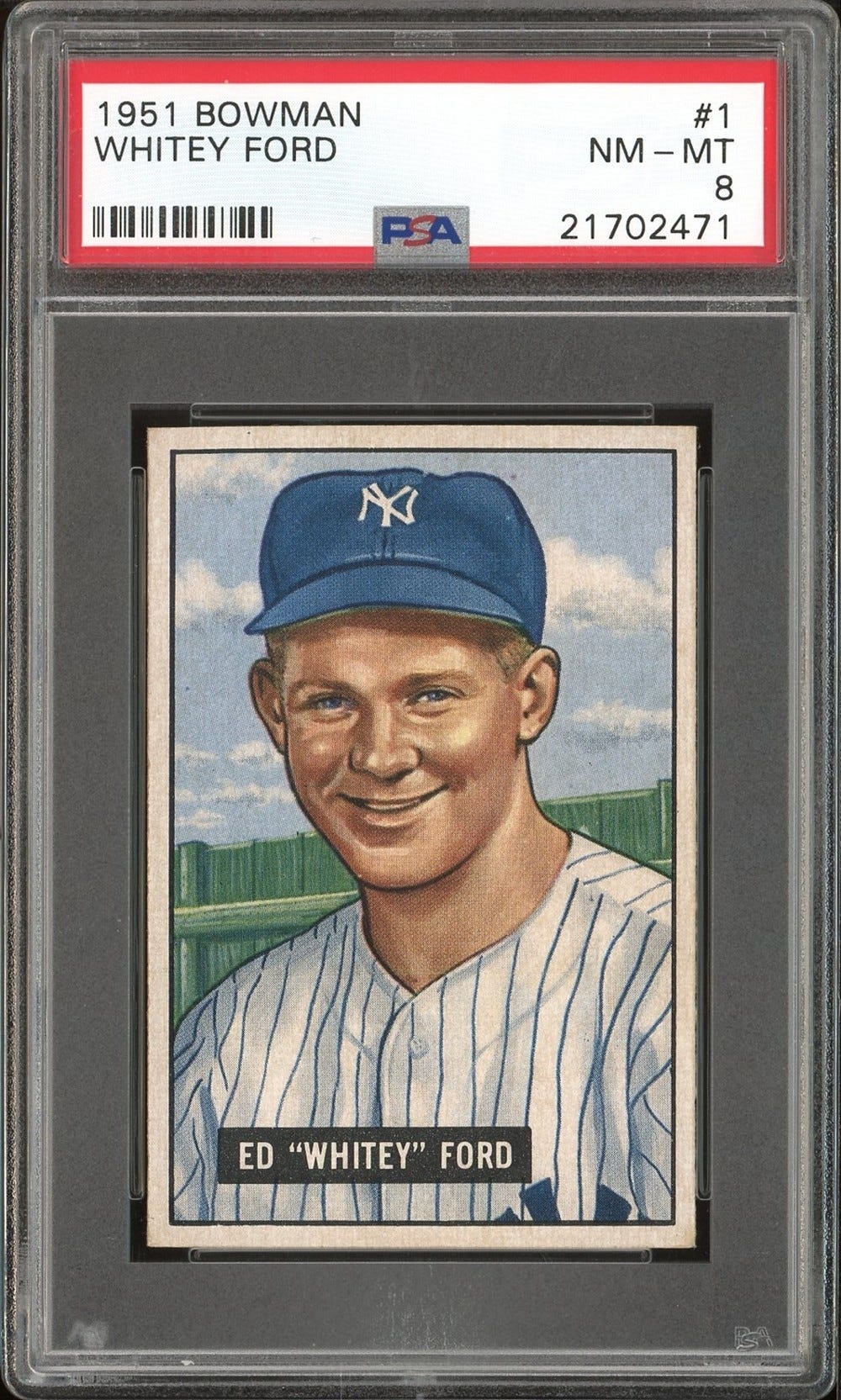

From the arrival of the first Upper Deck Baseball product in 1989 to debuts of such brands as Topps Stadium Club, Topps Finest, Upper Deck SPx, Donruss Diamond Kings, Fleer Greats of the Game, Playoff Contenders and Topps Heritage, there was plenty of evidence to suggest the creation of new products helped spark sales.

But an uglier trend was also developing. Revenues from new card sales have been declining every year since the early 1990s, yet up until last year, the number of brands (or sets) released every year by licensed manufacturers increased. In 1990, there were a total of 24 sets released for baseball, basketball, football and hockey. By 1995, that number had increased to 111. By 2000, it had escalated to 210 products.

The result was that while revenues from new card sales had fallen by almost half between 1990-2000, there had been a 10-fold increase in the number of new card products. Clearly, there was something wrong with that equation.

Last year, SCD surveyed more than 350 former subscribers who said they were no longer active in the hobby. More than 73 percent said the primary reason for dropping out of card collecting was their frustration at the number of products. When asked what it would take to get them interested in collecting again in the future, the most frequent response was having fewer cards to choose from.

Changing collecting habits

There was a time when card collecting was an activity driven by a sense of completion - a fairly easy task when there was just one set per sport, per year. Most collectors would make it their goal to open enough packs and then trade their duplicate cards with friends in an effort to complete their individual sets.

As more companies entered the market, and the number of products grew each year, the notion of trying to collect every set on the market became a logistical and economic impossibility. As a result, collectors had to start making choices as to where they would focus their collecting efforts. Some set collectors turned to rookie-card speculating. Some focused their efforts on team collecting or individual player collecting.

But as speculators began to leave the market and the collector base began to decline - a decline accelerated by the 1994-95 baseball strike - the growing number of products was being solicited to a diminishing number of customers.

So why didn't the card companies simply stop issuing so many products? Part of the problem was the licensing fees they were being required to pay to the leagues and player's associations. Those fees required companies to generate certain levels of income every year. It was getting harder to meet those levels when the card companies were reducing the production runs of existing products because collectors were demanding cards have some sense of scarcity. The only way for a manufacturer to compensate was to offer more brands.

For several years, it had simply been assumed that the problem of too many brands could be fixed simply by attracting more collectors to the hobby. The theory was that the more collectors in the hobby, the more demand they would generate and the better the sales would be.

But that was easier said than done. New collectors were not entering the hobby, in part, because they were so overwhelmed by the number of choices. And a number of existing collectors had started to buy fewer cards, focusing only on a handful of products each year. With revenues decreasing and production costs increasing, manufacturers had less money available for promotional efforts designed to attract more users.

Not only were the solutions not fixing the problems, they were exacerbating the problems. Clearly, it was time for a change.

Turning the tide

There has been plenty of talk in recent years regarding the neede to reduce the number of brands on the market. But truly aggressive steps by manufacturers and (more importantly) the licensors have really taken shape over the past 18 months. Among the noteworthy events:

In January of 2005, Topps unveiled the results of a third-party survey it had commissioned for the trading card market. The study indicated sales for new sports cards had decreased at an average rate of 15 percent for each of the previous five years, with product proliferation and soaring pack prices identified as the primary reasons for the declines. While the results did not surprise many in the hobby, it was the first time a card company made a public statement regarding the need for the industry to address the problems created by having too many products.

Topps took the results of the survey to the various sports licensing bodies (which consist of the leagues and players associations) and campaigned for a reduction in the number of brands those licensors would allow in the marketplace. "The sheer number of products in stores is intimidating to casual collectors and creates a barrier to creating new ones," Topps president Scott Silverstein said at the time. "Our research shows it will be difficult to grow the size of the market if this issue is not addressed."

In May of 2005, Fleer Trading Cards - which had licenses to produce basball, football and basketball cards - ceased operations.

Last summer, licensors for MLB and the MLB Players Association announced that only two companies - Topps and Upper Deck - would be licensed to produce baseball cards in 2006 and those companies would be limited to 20 card sets each. Donruss did not have its licenses renewed despite the fact the company had a loyal following of collectors. The moves meant the baseball card market would have 40 sets in 2006, less than half the number released the previous season.

After finishing the 2003-04 season with four licensed hockey card manufacturers (Upper Deck, Topps, Pacific and In The Game), the NHL and NHL Players Association entered into an exclusive, multi-year license with Upper Deck for hockey cards beginning with the current season. Upper Deck would be allowed to produce no more than 20 hockey card sets.

So in a span of less than two years, the lineup of sports card manufacturers has changed dramatically. Baseball went from four licensed manufacturers to two. Hockey went from four to one. Basketball and football also have one fewer licensee. Racing, which had more than 10 manufacturers in 1996, has had just one manufacturer (RC2/Press Pass) since 2001.

Impact On The Market

It's far too early to judge the impact of what the reduction in brands will have on the market as a whole, but the early indications are the some of the existing products are selling better and that collectors are embracing the elimination of some of the clutter.

For instance, when announcing its financial results for the fiscal quarter that ended Feb. 25, Topps reported a 55-percent increase in sales for the first series of Topps Baseball compared to the previous year, and a 35-percent increase in sales of Heritage Baseball.

Even many of the hobby shop owners who believe the changes are good for the future of the hobby acknowledge they will likely see a decrease in their overall sales this year simply because they have fewer products to offer their customers. But they believe there are other benefits.

"I'm hoping that with fewer releases available, more of my customers will take a look at products they might have otherwise overlooked in the past," said Mike Fruitman, owner of Mike's Stadium Sportscards in Aurora, Col.

Andy Aebi, owner of Andy's Sports Cards in Bellevue, Wash., said the decision to produce fewer brands was long overdue. "There was too much product out there," Aebi said. "Now, there's less competition for shelf space."

Other retailers say that the reduction in brands may have been too much, too soon. Rick Keplinger, owner of Rick's Cards in Stephenson, Va., said half his store's baseball sales came from Donruss product. As a result, his customers aren't happy with the reduction in brands. "Instead of buying current Topps or Upper Deck cards, they're simply going back and buying the older Donruss product," Keplinger said.

Steve Mandy, owner of Attack of the Baseball Cards in Union, N.J., was also not happy to see such a drastic reduction in the number of new products. "I have consumers who like to come in every week to see what's new," Mandy said. "They'd rather see two or three new products every week than the same thing they bought last week. A longer shelf life doesn't always mean people are buying the product. It can also mean a dead product sits for a longer period on the shelf."

Mandy also pointed out another problem with the reduction in products. "We have some customers who buy specific brands, and some of those brands aren't around any longer," he said. "One customer quit collecting a few years ago when Topps dropped Stadium Club. I have another who has told me he's going to quit this year because Donruss Diamond Kings is gone. They don't want to buy something else. They're not going to buy anything at all."

Licensors, however, say the early indications are that the market is responding in a positive manner to the "less is more" mentality.

Ted Saskin, executive director of the NHL Players Association, said sales of this season's hockey cards have exceeded his most optimistic expectations. "All indications are that we are having one of the best years in quite some time," Saskin said. "I know part of that is, of course, related to the tremendous new rookies that we have this year. That obviously translates into fan and collector interest. But I also think there's been a very strong marketing component and a very good effort and focus from the people at Upper Deck."

Evan Kaplan, category director for trading cards and collectibles for the MLB Players Association, said mass-market retailers like Wal-Mart, Target and Toys R Us are looking at stocking more cards because of the changes. "Feedback from retail buyers has been very positive because the manufacturers are also doing a lot more in terms of creating better product and supporting advertising. That's designed to attract new users, and more often than not, you're not going to attract new users of cards by having a presence at a store like Wal-Mart or Target."

Colin Hagen, VP of hard goods for MLB Properties, said the baseball card category is still determining how many brands is the perfect number per season. "We have to find the correct number of total releases per year, how long the shelf lives should be, and allowing the companies to be profitable enough that they can do the things they need to do to support those products, which they couldn't before," said Hagen. He added that it's possible there could be fewer than 40 baseball sets per year in the future.

Pete Quaglierini, the NFL's manager of trading cards, collectibles and NFL Auctions, said there's more to brand limits than just selecting an arbitrary number of releases. "I tell the companies now that they need to give us a rationale, every set's reason for existing," Quaglierini said. "It can be price point, target audience, content, but we feel there has to be a reason for being. We've smartened up and saw that there was too much out there, too much clutter, too much confusion and we pared it down. It helps when the other sports do that, too. I think the hobby will be very healthy, and soon."

Executives at Topps believe their efforts to reduce the number of products in the marketplace will have benefits for the industry as a whole. "We pursued long and hard this issue of fighting the proliferation that we felt strongly was choking the industry," said Topps chairman and CEO Arthur Shorin. "We knew that if nothing was done, it sounded the death knell. Having achieved this change in the licensing landscape is very encouraging. Long-term, no question about it, we've got to bring kids back. We're starting to see glimmers that give us reason to believe this is something reasonably good."